-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On Jul 27, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on markets.com

Markets.com offers traders fast, low-cost trading on a broad range of financial instruments, including over 1500 stock CFDs, Forex, commodities, cryptocurrencies, indices, ETFs, and bonds.

Although Markets.com offers only one live account, it offers more account benefits with higher minimum deposits. Spreads are extremely competitive, starting at 0.6 pips (EUR/USD), with no commissions and a minimum deposit requirement of only 100 USD on its Basic Account tier, making it accessible to beginner traders.

Full support is offered for MT4, MT5, and Markets.com’s award-winning in-house platform. An advanced multi-asset trading platform, the Markets.com platform is packed full of features, including excellent trading tools, expert analysis, and in-depth charting.

Markets.com also provides a high level of customer service compared to other brokers, and its educational materials provide an excellent resource for beginners starting their trading careers.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, B.V.I FSC |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 300:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, markets.com |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Regulation by top-tier authorities

- Hassle-free withdrawal process without any fees

- Its proprietary trading platform is praised for its user-friendly interface catering to both beginners and experienced traders

- Competitive spreads starting from 0.6 pips

Cons

- The maximum leverage of 300:1 could pose a risk for uninformed traders warranting cautious utilization

Is Markets.com Safe?

Although Markets.com is regulated by some top-tier authorities, including Australia’s ASIC, and the FCA of the UK, Markets.com’s Kenyan clients will be trading under its BVI FSC-regulated subsidiary, a much weaker regulator.

BVI FSC Regulation: Kenyan traders of Markets.com will be trading under the subsidiary, Finalto (BVI) Ltd, authorised and regulated by the Financial Services Commission of the British Virgin Islands (BVI FSC). Unlike regulators in the EU and UK, the BVI FSC does not require Forex brokers to keep a minimum level of capital, segregate client funds, participate in a compensation scheme, or provide customers with information concerning an execution policy.

Safety Features: Kenyan traders can take comfort in the fact that all client funds are held in segregated accounts at top-tier banks, and traders receive automatic negative balance protection.

London Stock Exchange: Safecap Investments Limited operates Markets.com in Cyprus and is a part of the Playtech plc Group, which is traded on the London Stock Exchange and constituent of the FTSE 250 index. This adds to the company’s credibility, as companies listed on major exchanges need to be transparent.

Company Details

![]()

![]()

Markets.com’s Financial Instruments

We were impressed with Markets.com’s wide range of financial instruments, including over 67 Forex pairs and 2000 share CFDs, which should keep most traders satisfied.

See below for Markets.com’s range of instruments and corresponding leverage:

- Forex pairs: Markets.com offers 67 Forex pairs to trade, including majors, minors, and exotics such as USD/ZAR and ZAR/JPY. This offering is around the average number of currency pairs offered by most brokers.

- Indices: Markets.com offers 40 spot indices, including the USA 30, USA 500, VIXX, and the USTech100. This is a narrow range of indices compared to other brokers.

- Futures: Markets.com offers 19 Futures, including the US 30, France 40, and the UK 100. This is slightly limited compared to most other brokers.

- Stock CFDs: Markets.com offers over 2000 stock CFDs to trade, including popular US tech companies and multinational energy companies. This is a broader range than is offered by other similar brokers.

- Commodities: Markets.com offers trading on 28 commodities, which is an extremely wide range compared to most other brokers. These include metals, energies, and softs such as cotton, wheat, coffee, and soybeans.

- Bonds: Markets.com offers a range of four bonds for trading.

- ETFs: Markets.com offers trading on 59 ETFs, which is a broader range than is available at most other brokers.

- Blends: Markets.com offers unique trading Blends – stock baskets that track market sectors, the portfolios of legendary investors, or even the fallout from top geopolitical events. There are over a dozen Blends available to trade, including the US Tech Blend, the Cannabis Blend, the Warren Buffett Blend, and the Brexit Winners and Brexit Losers Blends.

- Cryptocurrencies: Markets.com offers an impressive range of 25 cryptocurrencies for trading, including Bitcoin, Ethereum, Ripple, and Litecoin, among others.

