-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

| 🏦 Min. Deposit | USD 50 |

| 🛡️ Regulated By | FCA, ASIC, CySEC, FSA-St-Vincent |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, TradeStation |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Last Updated On Oct 9, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on FXCM

FXCM is an operating subsidiary within the FXCM group of companies and is an FSCA-regulated market-maker, with tight spreads and support for the MT4 platform.

FXCM focuses on traders who want to learn how to start trading the financial markets. New traders can take advantage of the trading tools and forex education that FXCM offers. At the same time, FXCM offers innovative trading tools, education and platforms for experienced traders with the aim of offering them the ultimate trading experience. All traders can benefit from FXCM’s enhanced execution model in popular currency pairs and CFDs.

| 🏦 Min. Deposit | USD 50 |

| 🛡️ Regulated By | FCA, ASIC, CySEC, FSA-St-Vincent |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, TradeStation |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Great platform choice

- Excellent education

- Innovative trading tools

Cons

- Limited demo account

Is FXCM Safe?

FXCM is a safe broker for Kenyan traders to trade with. However, they should be aware of trading with high levels of leverage and low minimum deposits because this could see their accounts going into a negative balance.

FXCM has been a global FX and CFD broker since 1999. Headquartered in London, FXCM is regulated by numerous top-tier authorities, including the Financial Conduct Authority (FCA) UK, the Australian Securities and Investments Commission (ASIC), the Cyprus Exchange and Securities Commission (CySEC), the Financial Sector Conduct Authority (FSCA) South Africa.

See below for a list of FXCM’s registered companies:

- Stratos Markets Ltd has been regulated in the United Kingdom by the FCA, license: 217689, since 2003.

- Stratos Trading Pty. Ltd has been regulated by ASIC, license: 309763, since 2007.

- Stratos South Africa (Pty. Limited has been regulated by the FSCA in South Africa, FSP No 46534, since 2016.

- Stratos Europe Ltd is authorised and regulated by the CySEC under license number 392/20.

- Stratos Global LLC is incorporated in St Vincent and the Grenadines, which does not regulate Forex brokers or provide licences to financial service providers.

Kenyan clients will be trading under the subsidiary Stratos Global LLC, which is not regulated by any authority and is registered in St Vincent and the Grenadines (SVG).

CFD brokers registered in SVG are not required to segregate client money from company operational capital, nor are they required to participate in compensation schemes. They are also not required to offer negative balance protection and have no leverage restrictions.

While FXCM does hold all client money in segregated client trust accounts, it does not offer Kenyans negative balance protection, which means they can lose more than their initial deposit.

Leverage is also high – up to 400:1, and FXCM has low minimum deposit requirements. This means that it will be difficult for traders who deposit small amounts to hold a substantial trading position without losing the money in their trading account and possibly going into a negative balance.

Overall, because of its strong international regulation, segregation of client funds, and history of responsible behaviour, we consider FXCM a safe broker to trade with. However, traders should be aware of trading with low minimum deposits and high leverage, as this could see their trading accounts wiped out.

Trading Conditions

FXCM offers commission-free trading and a simple account structure for retail traders. The minimum deposit for a live account is 50 USD and traders may receive a free 20 USD welcome bonus deposited into their FXCM trading account.

Account Types

FXCM has the standard demo account and a single live account offering. Additionally, FXCM can offer different trading conditions for traders with higher monthly trading volumes.

Demo Account – The Trading Station Demo has 5000 USD virtual money and expires after 30 days of inactivity.

Standard Account – A commission-free account with a minimum deposit of 50 USD with leverage up to 400:1 on Forex pairs and leverage on other CFDs up to 200:1.

Active Trader – Active Trader is an account status that is achieved by maintaining a minimum account balance of 25,000 USD and a monthly trading volume minimum. Active Traders will get tighter spreads, market depth functionality on the Trading Station platform and dedicated support in exchange for a small commission on volume traded.

Active Traders are welcome to develop trading programs for API trading, with access to high-quality institutional data. If you are interested in becoming an Active Trader, first open a live account and then discuss this possibility with your account manager.

