-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On Jul 16, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on FXTM

FXTM is an award-winning ECN/STP broker popular with beginner traders. It offers competitive spreads, instant trade execution, and accounts with low minimum deposits. Licenced by the Kenyan Capital Markets Authority and the South Africa FSCA, with excellent training material and 24/7 customer support, FXTM is a great broker for beginner traders.

| 🏦 Min. Deposit | USD 10 |

| 🛡️ Regulated By | CMA, CySEC, FCA, FSC |

| 💵 Trading Cost | USD 15 |

| ⚖️ Max. Leverage | 2000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Stock CFDs, Forex, Indices, Metals, Shares |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Good for beginners

- Excellent education

- Well regulated

- Low minimum deposit

- Copy trading accounts

Cons

- Expensive withdrawals

Is FXTM Safe?

FXTM has been regulated by the Kenyan Capital Markets Authority (CMA) since 2020, which means that funds are kept in local accounts and managed according to Kenyan regulatory policies. With full UK FCA authorisation (license: 777911) since 2018, and licensed by the South African FSCA (FSP: 46614), FXTM has excellent international accountability.

Additionally, FXTM has been widely recognised by its peers in the industry. In 2017, FXTM won the award for Most Innovative Broker (FX Empire) for growing its product offering to include cutting-edge pivot point technical analysis tools, copy trading functionality on ECN accounts, and expanded payment methods. In 2018, FXTM also awards for Best Forex Education Provider Africa (International Business Magazine) and Best Trading Conditions (World Finance).

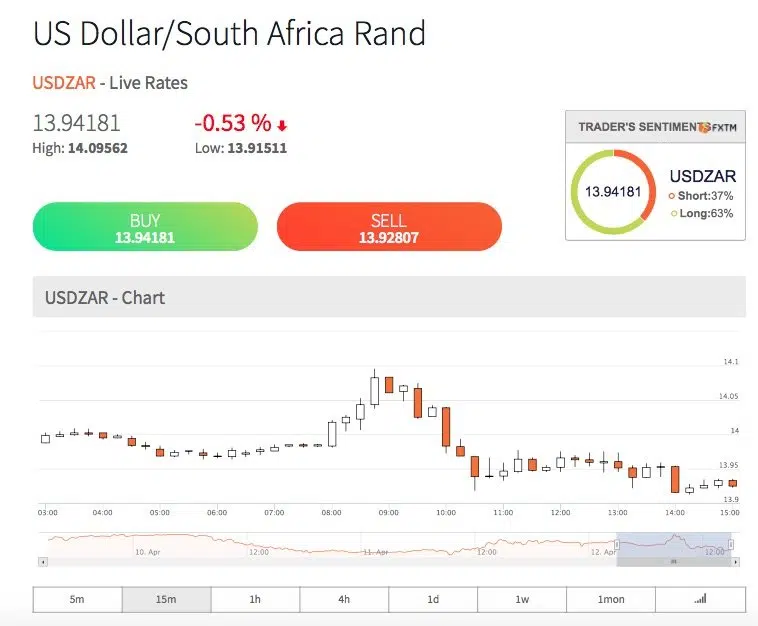

FXTM Trading Conditions

As with most brokers, trading conditions become more favourable the more money a trader chooses to deposit. But base trading conditions are better than most Forex brokers and this makes it attractive to new traders. Leverage is flexible depending on the country of residence, knowledge and experience. The margin call is fixed on all accounts is set to a very reasonable 80%.

Account types

FXTM has two main sets of account types and each is suited to a different kind of trader.

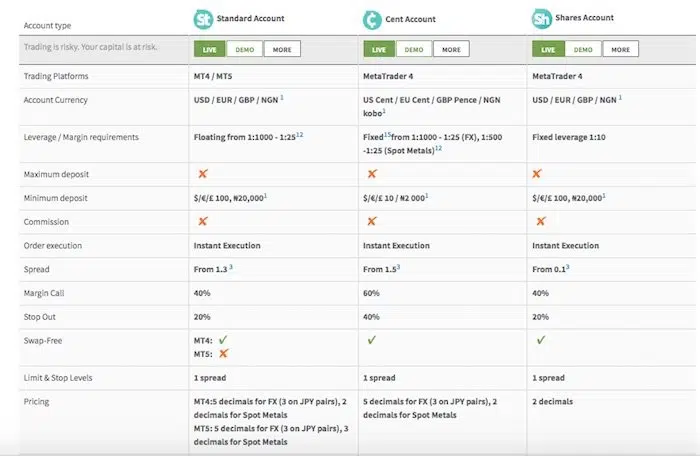

Standard Accounts

There are three standard accounts for Forex traders. All three Standard accounts use instant order execution. With instant execution you can set your stop loss and take profit orders at the same time that you are posting your trade, allowing better control of the trades. The spreads are generally wider than market execution accounts, in exchange for the lower deposits required.

