-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Fusion Markets Broker Review

Last Updated On Nov 15, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Fusion Markets

Founded in 2017, Fusion Markets offers two low-cost accounts, available on MT4, MT5, and cTrader, great research tools, 24/7 customer service, and free and fast withdrawals.

Fusion Markets accounts have no minimum deposit requirements, and its Zero Account has spreads that start at 0 pips (EUR/USD) in exchange for a commission of 4.5 USD, making it one of the lowest-cost accounts in the industry.

We are impressed that in addition to MT4 and MT5, cTrader is also available. Fusion Markets is now one of a handful of brokers that has such a good platform offering.

It also offers an excellent range of market analysis materials, has free VPS hosting for clients that trade over 20 lots a month, and various copy trading services. Our only issue with Fusion Markets is that it has no educational materials, making it a poor choice for beginner traders.

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | ASIC, VFSC |

| 💵 Trading Cost | USD 4.50 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, cTrader, TradingView |

| 💱 Instruments | Forex, Stock CFDs, Indices, Commodities, Cryptocurrencies |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Low minimum deposits

- Tight spreads

- Excellent market analysis

Cons

- No in-house platform

- No education

Is Fusion Markets Safe?

With regulation from Australia’s top authority, ASIC, Fusion Markets has a high trust rating, but Kenyan traders will be onboarded through its VFSC-regulated entity, which offers fewer protections.

Regulation: Fusion Markets has an excellent reputation and is regulated by a top-tier authority – ASIC of Australia. However, Kenyan traders will be onboarded through Fusion Markets’ Vanuatu-based entity, regulated by the Vanuatu Financial Services Commission, which provides little regulatory oversight. See below for Fusion Markets’ licence:

Safety Features: Fusion Markets segregates all funds from the company’s operating capital and offers negative balance protection to all its clients. VFSC regulatory oversight also means that Fusion Markets can offer higher leverage and bonuses to Kenyan traders, which may be attractive to some.

Company Details:

![]()

![]()

Fusion Markets’ Trading Instruments

Fusion Markets offers a good range of CFDs to trade, including 80 forex pairs, a much larger range than other similar brokers.

Complete list of instruments and leverage:

![]()

![]()

- Forex: Fusion Markets’ range of currency pairs is much broader than the industry average and includes majors, minors, and exotics.

- Share CFDs: Fusion Markets’ range of share CFDs is limited compared to other large international brokers and includes popular US tech companies and multinational energy companies.

- Commodities: Fusion Markets’ range of commodities is excellent, as most brokers offer trading on between 5 – 10 commodities.

- Indices: Fusion Markets offers trading on a limited number of indices compared to other brokers.

- Cryptos: Fusion Markets offers trading offers an average range of cryptocurrencies compared to other brokers.

Overall, Fusion Markets has a similar number of assets compared to other brokers, but it stands out for its number of Forex pairs.

Accounts and Trading Fees

Fusion Markets has two accounts with very low trading costs compared to other brokers, and neither trading account has a required minimum deposit.

Trading Fees: Neither the Zero Account nor the Classic Account has a required minimum deposit, though we recommend starting with a minimum of 200 USD to avoid margin calls. Trading costs on both accounts are much lower than most other brokers.

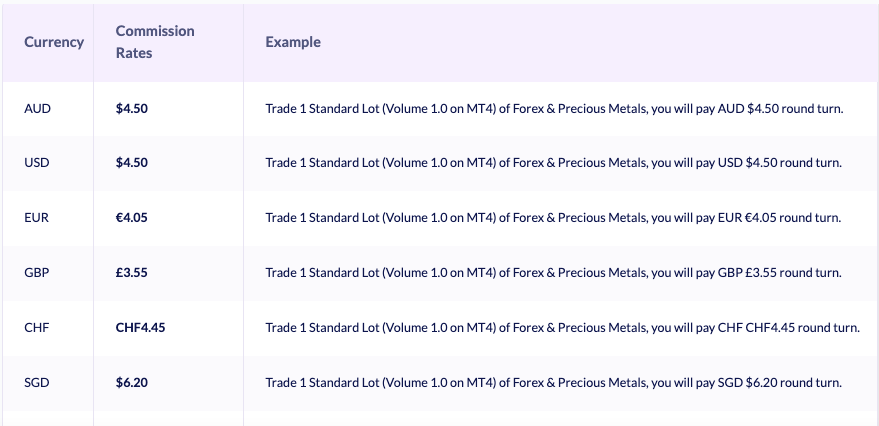

Account Trading Costs:

![]()

![]()

As you can see from the table above, the trading costs on the Classic Account are built into the spread and are slightly higher than those on the Zero Account, which has a small commission that changes depending on which trading account currency you choose.

