-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On May 10, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Oanda

A popular broker in Kenya, OANDA has a comprehensive education suite, no minimum deposit requirements, low trading fees, and a great mobile trading app. However, Kenyan traders may be concerned that OANDA’s global entity has very little regulatory oversight and that they are not offered negative balance protection.

Traders may also be disappointed by the relative lack of financial instruments and high withdrawal fees, but OANDA offers support for both the MT4 and MT5 platforms in addition to a great range of trading tools and detailed market analysis.

Despite the poor regulatory oversight and small range of trading instruments, OANDA is a good all-round broker. The low fees will attract many traders, and with the introduction of MT5 support, we expect that the number of trading instruments will increase in the near future.

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | FCA, ASIC, IIROC, B.V.I FSC |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 800:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Tight spreads

- Low minimum deposit

- Good for beginners

Cons

- Limited currency pairs

Is OANDA Safe?

A popular broker in Kenya, OANDA is regulated by some of the best authorities in the world, including the UK’s FCA and ASIC of Australia. But, Kenyans will be onboarded through the British Virgin Islands-based entity, which provides little regulatory oversight and Kenyan traders will have no negative balance protection.

Regulation: All Kenyan clients will be trading with OANDA Global Markets Ltd, which is registered in the British Virgin Islands, and authorised and regulated by the BVI Financial Services Commission. Unfortunately, the BVI FSC has a light touch when it comes to regulating forex brokers, and consumers are not afforded the same protection as that of reputable regulatory bodies such as the FCA.

Safety Features: OANDA’s Kenyan clients can be sure that their funds will be kept in segregated bank accounts, but OANDA Global Markets Ltd does not offer negative balance protection, so Kenyan traders may lose more than they invest. Additionally, OANDA offers leverage of up to 200:1 on its account types and has no minimum deposit requirements, which in combination makes it difficult to hold a substantial trading position without getting stopped out and losing the money in your trading account or even incurring a negative balance.

Company Details:

![]()

![]()

We confirmed each of the licences and regulations on the regulator’s online register. See below for details of OANDA’s BVI FSC-regulated entity:

OANDA’s Financial Instruments

The choice of financial assets offered by OANDA is slightly limited compared to other large international brokers, and more advanced traders looking for particular instruments may be disappointed. But we were pleased to see that as of 2022, it added a range of share CFDs to its offering.

Range of Instruments: While OANDA offers a selection of CFDs to trade, it has only just introduced the MT5 trading platform, and the MT4 platform is primarily a platform for trading Forex. This shows in OANDA’s relatively limited range of financial instruments, which includes Forex, commodities, metals, cryptocurrencies, indices, and share CFDs.

Full List of Instruments and Leverage:

![]()

![]()

- Forex: OANDA has 45 currency pairs available for trading which is around the industry average. These include majors (EUR/USD, GBP/USD, and USD/JPY), and minors (NZD/CAD, EUR/JPY, and USD/ZAR).

- Indices: Limited compared to other brokerages, there are only 16 indices available for trading at OANDA. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

- Commodities: OANDA offers an average range of commodities for trading, including metals such as gold and silver and energies such as oil.

- Share CFDs: OANDA offers around 350 share CFDs, which is slightly limited compared to other brokers, but includes the big names in the EU, such as Adidas, Santander, Lufthansa, Deutsche Bank, and Porsche.

- Cryptocurrencies: OANDA offers trading on 13 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, among others. This is an average range compared to other brokers.

Accounts and Trading Fees

OANDA offers five accounts, which is more than other brokers, but we were disappointed to find that its trading fees are higher than average.

Trading Fees: The Standard, Premium, and Swap-Free accounts have trading costs included in the variable spreads, while the Core and Core Premium Accounts offer tighter spreads in exchange for a small commission per trade. Trading costs are slightly higher than average on its Standard and Swap-Free Accounts but significantly lower than average on its Premium, Premium Core, and Core Accounts. Additionally, traders must prove that they are indeed Muslim to open a swap-free account.

See below for account details:

As you can see from the table above, spreads on the Standard and Swap-Free accounts are wider than average. The average cost for trading one lot of EUR/USD among similar brokers is about 9 USD per lot. However, at 6 USD, trading costs on the Core Account are significantly lower than average.

Standard Account

A commission-free account, the Standard Account has no minimum deposit, leverage of up to 200:1, and access to all tradable instruments. Spreads start at 1.0 pips on the EUR/USD, which is wider than other similar brokers.

Core Account

The Core Account offers much tighter spreads than the Standard Account – starting at 0.2 pips on the EUR/USD and charges a reasonable commission of 4 USD per lot. The maximum leverage is also set to 200:1.