Overall, Markets.com’s range and depth of trading instruments are more comprehensive than many other brokers, and it excels in its cryptocurrency and commodities offerings.

Markets.com Account and Trading Fees

Markets.com offers one live account, with different tiers that offer more benefits with higher minimum deposits.

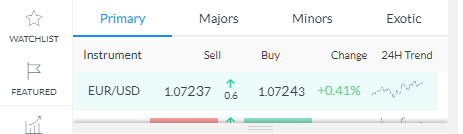

Trading Fees: Market.com’s Basic Account tier has a minimum deposit requirement of 100 USD, making it accessible to most traders, while its highest tier account (the Platinum tier) is accessible to traders with a 50,000 USD deposit. Spreads are much tighter than other brokers across all account tiers, with spreads that start at 0.6 pips (EUR/USD) on its lowest account tier, and lower still on its Platinum Account.

Account Trading Costs:

We opened and tested Markets.com’s account and found that as advertised, spreads are 0.6 pips on the EUR/USD:

As mentioned, the account tiers have increasing benefits with higher minimum deposits. For example, traders who open a Basic Account will not have access to a Senior Account Manager, but those with a Platinum-tier Account will have daily access. Higher account tiers also include benefits such as quicker withdrawals, Reuters analyst research access, wire transfer fee reimbursement, and higher bonus levels. Click here for more information.

Overall, Markets.com provides one of the most competitive pricing environments in the industry.

Markets.com’s Deposits and Withdrawals

Markets.com charges low deposit and withdrawal fees compared to other brokers and offers a wide variety of payment methods.

A well-regulated broker, Markets.com ensures that all Anti-Money Laundering rules and regulations are followed. As such, all non-profit funds are returned to the original deposit source.

Accepted Deposit Currencies: The Markets.com client portal allows traders to deposit funds in 9 currencies, including USD, EUR, GBP, PLN, SEK, DKK, NOK, ZAR, and AUD. Unfortunately, Markets.com does not offer accounts denominated in KES. Markets.com charges a Conversion Fee on some trades. This is a small charge (0.3%) deducted for the currency conversion when the trading account currency and the quoted currency of the underlying asset are different. This is a disadvantage for Kenyans who will likely have bank accounts denominated in KES.

A convenient way to save on conversion fees is by opening a multi-currency bank account at a digital bank. Digital banks offer great exchange rates in addition to free or cheap international bank transfers.

Funding Methods and Fees: Deposits and withdrawals can be made securely at Markets.com using major debit and credit cards, bank wire transfers, and leading payment services such as Neteller, Skrill, and PayPal. Markets.com does not charge deposit or withdrawal fees.

The minimum withdrawal amounts are as follows, which depend upon the payment method used:

- Credit Card/Debit Card – 100 USD/EUR/GBP

- Neteller/Skrill – 100 USD/EUR/GBP

- Wire Transfer – 100 USD/EUR/GBP

How Fast are Deposits and Withdrawals Processed?

- Credit card/debit card transactions take approximately 24 hours to process upon receipt. After clients have completed Markets.com’s Onboarding Process, their deposits will be credited to their trading accounts immediately.

- Wire transfers take approximately 1-2 business days to process upon receipt.

- E-wallet deposits and withdrawals can take up to 24 hours to reflect in your trading account.

We tested withdrawals via credit card and found that it 24 hours to arrive in our bank account. This is faster than other similar brokers.

Overall, Markets.com provides various payment methods, and its processing times are quicker than other similar brokers. Traders will also be pleased that no commissions are charged on deposits or withdrawals.