Zero Account

The most popular account with Fusion traders, the Zero Account has spreads starting from 0 pips with a round-turn commission of 4.50 USD (see below for more details). The account is designed for people who have traded before and are familiar with calculating trading commissions.

Classic Account

The Classic Account is designed for beginner traders. Spreads start at 0.8 pips (EUR/USD) with zero commissions, a lower trading cost than other similar brokers.

Deposits and Withdrawals

Fusion Markets offers a decent range of funding methods, and we were pleased that both deposits and withdrawals are free.

A well-regulated broker, Fusion Markets ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all non-profit withdrawals are returned to the deposit source. Traders can only withdraw up to 100% of the original deposit to a credit or debit card. After this, funds may be withdrawn by another method in the trader’s name.

Accepted Deposit Currencies: When we opened our account, we noticed that the Fusion Markets’ client portal allows traders to choose between six base currencies, including USD, EUR, GBP, AUD, JPY, and SGD. Because we were depositing KSH from our Kenyan-based bank account into our USD-based trading account, we were charged currency conversion fees on deposits and withdrawals.

Funding Methods: We were pleased to find that Fusion Markets offers a good range of payment methods, and it does not charge fees for deposits or withdrawals. However, your bank may use an intermediary bank with fees between 15-25 USD. Credit and Debit Cards and e-wallet transfers are free via the matched refund process. See below for a complete list of payment options and withdrawal times:

![]()

![]()

All withdrawals received by 11 am AEDT are processed on the same day. Requests received after 11 am AEDT will be processed the next business day. You should receive your funds within 1-5 business days for credit and debit cards, depending on the card provider, and 2-5 business days for bank wires.

Mobile Trading Apps

Fusion Markets does not have its own trading app, but MT4, MT5, and cTrader are all available as mobile apps.

MT4/MT5 Mobile Applications

Beginner traders should be aware that there is some loss in functionality when compared to desktop trading platforms, including reduced timeframes and fewer charting options. In addition, spotty connections can reduce the overall trading experience. Generally, it is better to be at your desktop to conduct day-to-day trading and use a mobile device to keep an eye on the markets or close open positions.

The MT4 and MT5 apps allow traders to work from anywhere, with functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading to further assist traders while on the move.

cTrader App

cTrader is one of our favourite trading platforms, and we are glad that Fusion Markets has added it to its offering. Fusion Markets is one of a handful of brokers that supports it. Its clean design makes it easy for beginners to pick up, but it also has the advanced order types and automation options required by more experienced traders. The Fusion Markets’ cTrader app keeps most of the best parts of the desktop version, including the complete range of order types, price alerts, trade analysis, and symbol watchlists.

Other Trading Platforms

With MT4, MT5, and cTrader all available, FP Markets offers support for more trading platforms than most brokers.

Fusion Markets offers traders MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, each of which offers Expert Advisors, automated trading support, strategy backtesting, customisable charting, indicators, and copy trading functionality.

All platform choices are free to use, all can be downloaded to your PC or Mac, and all have web versions of the platform. Traders who want more EAs to use, and don’t mind the dated interface, should consider using one of the MetaTrader products. cTrader is often a favourite for beginner traders as it requires less setup, has a more modern interface, and offers more advanced order types.

All three trading platforms offered are considered among the best in the industry. While Fusion Markets does not have its own proprietary desktop platform, which is usually easier for beginners to learn, the choice of any of the three major platforms will keep most traders satisfied.

Trading Platforms Comparison:

![]()

![]()

Opening an Account at Fusion Markets

The account opening process at Fusion Markets is hassle-free, and accounts are ready for trading immediately.

All Kenyan residents can open an account at Fusion Markets.

Creating an account is straightforward. The process is fully digital, and accounts are available for trading immediately:

New traders must click on the “Open Account” button at the top of the page, where they will be directed to register an account.