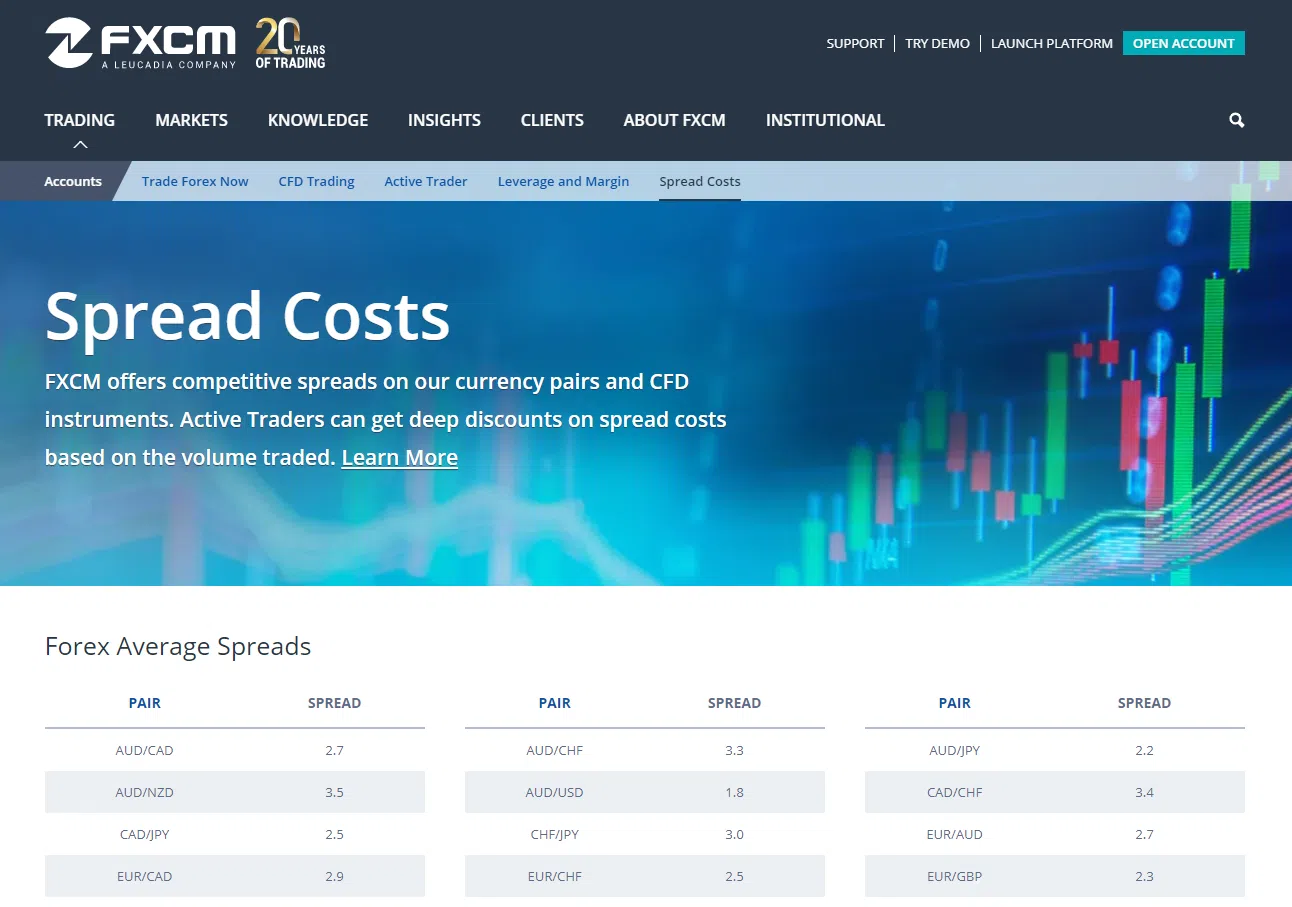

Spreads and Commissions

Standard accounts only charge the spread with the average spread for EURUSD at 1.4 pips*. For those traders who qualify for Active Trader status, a tighter spread can be offered by adding a commission on the volume traded.

*Average Spreads: Time-weighted average spreads are derived from tradable prices at FXCM from April 1, 2020, to June 30, 2020. Spreads are variable and are subject to delay. The spread figures are for informational purposes only.

Deposit and Withdrawal Fees

FXCM does not charge administration fees for deposits via credit card, debit card and bank transfer. There are no withdrawal fees for credit or debit card transfers, but bank wire withdrawals may have an administration charge.

Inactivity Fee

There is an inactivity fee of 50 USD if there is no trading activity for 12 months, and a balance remaining in the account.

FXCM For Beginners

One of the major advantages of FXCM for beginner traders is the quality of the educational material they offer. This high standard of educational material was recognised when FXCM won the Best Educational Materials Award from Investment Trends.

