For over a decade, FxScouts Kenya has been reviewing forex brokers and provided in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Kenyan markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

- Pepperstone - Best Kenya CMA Regulated broker

- AvaTrade - Best Mobile Trading Experience

- FOREX.com - Best Broker for Serious Beginners

- XM - Lowest Trading Fees in Kenya

- Exness - Best Trading Account Conditions for Beginners

- HFM - Best Low-Cost KES Trading Acount

- FBS - High Leverage Trading and 1 USD Minimum Deposit

- Axi - Best ECN broker on MT4

- IC Markets - 3 platforms and tight spreads

- markets.com - Best Mobile Trading Platform

Best Forex Brokers in Kenya 2024

How To Choose a Kenyan Forex Broker

Although international brokers accept clients from most countries, trading conditions and regulatory supervision may be different for Kenyan traders. To find the best Forex broker for Kenyan residents, we need to understand account conditions for Kenyan clients in detail.

To test each broker’s trading platform, we opened an account, set up the trading software, read through the educational material, and deposited and traded R4000 of our money. We also created all kinds of trouble for the customer service teams, read through the fine print in the client agreements, and tested how long it took to withdraw our money. In our test, we investigated:

Broker Regulation: Regulators keep an eye on Forex brokers to make sure they’re behaving legally and ethically. Some regulators, such as ASIC, the FCA, and CySEC, are better at keeping brokers honest than others. The CMA in Kenya is getting better at regulating brokers all the time and Kenyans should feel safe trading with a CMA regulated broker.

Account Supervision: Most brokers are supervised by multiple international regulators. As a Kenyan resident, it is important to know which regulatory authority will supervise your trading account. It is common for internationally-regulated brokers to open trading accounts for Kenyan residents under their offshore licenses (Mauritius, Seychelles, Vanuatu, etc.) to offer higher leverage or to bypass powerful client protections put in place by the CMA. Traders with accounts registered under offshore licenses are not protected by the CMA and are open to the additional risks of broker bankruptcy, fraudulent activity, or unfavourable trading conditions like a lack of negative balance protection.

Broker Trading Conditions and Costs: Better Forex brokers will often have lower trading costs, meaning that spreads are tight and minimum deposits are low. Trading execution should be lightning-fast and with little or no intervention. Forex brokers should also publish their spreads, execution policy, and a list of all CFDs available to Kenyan traders. We often see that trading conditions and negative balance protection availability change depending on a trader’s country of residence.

Broker Education and Analysis: Brokers should offer beginner traders a coherent and well-structured trading course alongside a demo account. Brokers should supply detailed market analyses to highlight trading opportunities and provide a complete learning experience. While all material is available in English very few Kenyan brokers will offer the same material in Swahili.

Broker Trading Platform: Brokers will have their own trading platform or provide support for a third-party platform, such as MT4, MT5, or cTrader. Some brokers will do both. Most Forex traders generally have a platform preference, so brokers with multiple platforms are more likely to have the platform a trader wants to use. Platform availability may vary between countries of residence, so our research notes which platforms are available for Kenyan residents.

Pepperstone – Best Kenya CMA Regulated broker

- Lowest-Cost ECN Broker

- No Minimum Deposit

- All Popular Trading Platforms

Pepperstone is the best Forex broker in Kenya. With low trading fees, no required minimum deposit, and a wide selection of popular trading platforms, Pepperstone is suited to beginners, with one of the better entry-level courses offered by any Forex broker, and experienced traders with a low trading cost account with fast trade execution.

Low Trading Fees: Pepperstone has two low-cost account options. The Razor Account, intended for scalpers and algorithmic traders, has spreads starting at 0 pips on the EUR/USD, plus a 7 USD volume-based commission per lot traded. The Standard Account is one of the lowest-cost beginner accounts available with no volume-based commission and spreads starting at 1.00 pips on the EUR/USD.

No Minimum Deposit: Pepperstone doesn’t have a required minimum deposit for either trading account. Pepperstone does suggest that you open a trading account with at least 200 USD, but this is not a requirement.

3 Popular Trading Platforms: Traders need to use a trading platform to access the Forex market, and Pepperstone supports all three of the most popular trading platforms. MetaTrader 4 (MT4) is the most popular and is used by most traders, MetaTrader 5 (MT5) is a newer version and has more tools, like an embedded economic calendar and chat system. Finally, Pepperstone also lets traders use cTrader, which is easier for many beginners to learn but has all the sophisticated automation tools found in MT4 and MT5.

AvaTrade – Best Mobile Trading Experience

Who AvaTrade is for: Traders who want a good all-round broker with low costs, free withdrawals, and a well-designed mobile trading app.