- Fusion Markets’s intake form requires clients to register an account with an email address and a password.

- Next, new traders can take a short introductory tour to help traders navigate the hub. The hub allows traders to manage their accounts, funding and withdrawals, access news, and receive trade ideas.

- When selecting to open a live account from the hub, traders can choose between a Pro Account (with high leverage), but will have to meet certain eligibility criteria or a Retail Account (for non-professional traders).

- Traders are then directed to fill in their personal details (including name, country of residence, email address, birth date).

- Traders then need to select their preferred account type (Zero or Classic), trading platform (MT4 or MT5), and account base currency.

- Traders must submit their verification documents to Fusion Markets. These include:

- Proof of Identification – Fusion Markets accepts all government-issued identification documents such as passports, national ID cards, driving licenses, or other government-issued IDs.

- Proof of Address – Proof of residence/address document must be issued in the name of Fusion Markets’ account holder within the last six months. It must contain a trader’s full name, current residential address, issue date, and issuing authority.

- We advise that you read Fusion Markets’ risk disclosure, customer agreement, and terms of business before you start trading.

Overall, Fusion Markets’s account-opening process is fully digital and hassle-free, and accounts are available for trading immediately.

Research and Trading Tools

With an extensive hub of news available from within its client portal, Fusion Markets’ market research is excellent compared to other similar brokers. It also offers a great range of useful trading tools and provides access to two popular copy trading platforms.

Fusion Markets’ research consists of Analyst Views, Technical Insights, and Market Buzz, all available from within its trading hub. It also offers subsidised VPS hosting, MAM accounts, and social or copy trading through Myfxbook Autotrade and Duplitrade.

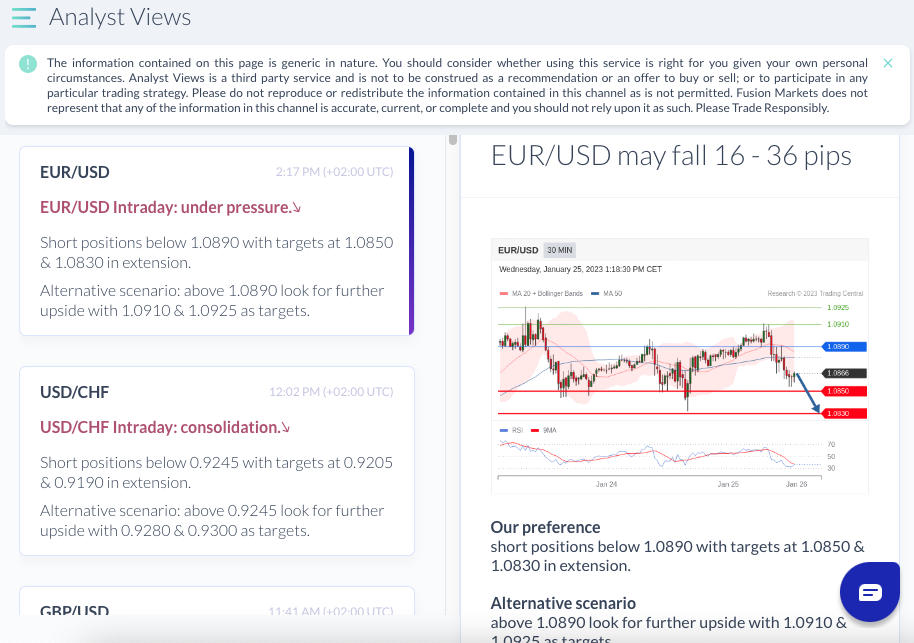

Analyst Views

Analyst Views provides trading ideas for trade set ups in real time, highlighting key support and resistance levels and commentary about the instrument in question. This feature is also available as a custom indicator on MT4 and MT5.