Education Material

The Forex Trading Guides at FXCM is a set of 5 downloadable eBooks, a good educational resource for beginner traders. These books can be printed and used as study material when away from a computer screen. The eBooks introduce Forex basics, trading strategies, trading habits, the FXCM’s proprietary Trading Station platform, and how to identify potential trading opportunities on the market.

The video library is organised into different categories that span from more broker-focused topics like how to make deposits on the platform, to more advanced trading topics like order types that help traders manage risk in trades.

Additionally, this section has an introduction to the Trading Station platform on both desktop and mobile. Since this platform is unique to FXCM, new clients will find these videos very useful.

As with many other brokers, FXCM uses webinars to teach Forex trading. Additionally, past recordings are recorded and available to all clients.

Analysis Material

Much like other brokers, FXCM offers a complementary economic calendar and daily economic news containing some light analysis. However, FXCM takes their analytical offering one step further with Market Data Signals and the Market Scanner – tools to help traders uncover potential trading opportunities in the market.

The Market Data Signals, which are also posted to the FXCM Markets Data twitter account, are a collection of technical signals ranging from indicator data to asset pricing and market impact.

The Market Scanner helps traders uncover potential trading opportunities based on preferred indicators and time frame. Some traders will prefer to trade a limited set of currency pairs, while others will enjoy trading unique patterns using specific indicators over longer or shorter time frames. The Market Scanner is a unique tool for technical traders, but it is important to note that it does not take into consideration a trader`s personal circumstances and trading objectives, therefore should not be considered investment advice. As always, be aware that past performance is not indicative of future results.

Customer Support

Support is available 24/5 via live chat, phone, email and drop-in. FXCM’s South African office is located at 114 West, 6th Floor, Katherine & West Building, Sandton 2196, Johannesburg, South Africa and there is an open-door policy for all traders that want to know more about FXCM and the Forex market.