Standard Account – This account type requires a 100 USD minimum deposit. The spreads start at 1.3 pips, and the margin call is 40% in FT Global Limited and 80% in Forextime Limited. The advantage of this account is that you can also trade the cryptocurrency offerings available in FT Global Limited.

Cent Account – This is an entry-level account, with a minimum deposit of only 10 USD. The spreads are wider, starting at 1.5 pips, and the margin call is 60% in FT Global Limited and 80% in Forextime Limited. There are also limitations on what currency pairs can be traded, as the more exotic pairs will require wider spreads that are not compatible with this account size. The only attractive aspect of this account compared to the others is the minimum deposit, so if you do have the money to invest, open either the Standard account above or the ECN Zero.

Shares Account – The Shares account type requires a 100 USD minimum deposit. The spreads start at 0.1 pips, and the margin call is 40% in FT Global Limited and 80% in Forextime Limited. FXTM offers trading on nearly 180 different company shares from the NYSE and NASDAQ and provides real-time data from both exchanges.

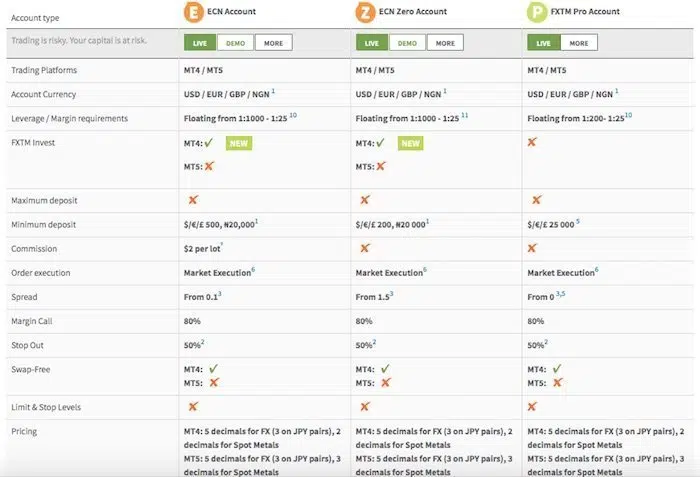

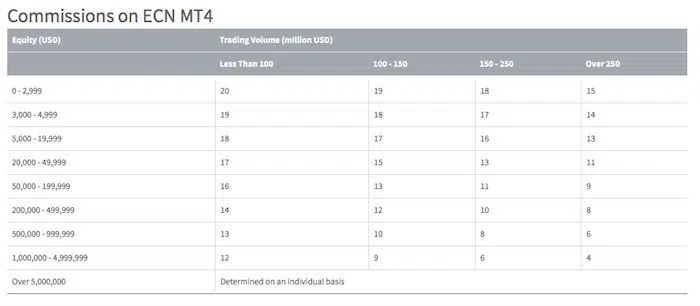

ECN Accounts

There are two main accounts for retail Forex traders and one for more professional traders with a higher minimum deposit. All the ECN accounts use market execution to execute orders and offer the option to use the MT5 trading platform. Because these are market execution accounts you will not be able to set your stop loss and take profit orders when you post your trade, increasing your risk during times of high market volatility. All the ECN Accounts require a higher minimum deposit than the Standard Accounts, but spreads are narrower.

ECN Account – if you are looking for tighter spreads and don’t mind paying a commission per lot, then this could be an account for you. With the standard leverage offered, this account requires a minimum deposit of 500 USD.

ECN Zero Account – Spreads starting at 1.5 pips are offered with this account type, but no commission per lot traded and a lower 200 USD minimum deposit. Because of the wider spreads, you will pay more fees to the broker in the long run with this account when compared to the main ECN account.

FXTM Pro Account – A 25,000 USD minimum deposit, no commission on trades and spreads as low as 0 pips. The FXTM Pro account is an excellent professional account that cannot be improved much. If you are a professional trader, sign up and get in touch with the team to see if FXTM is right for you.