Premium Account

The Premium Account can only be opened when traders have an account balance of 20,000 USD and trade more than 10 million USD notional or equivalent per month. Spreads start at 0.8 pips on the EUR/USD, which is tighter than the spreads on other brokers’ commission-free accounts, and traders have other account benefits, including personalised account management, zero deposit fees, free withdrawals, priority support, and free VPN access. Note that the Premium accounts are only available on MT5 and the fxTrade app.

Premium Core Account

Like the Premium account, the Premium Core Account requires an account balance of 20,000 USD, and traders have to trade more than 10 million USD notional or equivalent per month. Spreads start at 0.2 pips (EUR/USD) and a commission of 3.5 USD (round turn) is charged per lot traded. These fees are some of the lowest in the industry.

Swap-Free Account

This account is also commission-free, and as no interest is paid or received spreads are wider than on the Standard Account – starting at 1.6 pips on the EUR/USD. The only base currency supported for this account is USD, but otherwise, it is similar to the Standard Account. Swap-free accounts are opened by first opening a Standard Account and then requesting the change from OANDA’s customer service.

Deposits and Withdrawals

OANDA offers a limited range of funding methods and charges high fees for withdrawals via bank transfer.

In line with Anti-Money Laundering policies, deposits and withdrawals at OANDA cannot be made to/from third-party accounts.

Trading Account Currencies: At OANDA, traders can only choose from four base currencies: USD, SGD, HKD, and EUR. This is limited compared to most other international brokers and is disappointing for Kenyans who will likely have bank accounts denominated in KES and will have to pay conversion fees (of 0.5%) on all deposits and withdrawals. Conversion fees can make trading expensive, and are usually not presented on the fee report, but affect profitability.

Deposit and Withdrawal Fees: While no fees are charged for deposits, OANDA charges fees for withdrawals by bank transfer. See below for more details:

- Bank Wire: Bank wire deposits take 3-5 business days and are free. Bank wire withdrawals are charged at 20 USD per transaction and will take 2-4 business days. Be aware that banks may also charge a processing fee, especially in the case of international bank transfers.

- Credit/Debit Card: Credit and debit card deposits are processed immediately and are free. Withdrawals to credit/debit cards take 1-3 business days and are also free.

- Skrill/Neteller: Deposits with Skrill and Neteller are free and take up to 1 business day – Skrill/Neteller may charge a service fee, however. Withdrawals to Skrill and Neteller take up to 1 business day and are also free, though conversion fees may apply and Skrill/Neteller may charge an additional service fee.

Overall, withdrawals by bank transfer are expensive and OANDA offers few methods for depositing and withdrawing funds.

OANDA’s Mobile Trading Platforms

With support for MT4, MT5, and recently, its own in-house mobile trading app, OANDA’s mobile platform support is better than other brokers.

All three of OANDA’s mobile platforms are available on both Android and iOS.

fxTrade App

We downloaded and tested the fxTrade app on an iPhone 11 and were impressed that we could access all our accounts with one login. The app integrates seamlessly with MT5 and you can trade directly on the charts, view multiple time frames, deposit and withdraw funds, choose from a huge number of technical indicators, and access VPS services. We were also pleased to find how easy it is to set risk and profit parameters on our order ticket. Disappointingly, traders can only choose from 81 of the 350 CFD instruments available at OANDA, which may limit some traders’ experience.

MT4 and MT5 Mobile Apps

Traders should be aware that there is some loss in functionality when compared to the MT4 and MT5 desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Other Trading Platforms

OANDA offers full support for the MT4 platform and at the end of 2021, added MT5 to its trading arsenal, which means that traders can trade specialty instruments such as share CFDs.

MT4 and MT5

The advantage of brokers offering third-party platforms such as MT4 and MT5 is that traders can take their own customised versions with them should they decide to migrate to another broker. Additionally, there are thousands of plugins and tools available for the MetaTrader platforms. However, these platforms are not as beginner-friendly as the in-house platforms offered by other brokers.

Platform Overview

![]()

![]()

Opening an Account at OANDA

We found that OANDA’s account-opening process is seamless and hassle-free compared to other brokers, and we were pleased that our trading account was ready for trading within a day.

We tested the account opening process, which took approximately 10 minutes to complete, and once our documentation had been submitted, our accounts were ready for trading within a day.

OANDA offers corporate and individual accounts, but we will focus on opening an individual account:

How to open an account at OANDA:

- New traders will have to click on the “Start Trading” button at the top of the page where they will be directed to register an account.