Why we like AvaTrade: AvaTrade’s biggest selling points are free deposits and withdrawals to Kenyan bank accounts and low trading fees, with Forex spreads starting at 0.9 pips on the EUR/USD. While AvaTrade’s minimum deposit of 100 USD isn’t the lowest you can find, it’s still low enough for most beginners. Traders on the move will like AvaTrade’s well-designed mobile app, AvaTradeGO, with its smart risk management tools and direct connection to AvaSocial, AvaTrade’s popular social trading system. Another highlight is the 13 cryptocurrency pairs available to trade at AvaTrade, more than most other brokers in Kenya. Cryptocurrency traders will also appreciate the dedicated 24/7 crypto trading customer support. It’s no secret that share CFDs are also very popular right now and AvaTrade has that sector covered too with 625 share CFDs to trade, including famous tech stocks like Google, Apple, and Amazon.

AvaTrade’s drawbacks: As we noted above AvaTrade has low trading fees, but they are not the lowest available in Kenya – some brokers have spreads down to 0.6 or 0.7 pips on the EUR/USD. And it’s possible to find much lower minimum deposits, all the way down to 3 USD in some cases. But most serious beginners will want a deposit of 100 USD or more and AvaTrade’s strength lies in its all-around excellence.

Forex.com – Best Broker for Serious Beginners

Founded in 2001, Forex.com is a well-regulated broker with a 100 USD minimum deposit and low fees that is more suited to serious beginners and more experienced traders. Some beginners with low minimum deposits will be put off by the high trading costs on Forex.com’s entry-level Standard and MT5 accounts. However, experienced traders will be interested in the Commission and DMA accounts, with minimum deposits of 100 USD and 25,000 USD, respectively. These accounts have some of the most competitive spreads (0.0 pips on the EUR/USD) combined with some of the lowest commissions in the industry.

FOREX.COM FEATURES

- Excellent education and market analysis for traders of all skill levels

- Support for MT4, MT5, and the Forex.com web-based trading platform,

- Range of trading tools on offer, including Trading Central, Trading View, SMART Signals, and subsidised VPS hosting.

- Wide range of tradable assets: over 91 currency pairs, 4500 share CFDs, commodities, indices, precious metals, and cryptocurrencies.

XM – Lowest Trading Fees in Kenya

- XM Ultra-Low Account

- 1200+ shares to trade

XM has a few different accounts, two of which have very low minimum deposits of 5 USD. But the lowest fees are found on its Ultra-Low Account, though the minimum deposit is much higher. Beginners will also benefit from XM’s great education section and the demo account that never expires.

Low Fees on the XM Ultra-Low Account

With a minimum deposit of 50 USD, traders can open the XM Ultra-Low Account, which is one of the lowest-cost trading accounts in the world. Spreads start at 0.6 pips on the EUR/USD with no commission. Traders can also open a Micro Ultra Account, which has the same costs as the Ultra-Low Account but allows smaller trade sizes. Small trade sizes are good for beginners looking to lower their risk.

1200+ Shares to Trade

While XM does not offer cryptocurrency trading, it does have over 1200 shares to trade. Other trading assets include commodities, precious metals, indices and 57 Forex pairs. XM has two of the most popular trading platforms in the world with MetaTrader 4 (MT4) and MetaTrader 5 (MT5), but share trading is only available on MT5.

Exness – Best Trading Account Conditions for Beginners

Founded in Russia in 2008, Exness Group has over 200,000 clients worldwide and offers trading on 100+ Forex pairs, a small range of cryptocurrencies, 70+ stock CFDs, indices and commodities. Exness has nine account types on the MT4 and MT5 platforms – many more than most brokers. The Standard Cent Account is aimed at beginners who want low fees and a low minimum deposit with a 1 USD minimum deposit, micro-lots unlocked, and spreads as low as 0.3 pips. The only disadvantages to this account are that traders will only be able to trade currency and metals and MT5 is not supported.

EXNESS FEATURES

- Nine accounts on the MT4 and MT5 trading platforms

- ECN Accounts for experienced traders with raw spreads and 7 USD commission

- Automated instant withdrawal system, with free withdrawals to e-wallets.

- 24/7 customer service

HFM (HotForex) – Best Low-Cost KES Trading Acount

Who HFM is for: Traders who want a Kenyan Shilling trading account with a low minimum deposit and fast and free withdrawals to Kenyan banks.

Why we like HFM: HFM is a fantastic all-around broker, but its fast and free deposits and withdrawals and KES trading accounts are the highlights here. All three of its account types have the option of using Shillings (KES) as the trading currency, but the standout is the Micro Account, with a 550 KES minimum deposit and decent trading fees starting at 1 pip spreads on the EUR/USD. Traders always want to deposit and withdraw their funds as fast and as cheaply as possible, and HFM excels over other brokers with instant deposits and 2-day withdrawals, all with no extra charge. Fast and free funding is available for clients with Kenyan bank accounts. Beginners and those with little time to trade should note that HFM also has a copy-trading account where clients can copy the trades of experienced and profitable traders. The three standard accounts have access to trading on Forex, cryptocurrencies, commodities, indices, shares, bonds, and ETFs. With CMA regulation, HFM clients can rest assured of local protection of their trading accounts.

HFM drawbacks: HFM is popular for its range of CFDs and while the Micro Account has a low minimum deposit, a starting spread of 1 pip is a bit higher than other brokers. Copy traders should also be aware that the HFCopy account is only available on the MT4 trading platform, and trading is restricted to Forex, indices, and gold.