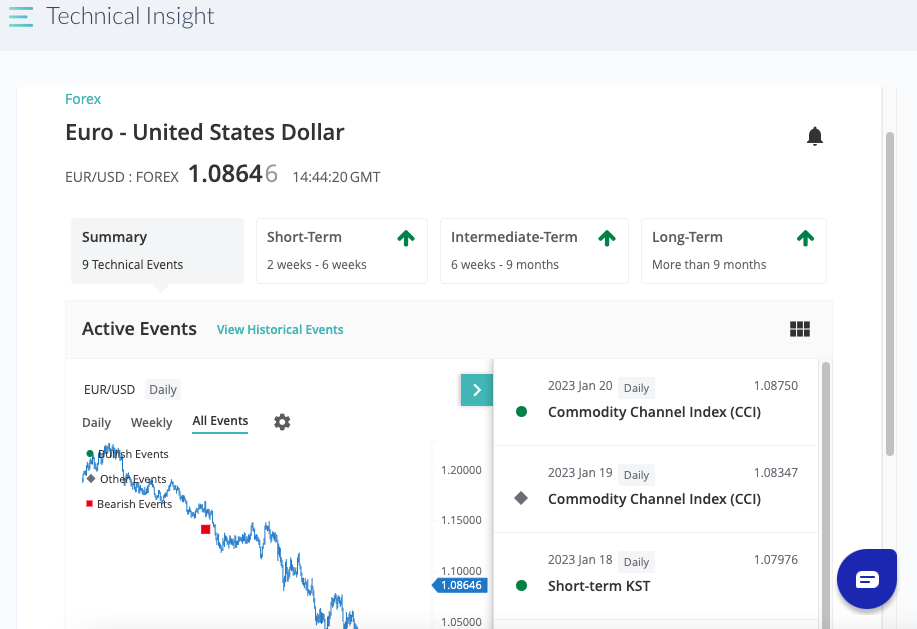

Technical Insight

Technical Insight allows you to search all the financial assets available at Fusion Markets and provides an educational overview of technical analysis indicators, view both short and long-term price action, and view the most popular trades.

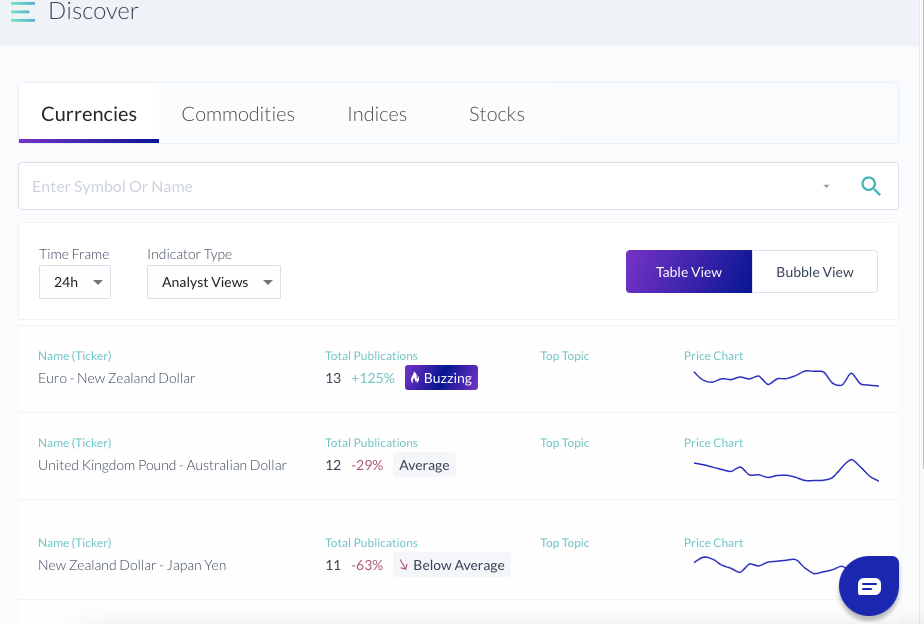

Market Buzz

Market Buzz is an AI tool that sifts through thousands of articles available on the internet to bring you the most relevant news, price movements, and information. You can create watchlists of your favourite symbols, and it will find news from top-quality sources and rank them according to the top discussion topic for each instrument. As you can see below, financial instruments that are moving because of news-worthy events are highlighted as “Buzz” instruments:

VPS

Fusion Markets offers subsidised VPS hosting via third-party company, New York City Servers, for traders using the MT4 and MT5 platforms. VPS hosting allows traders to run automated algorithmic strategies, including expert advisors, 24 hours a day, 7 days a week on a virtual machine. Traders can access a complimentary VPS sponsored by Fusion if they trade more than 20 lots of FX or Metals in a 30-day period.