- OANDA’s intake form requires clients to fill in their country of residence, and personal details, (including name, country of residence, and telephone number).

- Next clients must confirm their citizenship, filling in their identity or tax number.

- The fourth step requires traders to confirm their home address.

- Lastly, traders are required to fill in their employment status and financial details.

- Note that verification documents are not needed for traders who deposit less than 9,000 USD.

- For clients that deposit more than 9,000 USD, OANDA needs at least two documents to accept you as an individual client:

-

- Proof of Identification – OANDA accepts all government-issued identification documents such as passports, national ID cards, driving licenses, or other government-issued ID. The document must be valid and must contain a trader’s full name, date of birth, a clear photograph, and issue date, and if it has to have an expiry date, that should be visible as well.

- Proof of Address – Proof of residence/address document must be issued in the name of the OANDA account holder within the last 3 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

After the application is approved, traders can log in and fund their accounts. We advise you to read OANDA’s risk disclosure, customer agreement, and terms of business before you start trading.

Overall, OANDA’s account-opening process is quick and efficient, and accounts are generally ready for trading within one business day.

OANDA’s Trading Tools

OANDA’s trading tools are excellent compared to other similar brokers.

OANDA offers a variety of trading tools, including Autochartist, MT4 Premium Tools, and a Trading Performance Portal.

Autochartist

Autocharist is a powerful pattern recognition tool that scans and analyses the markets to identify trading opportunities. Other features of Autochartist include:

- Continuous intraday market scanning

- Correlating signals: receive email notifications and flag trading opportunities when support/resistance levels coincide with chart pattern projections

- Spot potential trading opportunities: get automated alerts about emerging or completed charts, Fibonacci, and key level formations

- Review only the forecasts that have historically had a certain level of success probability

- Volatility analysis

- Set instrument-specific exits based on estimated market volatility

- Performance statistics

- Customisable daily market reports sent to your inbox

Autochartist is one of the best technical analysis tools on the market, and OANDA does well to offer this tool to its clients.

MT Premium Tools

The MT4 Premium Tools are a host of powerful forex trading indicators, including an alarm manager, keyboard trading, mini terminal, tick chart trader, and more. These are provided by FX Blue Labs. You can access over 15 indicators and nine expert advisors in a single download. Popular features such as Renko charts, one cancels the other (OCO) orders, keyboard trading, tick chart trading, and advanced trade management are all included free of charge to OANDA MT4 traders.

Trading Performance Portal

The Trading Performance Portal is a behavioural analysis tool that is designed to help you improve your trading patterns. Powered by Chasing Returns, OANDA’s portal analyses your trading history and helps you focus on your strengths while identifying areas you can improve.

Overall, OANDA offers a comprehensive suite of useful trading tools compared to other similar brokers.

Trading Tools Comparison:

![]()

![]()

OANDA for Beginners

Beginner traders will find OANDA a relatively welcoming experience with a well-structured education section available for traders with different levels of experience. Considering OANDA’s history as an FX data service, it’s no surprise that the market analysis is detailed and excellent. However, customer service in Kenya is limited in scope.

Educational Material

The education section is not easily discoverable on OANDA’s website. It is not linked from the menus across the top of the page and can only be found in the menus at the bottom of the page. Whether this is intentional or an oversight is unknown.

Once discovered, education at OANDA is split into three subsections: Getting Started, Tools and Strategies, and Capital Management. Information is detailed and helpful and is presented in a mixture of video and text. It also offers a demo account.

The Getting Started section covers the basic aspects of Forex CFD trading such as leverage and margin and introduces traders to the MT4 platform. The Tools and Strategies section covers analysis and explains how traders can use various technical analysis tools to better predict the markets an essential skill for successful traders. Finally, the Capital Management section covers risk management and how to apply it in real market conditions.

Alongside these tutorials, OANDA also hosts frequent webinars on all aspects of trading, including the Basics of Trading and Live Market Analysis. Past webinars are also stored in an archive and are available on demand. Webinars and the webinar archive are free but do require registration with your name and email address.

Demo Account

OANDA’s demo account mimics the conditions found on the Standard Account and is available with a virtual 100,000 USD balance. The demo account will not expire if you request this from OANDA customer service.

Education Comparison:

![]()

![]()

Analysis Material

OANDA’s analysis section is excellent compared to other brokers, curated by its in-house analysts and third-party provider, Market Pulse.

Market analysis is supplied by OANDA’s MarketPulse service. MarketPulse is an award-winning news site that delivers round-the-clock commentary on a wide range of asset classes, as well as in-depth insights into the major economic trends and events that impact the markets.