Trading Platforms

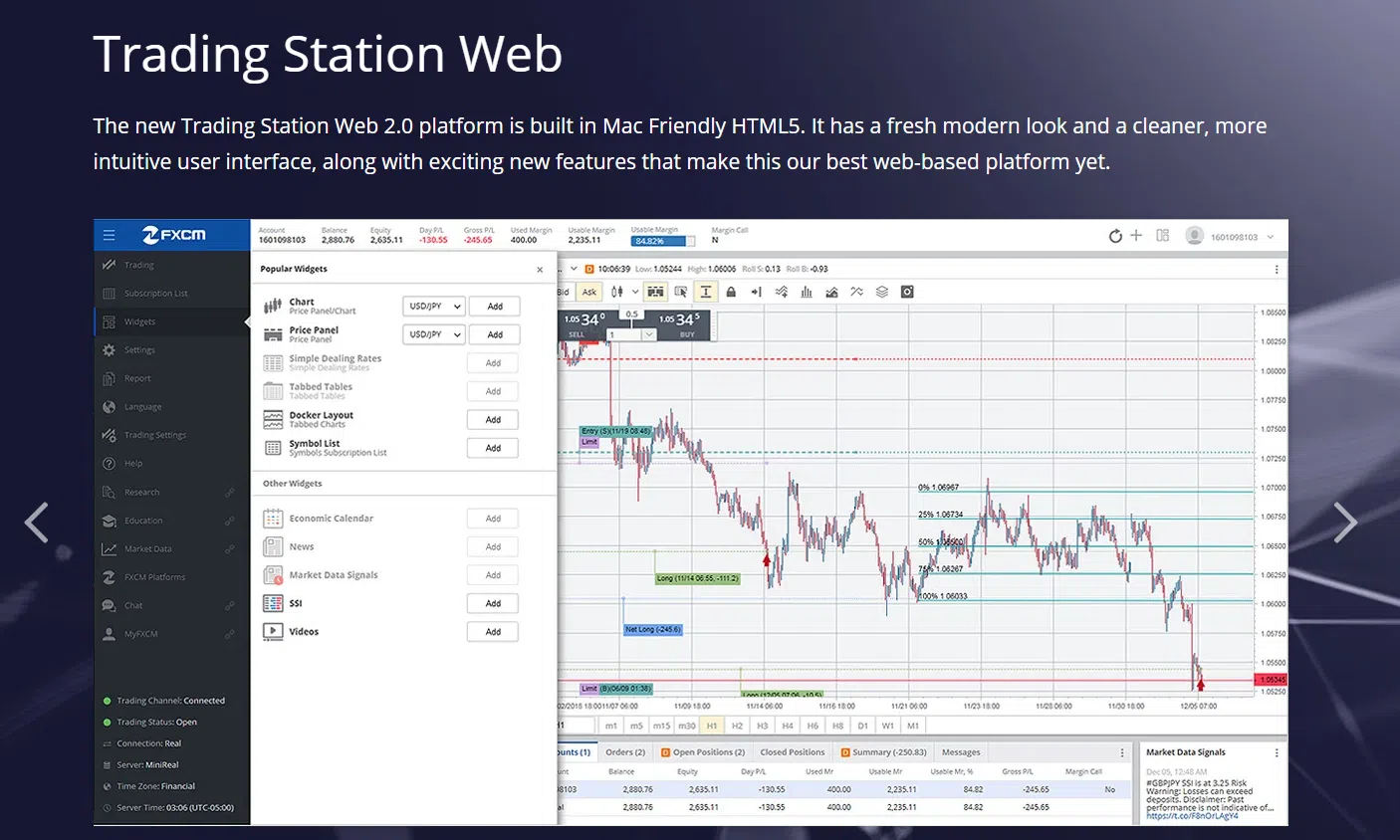

FXCM supports a wide range of trading platforms including the industry-standard platform MetaTrader 4, its award-winning proprietary platform Trading Station, and other speciality platforms.

Trading Station – Winner of the award for Best Proprietary FX Platform 2012 from Forex Magnates, this award-winning platform has continued to impress FXCM customers.

The features are similar to MT4, including EA integration, micro-lot trading, custom indicators, strategy optimisation, strategy backtesting, and advanced charting. But in contrast to MT4, Trading Station is easy to use and requires less setup. That said, MT4 is used by many other brokers so traders who may switch brokers in the future might prefer to use the industry-standard software.

MetaTrader 4 – MetaTrader 4 is still the industry standard even though its successor, MetaTrader 5, has been available for some time. MetaTrader 4 has been the industry standard for CFD trading since 2005 and most ECN and STP brokers will have support for it.

The advantages of using MT4 are numerous but most centre around the community support and the number of users that the tool boasts. Support is available for MT4 from FXCM customer support and you will also find a wealth of guidance online.

Setting up MT4 is more involved than with Trading Station, but should you wish to change broker or operate multiple accounts at different brokers simultaneously, MT4 is a better platform choice.

Speciality Platforms

FXCM supports a number of speciality platforms for experienced traders.

- QuantConnect – An algorithmic trading platform with API integration.

- MotiveWave – A platform for technical traders with advanced tools.

- AgenaTrader – A powerful platform for professional traders.

- Sierra Chart – A professional platform with numerous 3rd party tool connections.

- SeerTrading – An algorithmic trading platform with strong back-testing capabilities.

- NeuroShell Trader – A technical trading platform for building custom strategies for manual and automated trading.

- StrategyQuant – A machine learning automated trading platform.

Trading Tools

FXCM is unique in the number of algorithmic trading tools available, as well as a strong set of premium signals, a Technical Analyzer and the Trading Analytics. Additional major tool sets at FXCM are apps and API tools to build custom applications for algorithmic trading.

FXCM Apps – FXCM Apps include different expert advisors, apps and indicators, some of which are free. The FXCM App Store has add-ons for all the supported platforms and are broken down into the following areas.

- MT4 Expert Advisors and Automated Strategies

- Indicators

- Scripts and Add-ons

- Standalone Apps

Clients can claim a 100 USD coupon for the FXCM App Store with the A-to-Z Education Program, allowing clients to get started with premium applications.

API Trading – The API trading toolset is a way for traders to build their own applications, and then use the APIs offered by FXCM to connect those applications to each other and different data sources. These connections are required to build smarter algorithmic trading applications.

fxcmpy Python Package – The fxcmpy Python Package enables application builders to use a REST API in their applications, which is helpful for creating algorithmic trading strategies.

Mobile Apps

FXCM offers traders easy access to the Forex market with the Trading Station Mobile platform where trades can be placed and managed on the go through its simple, intuitive interface.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the FXCM offer. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

FXCM Risk Statement

Trading Forex is risky, and FXCM South Africa (PTY) Ltd would like you to know that: “CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.”

Overview

Widely respected as one of the biggest names in the Forex CFD businesses, FXCM is a leading FSCA regulated broker. In comparison with other brokers, FCXM excels in platform choice, quality of educational material, and customer support.

A reasonable minimum deposit of 50 USD will open up FXCM plus and with that, a large selection of the trading tools. For traders looking for a big international brand with FSCA regulation and localised educational resources, FXCM is your choice in a broker.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how FXCM stacks up against other brokers.