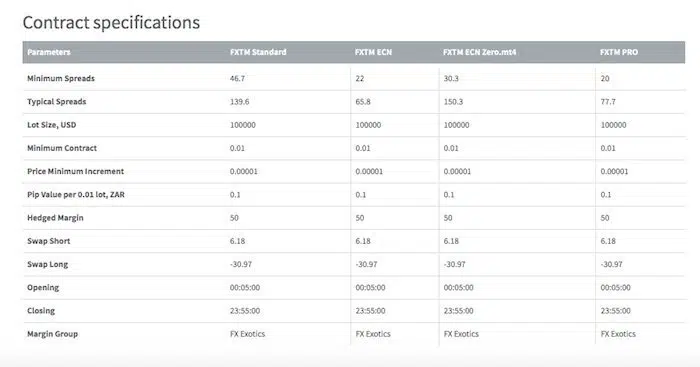

Spreads and Commissions

The spreads on the different account types vary between the ECN and Standard accounts. This is more due to the combination of commission and spread fees and how the order is executed.

Deposits and withdrawal fees

All major credit cards are accepted, as are all e-wallets. If you prefer to make a deposit via bank transfer, you should expect this to take a little longer. No commission is charged on deposits, but withdrawals have commissions depending on withdrawal type. They are:

- NetTeller & Skrill – Free

- Credit Cards – 2 EUR/ 3 USD/ 2 GBP Fee

- Bank wire – 20 EUR/ 25 GBP/ 40 USD

FXTM For Beginners

The educational material at FXTM is suitable for beginners but may seem lacking to the more advanced trader. By keeping the focus on beginners looking for reasonable trading conditions, the FXTM team of educators and analysts have succeeded in creating a welcoming environment for new traders. Additionally, FXTM is one of the few brokers with 24/7 support, allowing traders to get set up on weekends or holidays.

Educational Material

For the absolute beginner, FXTM has a great deal of training material to help new traders get started. Materials include articles, videos, webinars and a searchable glossary of new vocabulary. This is an excellent resource and many hours can be spent covering the basics of Forex Trading. For the more advanced trader, there is an additional set of videos that cover analysis topics, and more detail on chart reading techniques.

Analysis Material

FXTM has an open “Daily Market Analysis” section on their website where research analysts post bulletins that connect daily news items with analysis and actionable trading ideas. For advanced traders, this can be combined with other sources to achieve a more comprehensive view of global events and the trading opportunities they represent.

Customer support

FXTM customer support is open seven days a week, which is unusual compared to the standard 24/5 service offered by other brokers. Support is open Monday to Friday (24 hours), Saturday (11:00 to 16:00) and Sunday (12:00 to 20:00).

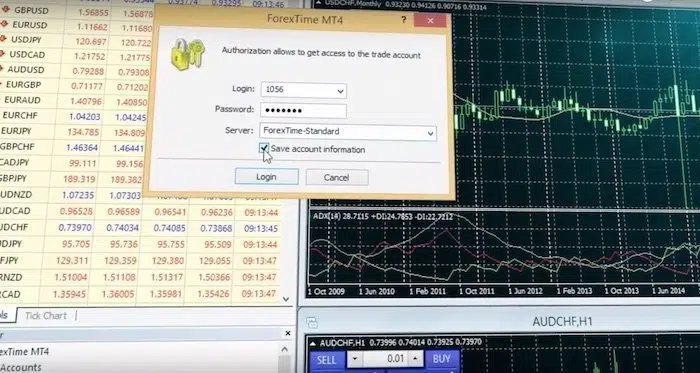

FXTM Trading Platforms

All FXTM accounts use the industry-standard MetaTrader 4 and all three ECN Accounts give you the option of using MetaTrader 5.

Mobile Trading Apps

MetaTrader is freely available on both Android and IOS mobile phones and tablets. The advantage of using the MetaTrader platform is the cross-device and multi-broker functionality, making it easier to change broker or use multiple brokers.

FXTM in their own words

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the FXTM offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

FXTM Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. FXTM would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

FXTM is a well regarded ECN/STP broker with a strong focus on educating new traders, customer support and innovation. With a broad selection of account types to satisfy traders of all experience levels, industry-standard trading platforms, multiple international regulators and widespread industry recognition we can recommend FXTM for both new and experienced traders.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how FXTM stacks up against other brokers.