Markets.com Mobile Trading Platforms

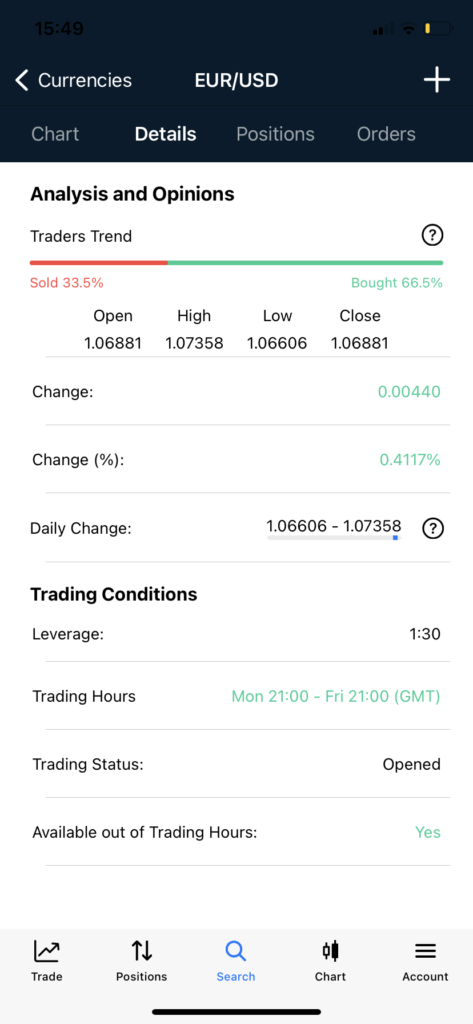

We found that Markets.com’s mobile trading platforms are user-friendly and well-designed compared to other market makers.

Markets.com offers support for the Markets.com App, and MT4, and MT5 mobile trading apps for Android and IOS.

Markets.com Mobile App

We found that the app has a sleek design and intuitive interface. We could easily transfer, withdraw and deposit funds, search for instruments, and create watchlists. It also displays the market sentiment for all instruments. We were also pleased to find that the app has an integrated news feed:

MT4 and MT5 Mobile Trading

The advantage of using the MetaTrader platform is the cross-device and multi-broker functionality, making it easier to change brokers or use multiple brokers. The Markets.com MT4 and MT5 apps allow traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. Functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading further empowers traders while on the move.

Overall, Markets.com provides a good mobile trading experience compared to other similar brokers.

Markets.com Trading Platforms

Markets.com offers support for MT4, MT5, and the Markets.com trading platforms, which is a wider range than is available at most other brokers.

Markets.com

The Markets.com trading platform is known for its ease of use and excellent features. We found that it offers advanced charting, making it easier to spot trends and identify new trading opportunities, and comprehensive drawing tools to plot trendlines, channels, pitchforks, Fibonacci Retracements, and much more. We were also impressed to find that the platform allows you to add up to five types of indicators to the chart at once, overlay multiple assets, or compare up to eight instruments side-by-side.

The search function on the Markets.com platform is excellent. We were able to search for specific instruments or use filters to navigate asset classes and subcategories to find new trades. In addition, Markets.com highlights the hottest instruments and the biggest movers with the Featured tab.

One drawback of the platform is that it does not allow automated trading, but Markets.com offers MT4 and MT5 for these purposes:

MetaTrader 4

Having established itself as the industry-leading platform, Metatrader 4 (MT4) is considered the most reliable and popular platform in existence. Its intuitive interface and user-friendly environment provide essential tools and resources for successful online trading. However, Markets.com only offers support for the most basic version of MT4, which means that it lacks essential trading features. There are thousands of add-ons available for free, but traders may have to pay extra to take advantage of the platform’s full functionality.

Metatrader 5

MT5 is more powerful and faster than MT4 when it comes to back-testing functionality for automated trading algorithms. It also has a built-in news feed, market depth indicator, economic calendar, and trades can be made on the charts.

Overall, Markets.com‘s trading platform support is one of the best in the industry. Its proprietary Marketsx platform is simpler and easier to learn for beginners and is packed full of useful features.

Platform Comparison:

![]()

![]()

Opening an Account at Markets.com

We found that opening a trading account at Markets.com took less than 24 hours and that it was easy to upload our documents.

We tested the account opening process, which took approximately 10 minutes to complete, and once our documentation had been submitted, our accounts were ready for trading within about 24 hours.

As a Kenyan trader, you are eligible to open an account at Markets.com but will need to meet the minimum deposit amount of 100 USD/EUR/GBP to do so.

