-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Last Updated On Jul 11, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Axi

Built by traders, for traders, Axi is an ASIC and FCA regulated ECN broker for the serious trader, where traders execute their positions directly on the markets without any broker interference.

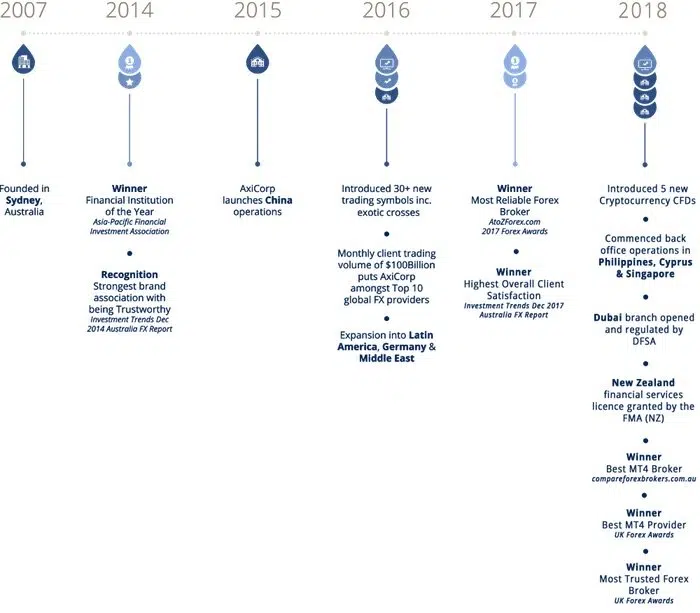

While the trading platform choice is limited to MT4, Axi has received strong industry recognition for their setup including Best MT4 Broker 2018 (Compare Forex Brokers Australia) and Best MT4 Provider 2018 (UK Forex Awards).

Joining Axi requires a $5 minimum deposit which gives you a strong MT4 setup and an ECN account. This combination only highlights further that they are built by traders, for traders.

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Low minimum deposit

- Tight spreads

- Innovative trading tools

Cons

- MT4 only

- Limited range of assets

Is Axi Safe?

Axi is a trading name of AxiCorp Financial Services, an Australian financial services company founded in 2007. Axi has been regulated by the FCA in the UK (license 509746) since 2010, and ASIC in Australia (license # 318232) 2007. ASIC and the FCA are recognised as two of the strongest regulators in the world, and Axi should be considered well-regulated and secure. ASIC and the FCA are recognised as two of the strongest and most effective regulators in the world, and Axi is subject to frequent inspections and audits to ensure it is in compliance with rules in both jurisdictions. Axi keeps all funds in segregated accounts and all customer information and communications are encrypted.

Axi has won many awards but recent standouts include Most Trusted Forex Broker (UK Forex Awards 2018) and Highest Overall Client Satisfaction (Investment Trends December 2017 Australia FX Report).

Being an ECN broker, client trades are posted directly to the market without any dealing desk interference from the broker, removing any possibility of a conflict of interest.

Trading Conditions

Axi offers excellent trading conditions are on both of its live accounts, the difference between the two is the commission and tighter spreads on the MT4 Pro Account. A major advantage with Axi is the free AutoChartist on all accounts and a free VPS service once you hit a minimum trading volume. While neither account requires a minimum deposit, it is highly recommended that you start with at least 200 USD.

Account Types

Demo Account

Axi offers a demo account with a virtual balance of 50,000 USD that remains open for 30 days. While using your demo account, Axi will provide you with a dedicated account manager to assist you and answer any questions you may have. The demo account is an opportunity to experience Axi’s services without risking your money, but the 30-day limit is unusual – many brokers offer unlimited demo accounts (but without the dedicated account management service).

MT4 Standard Account

With no minimum deposit, the MT4 Standard Account is a commission-free account where spreads start at 1 pip. This gives you access to over 140 FX pairs, maximum leverage of 500:1 (30:1 in Europe/UK), free AutoChartist and a free VPS service (the VPS service is subject to a minimum trading volume).

MT4 Pro account

The MT4 Pro Account is very similar to the MT4 Standard Account, with the same perks and trading assets, the only difference being that this is a commission account, with a 7 USD round trip commission on trades and spreads from 0 pips.