FBS – High Leverage Trading and 1 USD Minimum Deposit

Who FBS is for: With a wide range of accounts, FBS will appeal to both experienced traders looking for high leverage and low fees or beginners looking for low minimum deposits and cryptocurrency trading

Why we like FBS: FBS’ strength is in its range of accounts, with trading conditions for all types of traders. Beginners will focus on its Cent Account with its 1 USD minimum deposit or the Micro Account with a 5 USD minimum deposit, more experienced traders will be interested in the ECN account with a 1000 USD minimum deposit, raw spreads, and a 6 USD commission. Other accounts include a Standard Account with a 100 USD minimum deposit and Zero Spread Account with a 500 USD minimum deposit. Experienced traders will appreciate the high leverage available, with all accounts except the ECN account offering leverage of 3000:1. Beginners will also like the low trading fees on the entry-level accounts, with Cent Account spreads starting at 0.8 pips on the EUR/USD. Cryptocurrency trading is also a big draw here, with 37 cryptocurrencies available to trade, many more than most other brokers.

FBS drawbacks: As most traders know, high leverage is a double-edged sword. While it can greatly increase profitability, it also greatly increases risk. An FBS trading account with only a few dollars in it but 3000:1 leverage can be wiped out in an instant. And while FBS lets clients use the MT4 and MT5 trading platforms, its cryptocurrency products can only be traded using the FBS Trader mobile app. As many people already use their phones to trade, this isn’t the end of the world, but the FBS Trader app is currently only available on Android devices, not iPhones.

Axi – Best ECN broker on MT4

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Founded in Australia in 2007, Axi is an ECN broker offering trading on Forex, metals, commodities, cryptocurrencies, and indices – a smaller group of assets than most brokers but with a good selection of 70+ Forex pairs. Axi only provides support for the MT4 trading platform, but with the MT4 NexGen plugin it has the best ECN MT4 trading experience. The MT4 NexGen plugin includes an advanced sentiment indicator, a correlation trader, a more intuitive terminal window, and an automated trade journal.

AXI FEATURES

- ECN trading conditions, 20 liquidity providers so less slippage and requotes

- Pro Account with spreads starting at 0 pips and 7 USD per lot commission

- Max Leverage of 1:500

- Trading tools include Autochartist, Pysquation (an AI trade diagnostic) and VPS hosting

IC Markets – 3 platforms and tight spreads

Founded in 2009, IC Markets is an Australian and ASIC-regulated ECN broker with some of the tightest spreads in the world. Low commissions on all three major platforms are also a big draw, with a simple account structure that will satisfy all traders. IC Markets offers traders:

- Uncomplicated trading conditions and tight spreads

- Choice between MT4, MT5 or cTrader

- Excellent education and customer support

- Tight Spreads + Simple Account Choice

IC Markets offers three simple accounts with variable spreads on the MT4, MT5 and cTrader platforms. Two Raw Spread Accounts are available on either cTrader, MT5 or MT4 and a Standard Account is available on MT4 and MT5. The Raw Spread Accounts charge a small commission of 3 USD (cTrader) or 3.5 USD (MT4/MT5) but spreads are often down to 0 pips, averaging 0.1 pips on the EUR/USD pair. The Standard Account charges no commission but spreads start at 1 pip. IC Markets pricing relies on 25 different liquidity providers ensuring deep liquidity and the lowest spreads in the industry.

Best Brokers: Markets.com – Best Mobile Trading Platform

The Markets.com app provides a smooth and stable trading experience with low fees and a huge range of tools. With built-in advanced charting, traders have easy access to trendlines, channels, pitchforks, and Fibonacci Retracements. In the chart view, traders can see their orders, related instruments, and open positions with a single click.

The app offers traders fast, commission-free trading with some of the lowest fees available. Spreads start at 0.6 pips on major FX pairs with no commission and leverage of 300:1. The large variety of tradeable instruments include 765 global shares, 56+ currency pairs, 30 global indices, 22 commodities, 77 ETFs, 25 cryptocurrencies, and 4 government bonds.

FEATURES

Effortless mobile trading

900+ CFDs with low fees

Advanced trading tools

What is the Foreign Exchange Market?

The foreign exchange market, also known as the forex (or even more simply, the FX market), is the largest financial market in the world. Every day, trillions of dollars of global currencies are traded in what are called “pairs”, i.e. the exchange of one currency for another, such as rand for dollars, euros for Japanese yen, etc. These transactions are carried out five days a week, 24 hours a day around the globe and determine the value of every currency on the planet second by second, based on supply and demand. So, if the pound is in demand, its value against, for example, the dollar will rise and vice versa.

Given its scale and breadth, forex trading is easily accessible by individual investors, who can open an account with a few hundred pounds and begin trading immediately. But it is easy to lose money, especially if you are a beginner. Trading successfully requires effort, discipline and a determination to learn as much as you can about the market before you start. You also need to understand the regulations governing the market, the costs of trading and which brokers to use. Most importantly, you should understand the risks and disadvantages before deciding whether forex trading is for you.