How to open an account at Markets.com:

- We first clicked on the “Create Account” button, which directed us to Markets.com’s intake form.

- Markets.com’s intake form required us to fill in our personal details (including name, country of residence, email address, birth date, and level of education).

- We were then required to fill in our financial information and answer questions about our trading knowledge.

- The next step required us to submit a copy of our National ID or Passport with the signature page, as well as a copy of a recent utility bill or bank statement. Documents can be scanned or sent through as a high-quality digital camera picture.

- We advise you to read Markets.com’s risk disclosure, customer agreement, and terms of business before you start trading.

Our accounts were ready for trading within one day, which is about the industry average.

Markets.com Trading Tools

While Markets.com offers a wide variety of trading tools through its proprietary platform, it lacks support for third-party tools such as Autochartist and Trading Central, which are frequently available at other brokers.

Its powerful suite of decision-supporting tools is one of the main strengths of the Market.com online trading platform. The trading tools menu features several tools that crunch big data from leading analysts, hedge funds, and commentators to give you better insight into the market. Each tool has integrated buy and sell buttons, so you can quickly act upon the information presented.

Tools include:

- Fundamental Analysis: These include customisable trading alerts, in-platform financial commentary, including central bank statements, earnings announcements, and national budgets available through the platform’s newsfeed.

- Analyst Recommendations: See what top Wall Street analysts think of leading US stocks. Get price targets and buy/sell ratings on industry leaders like Microsoft, Boeing, Alphabet, and more.

- Insider Trades: See how executives at companies like Apple, Facebook, and Tesla are trading their own stock. Each trade is marked as informative or uninformative so that you can get a clear picture of insider sentiment.

- Hedge Fund Confidence: Follow the smart money with the Hedge Fund Confidence tool, which shows you which stocks the world’s top money managers were buying and selling in the previous quarter.

- Bloggers Opinions: See how top financial bloggers feel about a stock thanks to the Bloggers Opinions tool, which aggregates the latest commentary to tell you if analysts feel bullish or bearish on leading US stocks.

- News Sentiment: Have the latest headlines been bullish or bearish? Cut through the noise with the News Sentiment tool, which distills the latest news into simple insights you can use to inform your trading decisions.

- Traders can easily stay on top of market movements and changes in sentiment thanks to the highly customizable alerts function. Set alerts for any instrument based upon price targets or swings, as well as changes in sentiment data (where available). These alerts can be delivered by email or push.

Overall, Markets.com’s tools are comprehensive, but it lacks support for third-party tools.

Trading Tools Comparison:

![]()

![]()

Analysis Material

Markets.com offers excellent research tools compared to other brokers, including advance charting, an economic calendar, exclusive analysis and commentary, and an updated news section.

Top financial analysts and industry leaders deliver exclusive analysis and commentary on the web platform’s integrated video streaming service. Traders can access the latest news and views on the major markets and biggest economic developments, technical analysis, company earnings, and more. Markets.com account holders often get exclusive access to the latest training and strategies from top educational providers. See below for more details:

- News: On top of a packed schedule of regular shows, Markets.com brings you exclusive live coverage of key events, such as central bank decisions and the US non-farm payroll reports, as well as political news and breaking market developments.

- Knowledge Centre: The Knowledge Centre contains video tutorials on using the platform’s features and tools, as well as MARKETS View – where you’ll find the latest commentary and analysis.

- Notifications: Traders can also stay on top of the events and market developments with rolling market coverage via push and in-platform messages and email.

- Week Ahead Briefing: Prepare for the coming week’s trading with the Week Ahead briefing, delivered to your inbox every Sunday, and download in-depth guides on top markets to bolster your knowledge.

- Charting Tools: Markets.com provides excellent charting tools, to which traders can add over 80 technical indicators.

- Economic Calendar: Markets.com’s economic calendar allows traders to access predictions, trends, and analyses.

Overall, Markets.com has an excellent analysis section, written or curated by Forex experts, and full of detailed and interesting leads for new trading opportunities. While similarly high-quality market analysis can be found at other brokers, it is rarely in combination with the low trading costs found at markets.com.