New York City Servers has dedicated 24/5 customer support teams to help new users set up and install EAs and indicators directly to the virtual machines. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges.

MAM Accounts

Fusion Markets offers an account management service to its clients, which allows account managers to trade on their behalf. In order to perform this service, bespoke technology or software is required, also known as MAM.

MAM stands for Multi-Account Manager, which permits a range of customisable ways to sub-allocate trades. Account Managers take a portion of the profits generated by the trades.

Managed accounts are great for beginner traders who have limited experience with trading.

Copytrading

Fusion Markets offers excellent copy trading services through third-party providers, Myfxbook Autotrade and Duplitrade. These tools allow traders to find, follow and copy successful traders automatically.

In order to use the service, traders need to open an acccount and connect to the services.

The benefit of using copy trading services is that traders do not need to build their own strategy or conduct research on the forex markets. It is useful for traders who are interested in the financial markets but lack experience and knowledge.

Trading Tools Overview:

![]()

![]()

Fusion Markets Education

Unfortunately, Fusion Markets offers virtually no educational materials, which means that traders will have to self-educate with other third-party materials.

Education Overview

![]()

![]()

Fusion Markets’ Customer Service

We found that Fusion Markets’ customer service is excellent compared to other similar brokers.

Customer support is available 24/7 via email, live chat, and a local telephone number.

For the purposes of the review, we tested the live chat service and email. Our email was answered within a couple of hours, and the answer was relevant and to the point. We found the live chat agents were polite and responsive, and they were able to answer all our questions.

Fusion Markets Regulation

Regulation: Fusion Markets was established in 2017 in Australia and has a corporate structure composed of multiple regulated entities that operate in different regions across the world, including Australia, Seychelles, and Vanuatu. See below for more details:

- Fusion Markets is a trading name of FMGP Trading Group Pty Ltd (ABN 74 146 086 017). It is regulated by ASIC and licensed to conduct a financial services business in Australia under Australian Financial Services License No. 385620.

- Fusion Markets is licensed under The Financial Services Authority (FSA) – Fusion Markets is the trade name of Fusion Markets International Ltd, a company regulated as a Securities Dealer by the Financial Services Authority of Seychelles with license number SD096.

- Gleneagle Securities Pty Limited trading as Fusion Markets EN is a registered Vanuatu company (Company Number 40256) and is regulated by the VFSC.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker’s platform offering, and the trading conditions offered to clients, which are summarised in this review.

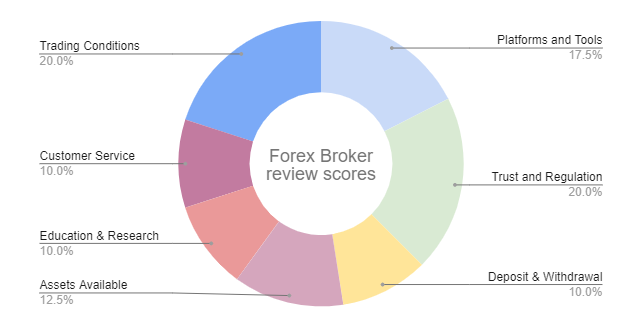

Each one of these is graded on 200+ metrics across seven areas of interest, and an overall score is calculated and assigned to the broker according to the diagram below:

Fusion Markets’ Risk Statement

Trading Forex is risky, and each broker must detail how risky the trading of Forex CFDs is to clients. Fusion Markets would like you to know that: All financial products involve risk. You should ensure you understand the risk involved, as certain financial products may not suit everyone. Trading in margin foreign exchange and derivatives carries a high level of risk, and you may incur a loss that is far greater than the amount you invested. Past performance of any product described on this website is not a reliable indication of future performance. Any information or advice contained on this website is general in nature and has been prepared without taking into account your objectives, financial situation or needs.

Overview

A relatively young broker, Fusion Markets has already forged a good name for itself. It offers two low-cost accounts on three of the most popular trading platforms and an excellent range of trading tools.

Fusion Markets also provides a wealth of market research, mainly through third-party companies, and has 24/7 customer service. The only drawback of an otherwise great all-round offering is its lack of educational materials, which may see beginner traders looking elsewhere for support.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Fusion Markets stacks up against other brokers.