Why does the Forex Market Exist?

There are many reasons why people trade currencies. Kenyan companies may need to buy dollars to pay for American imports, or they may need euros to pay for the acquisition of a company based in Europe. Central banks, such as the Central Bank of Kenya (CBK), can intervene in FX markets, buying and selling currency to manipulate its value for reasons of economic policy. Speculators also drive a very large part of the market, trading with the aim of generating a profit.

Large financial institutions, multinational corporations and hedge funds dominate the forex market, which reached a value of US$6.6 trillion per day in April 2019, according to the latest statistics. That size means it is a hugely liquid market, i.e. it is very easy to buy and sell currencies because there are so many buyers and sellers in the market for most currencies.

What Drives the Forex Market?

The rand is a free-floating currency. In other words, the value of the rand in the FX markets is determined by supply and demand. This is the case for the currencies of most advanced economies. By contrast, some currencies, such as the Chinese renminbi (RMB), have a fixed exchange rate. The Chinese authorities determine the value of the RMB against the dollar and keep the link until they decide to alter the exchange rate. Clearly, there is no potential for individual traders to profit from trading currencies with a fixed exchange rate.

The value of a floating currency such as the Kenyan Shilling, however, is constantly moving up and down against other currencies. Often these movements are relatively small, so the rand may begin the trading day at 115 KSH to the dollar and end a little higher or lower, or even back at its opening level. But dramatic economic or political news can spark much greater volatility. For example, the KSH fell by around 5% at the start of the Covid pandemic, back in March 2020. Traders, fearing a prolonged period of economic uncertainty, sold the KSH as quickly as they could.

Economic developments are also a key influence. New data suggesting the Kenyan economy is growing slower than anticipated might spark concerns that CBK could lower interest rates to stimulate growth. Lower interest rates reduce the appeal of holding a currency since you are getting less return on your money. That outlook consequently dampens demand for the rand and its value falls. Similarly, if Kenya’s economic outlook brightens and traders anticipate CBK will raise interest rates, they will buy the rand, increasing its value against other currencies.

That is why FX traders follow economic, financial and political news so closely, looking for any hint of information that could sway the value of currencies. They are hoping to react before other traders spot the development. Or they may take bets on a likely development, believing they have some insight that other traders lack.

Why is Forex Trading Popular?

Forex trading is the largest and most easily accessible market in the world. The costs involved are relatively low compared with other markets, there are lots of brokers to choose from in Kenya, and it is relatively easy to understand the ways in which you can trade the market. There are many freely floating currencies and since they can all be traded against each other there are a huge number of currency pairs to trade in. A vast amount of information is available to would-be traders, ranging from how to get started to outlining potentially profitable trading strategies.

You can trade from your living room using a fairly basic computer if you download the appropriate trading software, and it is relatively easy to set up an account with a broker. Unlike other financial markets, you can also exploit the concept of “leverage”, where you make use of borrowed money to increase your potential profits (and your losses). To explain what this means, currency pairs are traded in specific amounts called lots. They tend to be in 100,000 units of a currency, so, for example, if you are trading in the pound sterling against the US dollar, you would buy or sell £100,000 at a time. Since most people don’t have £100,000 available to trade, the broker effectively offers to lend you money. So, they may allow you to trade in a lot of £100,000 by opening an account with £1,000 and lend you the remainder. The initial £1,000 is known as the margin and your leverage, in this case, would amount to 100 to one (100:1).

As we mentioned, as well as increasing potential profits, leverage can dramatically increase risk. There are methods you can use to contain risk, but that is a topic for another article.

The Disadvantages of Forex Trading

Forex trading requires a considerable commitment. It takes time to learn how to trade profitably, and when you start to trade you may have to spend many hours per day on your computer screen following and researching what is happening in the market – and why – in preparation for your trading day. When that day is finished, you will need to analyse what happened and why your trading activities succeeded or failed, so that you can apply the lessons learnt to the next day’s trading. There could be days when you lose money and it is easy to become disheartened. There is certainly no guarantee of success. FX trading can be risky and you can lose money or you may find that it is simply not something you like or have the temperament for. You have to be patient, for example, waiting for opportunities to arise, and the market can experience bouts of extreme volatility that you may find highly stressful.

Is Forex Trading Legal in Kenya?

Yes, Forex trading is legal in Kenya and Kenyan brokers are regulated by the Capital Markets Authority (CMA). Kenyan residents can legally trade with any Forex broker in the world, though many brokers based overseas are not licenced by the CMA.

Overview of Forex Trading in Kenya

Over the last ten years, mobile phone use in Kenya has exploded. Most Kenyans are now connected to the internet everywhere they go and whenever they want. At the same time, employment opportunities for young people have dried up as the economy slowed. Young Kenyans looking for new ways to make money are at the forefront of a boom in Forex trading, made all the easier because:

- All Forex brokers now have mobile apps that allow traders to deposit and withdraw funds, check market news and make trades from their phones.

- Many brokers in Kenya have very low deposit requirements, some as low as 1 US dollar.