The 24/7 coverage at MarketPulse is provided by six expert analysts and professional traders with decades of experience covering and trading the full range of markets. All analysis is detailed, accurate, and posted within minutes of a market event occurring.

In addition to MarketPulse’s text-based coverage, regular videos and podcasts are also published.

Customer Support

Customer support is only available in English, Chinese, Spanish, and German. Support is available via email and live chat 24/5, but there is no local Kenyan number. For the purposes of this review, we found the customer support to be responsive but not knowledgeable of OANDA’s products and services.

Safety and Industry Recognition

Regulation: Founded in 1997 in Delaware, USA as an FX rate provider, OANDA has grown to become a large multi-service financial company offering retail CFD trading, Forex data services for institutions, and exchange rate information on over 38,000 currency pairs. As an international CFD broker OANDA is remarkably well-regulated, with regulatory oversight from no less than 7 top tier national regulators:

- OANDA Asia Pacific Pty. Ltd. is regulated and licensed in Singapore by the Monetary Authority of Singapore (CMS Licence No: CMS100122-4) and the International Enterprise Singapore (Commodity Brokers Licence No: OAP/CBL/2012) to trade commodity CFDs.

- OANDA Australia Pty Ltd. is regulated in Australia by the Australian Securities and Investment Commission (ASIC) ABN 26 152 088 349, AFSL No. 412981

- OANDA Japan Inc. holds a Type 1 Financial Instruments license from the Japanese Financial Services Agency, registration with the Kanto Local Finance Bureau #2137, and is a member of the Financial Futures Association of Japan #1571.

- OANDA Corporation is a registered Retail Foreign Exchange Dealer (RFED) with the U.S. Commodity Futures Trading Commission (CFTC), and a Forex Dealer Member (FDM) of the National Futures Association (NFA # 0325821).

- OANDA (Canada) Corporation ULC is regulated in Canada by the Investment Industry Regulatory Organization of Canada (IIROC).

- OANDA Europe Limited is authorised and regulated by the Financial Conduct Authority in the UK, No: 542574

- OANDA Europe Markets Limited is a company registered in Malta No: C 95813. It is authorised and regulated by the Malta Financial Services Authority as Category 3 Investment

Awards

OANDA has won numerous awards for its services and products over the years, such as Best Education Materials 2018 (Investment Trends – US Foreign Exchange Report) and No. 1 Forex Broker in Singapore 2017 (Investment Trends Singapore CFD & FX Report). More recently, OANDA was voted Most Popular Broker and Best Forex and CFD Broker 2020 by TradingView clients in the firm’s inaugural TradingView Broker Awards. TradingView is one of the world’s largest social networks for traders, boasting more than 15 million registered users around the world.

Overall, because of its history of responsible behaviour, strong international regulation, strict auditing processes, and wide industry acclaim, we consider OANDA a trustworthy broker.

Evaluation Method

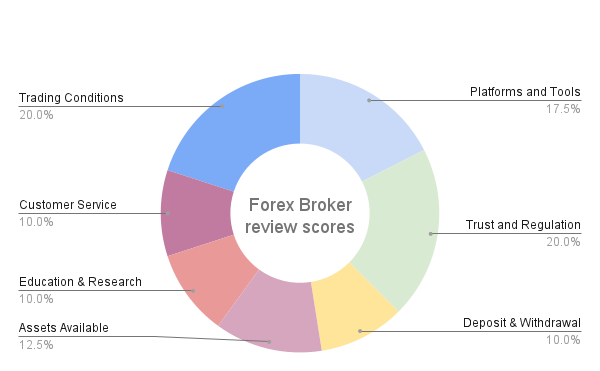

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

OANDA Disclaimer

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. OANDA would like you to know that: Trading our Products is high risk and can result in losses that exceed the total sum you have invested. All negative balances are payable.

Overview

A globally popular broker with an impressive history and a large non-CFD business, OANDA is relatively disappointing compared to other leading CFD providers. Only 45 FX pairs are available to trade, alongside a relatively small range of commodities, indices, share CFDs, and metals, but support is offered for both the MT4 and MT5 platforms in addition to its in-house mobile trading app.

Trading fees are average on Standard and Swap-Free accounts but improve significantly on the Core, Premium, and Core Premium accounts. Kenyan traders may be disappointed by the lack of regulatory oversight and that they are not granted negative balance protection and that local customer service is not available via telephone. But education and market analysis are excellent and OANDA provides a host of tools and plugins for MT4.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Oanda stacks up against other brokers.