Education Material

Traders will be pleased to find that Markets.com offers comprehensive education, available in both written and video formats. It offers a demo account which gives traders a good feel for its trading platforms.

The Education Centre is packed full of content to help traders get the most out of the platform and find more trading opportunities, offers a range of downloadable in-depth guides, and a great blog packed with articles that cater to beginner traders. Its videos are presented by industry experts and offer great advice on risk management, how to choose a trading strategy, and fundamental analysis, among other topics.

Markets.com also offers free webinars run by some of the top minds in the world of financial markets. Its expert presenters are on hand to answer questions and guide traders through a range of topics, from using its platforms to understanding the ins and outs of the markets.

Demo Accounts

Traders can also open a Demo Account, which allows them to learn the platform’s functionality and understand how the markets work. Demo accounts come loaded with 10,000 USD in virtual funds. The demo account lasts for 30 days but can be extended upon request. It is also fully mobile-compatible, so you can learn how to trade across all your devices.

Education Comparison:

![]()

![]()

Customer Support

Markets.com’s customer support is available 24/5, which is the industry average, but the quality of support far surpasses that of other brokers.

Markets.com aims to deliver a premium trading experience, and VIP support is a large part of its offering.

Technical support and customer service are available 24/5 in various languages over the phone or in-platform with the Live Chat feature. Traders can also get help via email.

We found the customer service via live chat responsive, polite, and knowledgeable – they were able to answer all our questions.

Regulation and Industry Recognition

Regulation: Founded in 2010, the Markets.com brand is operated by several regulated entities which are part of the Finalto Group. The brand is operated by its various companies, which are regulated in different jurisdictions, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Europe, the Australian Securities and Investments Commission (ASIC) in Australia, the FSCA of South Africa, and the BVI Financial Services Commission (FSC) for global clients. See below for more details:

- Finalto Trading Ltd. Is authorised and regulated by the FCA under licence number 607305.

- Safecap Investments Limited is authorised and regulated by CySEC under licence no. 092/08.

- Finalto (Australia) Pty Ltd is authorized and regulated by ASIC under licence no. 43906.

- Finalto (BVI) Ltd is authorized and regulated by the BVI FSC under licence number SIBA/L/14/1067.

- FINALTO (SOUTH AFRICA) PTY LTD is regulated by the FSCA under license no. 46860 and licensed to operate as an Over The Counter Derivatives Provider (ODP) in terms of the Financial Markets Act no.19 of 2012..

The longer the track record a broker has, the more proof we have that it has successfully survived previous financial crises, and Markets.com has been in operation for more than a decade. It also has a large international customer base and boasts protection from many top-tier regulators, making it a safe and reliable choice of broker.

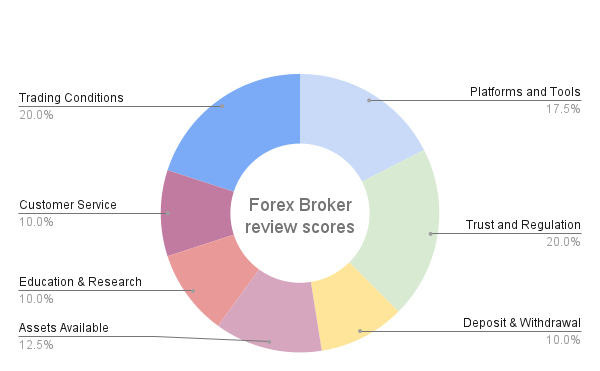

Evaluation Process

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Markets.com Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Markets.com would like you to know that: CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This information is not and should not be construed to be investment advice. It is communicated to you for general information purposes only and does not have regard to your particular investment circumstances or objectives. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise, and the investor may not get back the amount initially invested.

Overview

Markets.com is a well-regulated broker offering trading on an extensive range of assets not often seen at other brokers. It also boasts excellent trading conditions and traders are not limited by platform choice or the range of trading tools offered at Markets.com. Additionally, Markets.com excels in its customer support, and its educational and market analysis materials are top-class. Overall, Markets.com is a good choice of broker for traders of all experience levels.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how markets.com stacks up against other brokers.