- Many brokers offer rand trading accounts, so Kenyans do not have to convert their money into dollars first

Because it is so easy to get started Forex trading, the number of Forex scams and bad brokers has also increased as criminals attempt to profit from the boom. Recent media scrutiny and better enforcement by the authorities has led to a healthier local trading environment, but Forex scams are still frequent. Most Forex scams in Kenya start on social media and are conducted by unlicensed individuals.

Forex Regulation in Kenya

Despite its emerging market status, Kenya has a relatively strong regulatory regime when it comes to online retail Forex CFD trading. Unlike many of its peers, Kenya laid out a legal framework for local regulation in 2017 – and placed the traditional financial regulator, the Capital Markets Authority (CMA), in charge of enforcement.

As a result, Forex brokers with a physical presence in Kenya are required to hold a licence from the CMA and adhere to strict regulations, similar to those seen in Europe and the United Kingdom.

These regulations are important because they protect traders – operating and reserve capital requirements ensure that in the case of the broker bankruptcy traders can still claim their funds back, and leverage restrictions ensure that beginners traders don’t lose all their money while they are still learning.

The regulatory functions of the CMA as provided by the Capital Markets Act include; licensing and supervising all the capital market intermediaries; ensuring compliance with the legal and regulatory framework by all market participants; regulating public offers of securities, such as equities and bonds & the issuance of other capital market products such as collective investment schemes; promoting market development through research on new products and services; reviewing the legal framework to respond to market dynamics; promoting investor education and public awareness; and protecting investors’ interest.

Unfortunately, there are only three brokers currently regulated by the CMA and none of them has the trading conditions to match the international brokers offering their services in the country. But, by having a regime in place and brokers already licenced, Kenya is far ahead of many of its neighbours and we are optimistic that the Kenyan Forex industry is well-placed for secure and stable growth over the next few years.

It’s important to note that since 2017 a number of disreputable brokers and companies posing as Forex brokers have been operating in Kenya, so if you are going to work with a local broker it is essential that you investigate their regulatory status before opening an account.

According to the Capital Markets Act, section 23 (1),“No person shall carry on business as an online forex broker or hold himself out as carrying on such a business unless he holds a valid license issued under this Act or under the authority of this Act.”

Advantages of Trading with a CMA-regulated Broker

The main advantage of trading with a CMA-regulated broker in Kenya is the local protection of your trading account. While the CMA does not require brokers to sign up to a compensation scheme, local protection from the CMA means:

- Operating Capital Requirements: CMA licenced Forex brokers must maintain an operating balance of at least 50 million KSH, plus 5% of liabilities owed to clients.

- Capital Reserve: In addition, they must also retain a reserve of 40 million KSH (or 80% of their operating capital, whichever is higher) in cash or cash equivalent.

- Leverage Restriction: The CMA requires all Kenyan brokers to restrict leverage, in this case to a maximum of 1:400 for non-finance professionals.

Other common advantages of trading with a CMA-regulated broker are:

- Shilling (KSH) Trading Accounts: Most, but not all, CMA-regulated brokers will offer KSH trading accounts. This means no conversion fees when depositing or withdrawing to/from Kenyan bank accounts.

- Fast and Free Deposits and Withdrawals: Most, but not all, CMA-regulated brokers will offer free same-day deposits and withdrawals to/from Kenyan bank accounts. Most will also offer support for eWallets such as Ozow or PayFast, allowing instant deposits and withdrawals from Kenyan banks.

Disadvantages of Trading with a CMA-regulated Broker

Yes, there are disadvantages when trading with a CMA-regulated broker. The CMA is a good regulator but does not protect traders as well as regulators in the UK, Europe or Australia. The main disadvantages of trading with CMA-regulated brokers are:

- No negative balance protection: CMA-regulated brokers are not required to prevent traders from losing more money than they have in their trading accounts. It’s rare, but this does mean that traders in Kenya may end up owing their broker money.

- No financial compensation scheme: CMA-regulated brokers are not required to provide compensation to traders in the event of bankruptcy or closure.

- Leverage limits: Leverage is an essential part of Forex trading, but high leverage levels are risky. In Kenya, there is a limit to the leverage a broker can offer.

How do I Know that a Broker is Regulated by the CMA?

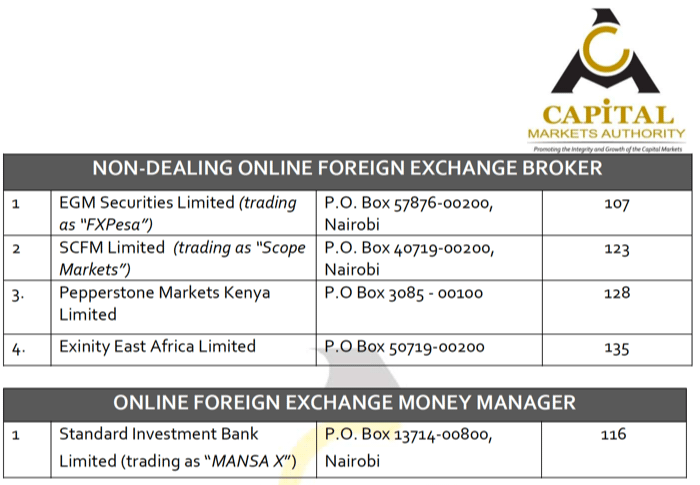

Some Kenyan traders may want to trade with CMA-regulated brokers, but how do you verify that a broker has a licence? Fortunately, checking if a Kenyan Forex broker is regulated by the CMA is easy. The CMA offers a search tool for all authorised brokers here: https://www.cma.or.ke/

This is what the results window looks like:

Forex Scams and Bad Brokers in Kenya and How to Avoid Them

As part of our work at FxScouts, we ask traders who have been scammed or defrauded by Forex brokers – or people claiming to be Forex “experts” – to let us know about their experience (you can find the details here).

Forex Scams

According to our latest research, we found that Facebook and Instagram were the sources of more than 50% of Forex scams in South Africa. Both companies have a poor record of stopping criminals, even after official complaints have been made. We also found that many victims paid the people who scammed them in Bitcoin or other cryptocurrencies and that almost half of the complaints people made were against individual scammers, not brokers.

Both social media and cryptocurrency are great tools for criminals who want to disguise themselves. People can use whatever name they want on social media, and cryptocurrency is almost untraceable. Once someone pays a scammer they met on social media with cryptocurrency, it’s impossible to get their money back.

Other telltale signs of a Forex scam are promises of guaranteed returns and the use of complex jargon. Forex trading is high-risk speculation and even professional traders cannot guarantee returns. And while there is Forex-specific jargon, trading can be explained in simple terms.

Any individual who offers to perform a financial service without a licence in Kenya is breaking the law. So always ask for a licence number and verify it with the CMA before handing over money.

Bad Brokers

Avoiding individual scammers is relatively easy compared to avoiding bad brokers. So what can Kenyan traders do to avoid bad brokers? There are a few telltale signs that a broker is not treating its clients fairly:

- Unpublished spreads: The spread is the broker’s fee for connecting traders to the Forex market. If a broker doesn’t want to say how much this fee is, it’s probably charging too much.

- High deposit and withdrawal fees: Deposits should always be free of charge and withdrawals should be low-cost. Be wary of high fees or unexplained charges

- Delayed withdrawals: Withdrawals should take a few days at the most. If a broker ignores withdrawal requests or delays for more than a week it is cheating its customers.

- Missing Deposits: Bad brokers will sometimes claim to have not received a deposit after it has been made. Always request proof of payment when depositing.

- Unresponsive Customer Service: In many cases, the customer service team at bad brokers will ignore complaints or requests for assistance – especially when dealing with any of the problems listed above.

- Paywalled/Limited Demo Accounts: Demo accounts are the best educational tool beginner Forex traders have. Brokers that require new traders to open a live account before they can open a demo account, or close demo accounts after a short time period, are trying to force beginners to start trading before they are ready.

If you have experienced any of the issues listed above and the broker has a licence from the CMA, you can always submit a complaint via the CMA’s complaints form here.

How to Compare Forex Brokers in Kenya

Though Forex brokers might appear to be similar, they are quite different once you dig a little deeper, and account conditions will vary for Kenyan residents. These are some of the most common questions traders will have when comparing Forex brokers.

Forex Brokers for Beginners

- Do I need a broker to trade Forex?

- Which is the best broker in Kenya?

- Which is the best broker for beginners?

- Which broker has the best demo trading account?

- Are Forex brokers in Kenya reliable?

- How do I choose a Forex broker?

- How do Forex brokers make money?

Forex Broker Fees and Trading Costs:

- Which brokers have the lowest trading costs?

- How do I make a deposit with a broker?

- How do I make a withdrawal from a broker?

- Which broker has the lowest minimum deposit?

- How do I calculate trading costs?

Other Trading Options

- Which broker has the highest leverage?

- Which broker has the most CFDs?

- Which broker has the most currency pairs?

- Which broker is the best for professional traders?

- What are managed Forex trading accounts?

Forex Broker Regulation

- How do I know if a Forex broker is regulated?

- How do I check if a Forex broker is licenced by the CMA?

Forex Broker Customer Support:

Forex Trading Platforms:

Do I Need a Broker to Trade Forex?

Yes, you will need a broker to trade Forex. Connecting traders to the Forex market is an expensive and technically complex business. It’s important to choose a regulated Forex broker with low costs and a history of treating its clients fairly.

Which is the Best Broker in Kenya?

The best broker in Kenya is AvaTrade. Avatrade’s fees are low, with a 100 USD minimum deposit and tight spreads. AvaTrade clients can trade Forex, cryptocurrencies, commodities, indices, stocks, bonds, vanilla options, and ETFs and have a choice of trading platforms and useful trading tools. Finally, the AvaTradeGo mobile app is one of the best-designed trading apps in the world; it’s easy for beginners to learn but with the functionality required by experienced traders.

Which is the Best Broker for Beginners?

IG Markets is the best broker for beginners in Kenya. IG Markets, with no minimum deposit requirement, has very low trading costs and negative balance protection as standard, making it an excellent low-risk option for new traders. Award-winning customer support is available 24/5 via email, live chat, and telephone. IG Markets also has a great education section, with articles, video tutorials, frequent webinars, advanced trading strategies, and chart analysis.

If you are looking for a reliable regulated broker for beginners, some other good options are:

Which Broker has the Best Demo Trading Account?

HotForex also has the best demo trading account in Kenya. The HotForex demo account never expires and comes with 100,000 USD preloaded on either the MT4 or MT5 trading platform.

Some other brokers with great demo accounts and strong regulation are:

Are Forex brokers in Kenya reliable?

Yes, most Forex brokers in Kenya are reliable and trustworthy. The most reliable brokers in Kenya are regulated by the CMA and a set of reputable international regulations. They should also have a history of treating Kenyan traders fairly. If you are unsure about the reliability of your Forex broker, you can check our list of brokers to avoid.

How do I Choose a Forex Broker?

When choosing a Forex broker there are three things to consider:

- Regulation: Make sure you choose a broker regulated by the CMA in Kenya or one of the other major regulators like CySEC (Europe), ASIC (Australia) or the FCA (UK). Regulated brokers have better security and will treat their traders fairly

- Cost: Look for a broker with a low minimum deposit and low fees. Broker fees will include the spread, commission and deposit and withdrawal fees.

- Education: If you’re a beginner you will want a broker with good educational content. All of the brokers on our Best Brokers for Beginners page have high-quality education for beginners.

How do Forex Brokers Make Money?

Some brokers (called market makers) only make money from the spread – the difference between the buying and selling price of the currency pair. These brokers will be the counterparty to any trade, so they make money when clients lose trades.

Other brokers (called ECNs) have tight spreads but make money from commissions, which are charged every time a trade is opened or closed. This type of broker makes money whether a client wins or loses.

Which Broker has the Lowest Fees?

Tickmill is the broker with the lowest fees, with the total trading cost on its Pro Account equalling 0.4 pips on the EUR/USD, this includes a 0 pip minimum spread and a round turn commission of 4 USD per 100,000 traded.

Other brokers with low trading costs are:

Broker fees are split into the trading costs, which is the total of the spread and commission, and non-trading fees such as deposit and withdrawal fees.

The spread is the difference between the buy and sell price of a Forex pair and is measured in pips, the smaller or “tighter” the spread the less money you spend when you make a trade. A commission is charged by some brokers every time a trade is opened or closed.

How do I make a Deposit with a Broker?

Making a deposit with a broker is a simple process. Once you have signed up and opened a live account you will be given a few options. Most brokers in Kenya will accept local bank transfers, credit cards, online payment solutions like Ozow and Payfast, and eWallets like Neteller and Skrill. Bank transfers usually take 1-2 days to process and may have a fee attached but all other deposit methods are usually instant and free.

How do I make a Withdrawal from a Broker?

To make a withdrawal from a broker you must have enough money in your trading account after deducting the margin needed to keep any trades open. Once you know how much you can withdraw, you can make a withdrawal request via your account dashboard. To prevent money laundering, Kenyan brokers will only let you withdraw the same amount as your initial deposit back to your credit card or eWallet. Anything more than this will have to be withdrawn to a bank account in your name.

Which Broker has the Lowest Minimum Deposit?

Exness is the broker with the lowest minimum deposit. Exness has three standard accounts which are advertised as having no required minimum deposit. This is not entirely true as the minimum deposit Exness accepts from Kenyan credit cards or bank accounts is 3 US dollars. Other regulated brokers in Kenya with low minimum deposits are:

With most brokers, larger deposits usually unlock lower trading costs and other perks. What level of minimum deposit you are comfortable with depends on your financial situation.

How do I Calculate Trading Costs?

When trading Forex, the total trading cost is the spread on the currency pair you are trading plus any commission your broker may charge. If you keep a trade open overnight you will also be charged a rollover (or “swap”) fee, which will be deducted automatically from your account. Major pairs, such as the EUR/USD or USD/JPY have tighter spreads and are cheaper to trade.

Which Broker has the Highest Leverage?

FBS offers the highest leverage of any Forex broker in Kenya. On three of their five accounts, leverage of 1:3000 is available. Other brokers in Kenya with high levels are leverage are:

Leverage is money borrowed from your Forex broker to increase the size of a Forex trade. Leverage is essential in Forex trading because the movements of the market are too small to make a decent profit unless you place thousands of dollars on each trade. Leverage can be used to make large profits with a little of your own money, but you can also quickly lose more than your original investment.

Which Broker Has the Most CFDs?

IG Markets is the broker with the most CFDs to trade. IG Markets offers trading on over 17,000 instruments, including Forex, indices, share CFDs, commodities, cryptocurrencies, digital 100s, options, ETFs, bonds, and interest rates.

Other brokers with a wide range of instruments to trade are:

Which Broker has the Most Currency Pairs?

Swissquote is the Broker with the most currency pairs, with over 130 currency crosses to trade. As part of a larger banking group, Swissquote is very well regulated and is one of the most secure brokers in the world. Swissquote targets professional traders and minimum deposits are high, starting at 1000 USD on its entry-level account.

Other Forex brokers with a larger than usual selection of currency pairs to trade are:

Which Broker is the Best for Professional Traders?

Pepperstone is the best broker for professional traders. An ECN broker with extensive liquidity streams, Pepperstone supports all three major trading platforms (MT4, MT5 and cTrader) and has some of the tightest spreads in the industry (0.09 pips EUR/USD spread on its Razor Account).

Commissions are low and there are no minimum deposit requirements. Commissions can be further reduced by becoming a member of Pepperstone’s Active Trader Program. The Active Trader Program has a number of other advantages for high-volume traders, including a free VPS service and priority customer support.

What are Managed Forex Accounts?

Some brokers will operate a managed account for you, but this is rare. There are independent money managers who can manage your account while they are trading for themselves. The minimum deposit requirements and additional risks involved when trading CFDs is different than on retail accounts.

If you have any questions after reading through this guide, please get in touch with us in the comments at the bottom of the page.

How do I Know if a Forex Broker is Regulated?

All regulated brokers are required to display their licence number and the authority they received it from on their website. These licence numbers can be easily verified on the regulatory authority’s website. Some scam brokers will use similar names to legitimate businesses, so make sure the name of the licence holder on the regulator’s website matches the broker’s details.

How do I check if a Forex broker is licenced by the CMA?

All Forex brokers that are regulated by the CMA are required to publish their Financial Service Provider (FSP) licence number on their website. Once you have the FSP number of a broker you can go use the CMA’s search page to enter the FSP and verify that the broker is indeed licenced.

How Can I Report Scam brokers?

If you believe you have been scammed by your broker, the first thing to do is warn others and tell your story. You can contact the CMA’s complaints department here and ask them to investigate. We also have a report a scam broker form which we use to gather information so that we get the word out. If you have been scammed, please complete the form.

Which Broker has the Best Customer Support in Kenya?

KhweziTrade is the South Africa broker with the Best Customer Support. KhweziTrade’s client support team is knowledgeable and helpful and all requests are answered quickly and efficiently. Kenyan traders are offered a personalised experience, with all traders receiving a personal account manager.

Which Forex Broker has the Best Platform?

Marketsx is a trading platform from Markets.com, offers trading accounts on the Marketsx platform to trade over 2,200 financial instruments. The platform also offers advanced charting, making it easier to spot trends and identify new trading opportunities. Marketsx also allows traders to use five types of indicators once, overlay multiple assets, or compare up to eight instruments side-by-side. Marketsx is available on mobile devices and via the markets.com website.

Which is the Best Platform for Forex?

Currently, MetaTrader 4 (MT4) is the best platform for trading Forex. MT4 has been around since 2005 but is supported by most Forex brokers and used by millions of traders around the world. MT4 is resource-efficient, fast, and can run on older hardware without any issue. It’s also fully customisable and can handle multiple trading accounts from different brokers with a single installation.

MT4 is particularly valued for its automated trading facilities. Traders can create or buy algorithmic trading robots and install them on their version of MT4 to automate trading or assist in decision making. It’s also possible to copy other traders through the MT4 trading signals facility.

Trading with Regulated Offshore Brokers in Kenya

As mentioned, there are several scam brokers currently operating in Kenya, and the few CMA licenced brokers are greatly restricted in the trading conditions they can offer. The safest and most profitable way to trade Forex CFDs in Kenya is to trade with a well-regulated offshore broker.

Most of the larger international brokers are regulated by one of three trusted government authorities, the most trusted authorities in the world are:

- The UK’s Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The Cyprus Securities and Exchange Commission (CySEC)

It is crucial to choose a broker that is regulated by at least one of these authorities, and you will find that some are regulated by more than one. The FCA is seen as the most rigorous of these authorities, as they charge a much higher licencing fee and require brokers to have more operating capital than ASIC or CySEC.

All of these regulators have much higher operating capital requirements than the Kenyan CMA and impose much stricter oversight and auditing of the brokers under their supervision, thereby ensuring a fair and secure trading environment.

Brokers with regulation from one of these authorities often have regulatory oversight from smaller, more lenient, regulators too. This allows them to offer a different range of products to overseas clients. For instance, the UK’s FCA requires that maximum leverage is set at 30:1, but an FCA-regulated broker with a subsidiary company regulated by the Mauritius Financial Services Commission (FSC) would be able to offer leverage of 400:1 to clients outside the UK and Europe.

While regulators like the Mauritian FSC are not as well regarded as the FCA, ASIC or CySEC, most of the brokers we recommend for Kenyan traders are regulated by at least one of the major regulators alongside any more lenient authorities.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the UK’s regulator, the FCA, or the Australian regulator, ASIC).

Our Rating & Review Methodology

Our State of the Market Report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

References

These documents were used in the inspiration, research and data collection for this article.