Spreads and Commissions

The spread is the only charge on the MT4 Standard Account, while commission and spread are charged on the MT4 Pro Account. Because Axi is an ECN broker, spreads will be tighter than that of other market maker brokers.

Deposit & Withdrawal fees

Deposit & Withdrawals

All deposits and withdrawals are free of charge, and you can fund your account via:

- Debit and Credit Cards (Visa, Master, Maestro, JCB) – Debit and credit cards will fund your account instantly

- Neteller/Skrill/Moneybookers – it can take up to 15 minutes for deposits from e-wallets to post to your trading account

- China Union Pay (only for Chinese residents) – deposits can take 1-3 business days

- Bank Transfer – Local bank transfers will be available daily, while international bank transfers will take 3-5 business days for the funds to reflect in your account.

- Broker to Broker Transfer – this deposit method usually takes 3-5 business days

Withdrawals are processed within 1-2 days, and funds will only be returned via the same method as the deposit. All withdrawal requests must be made from within the client portal. Axi does not charge a fee for making a withdrawal, but your bank may add charges depending on the method of transfer.

Axi For Beginners

Any beginner who is committed to learning to trade Forex with a traditional broker on the industry-standard trading platform will find Axi an excellent place to start.

Educational Material

Trader education at Axi is detailed and flexible, available in both written and video format. Highlights of the education available include:

- Video tutorials on demand

- Courses available in 24 languages

- eBook with simple lesson structure

- Frequent tests to monitor your progress

Subjects covered include:

- Forex trading basics: Currency pairs, leverage, spreads, opening/closing trades

- Analysis techniques: Charts, technical analysis, support/resistance

- Developing a trading strategy: Including day trading, news trading, trend trading and more

- Trading psychology: Risk management, greed and overcoming the fear of loss

Analytical Material

Aside from a perfectly functional Economic Calendar, Axi also runs a Market News Blog which features regular analysis, both technical and fundamental, as well as educational pieces and features (such as the effect of the Corona Virus on global markets). Regular analysis includes a weekly market preview, charts of the week and a daily briefing on the market open.

Overall, not as in-depth as you may expect from a broker of this type, but all analysis is solid and well-written.

Customer Support

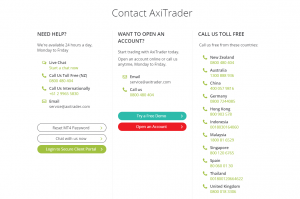

All new and existing clients have dedicated account management and access to customer support 24/5 via telephone, email and live chat. Toll free numbers are available in Australia, China, Germany, Hong Kong, Indonesia, Malaysia, New Zealand, Singapore, Spain, Thailand and the UK.

This support will help you get started and learn how to trade at any time of day that suits your schedule.

Axi Trading Platforms

Currently, Axi only supports the MetaTrader 4 (MT4) platform, but with the growth in popularity of MetaTrader 5, we do expect support to be added for the newer version soon. MT4 trading on Axi is truly customisable though, with a range of tools and plugins that can be added to the platform to make it more powerful.

The MT4 platform is also available for Android, iPad, Mac, and iPhone mobile devices.

Trading Tools

Here is where Axi really shines, with a wide range of trading tools that can be plugged directly into your MT4 trading platform. While all of these tools are “free” to Axi clients, many of them are conditional on higher minimum deposits – our highlights include:

AutoChartist: Free to all Axi clients, no matter their account balance, continuously scans markets and automatically recognises trade set-ups based on support and resistance levels. Once an opportunity has been identified, traders are informed. One of the most useful tools on the market.

PsyQuation Premium: With a minimum deposit of 500 AUD (or currency equivalent) you will get access to PsyQuation Premium. PsyQuation is one of the world’s most advanced data analytics plugins for retail traders. Using highly sophisticated algorithms it works like a trading coach, analysing your trading style, identifying mistakes and helping you avoid making similar mistakes again.

Auto/Social/Copy Trading: Axi also offers DupliTrade (with a 5000 AUD minimum deposit), a powerful auto-execution system that duplicates the trades of chosen strategy providers; Myfxbook, a free social trading plugin that allows you to follow and copy other traders; and ZuluTrade, another free social trading platform that easily allows you to follow and copy other traders.

MT4 Forex VPS Hosting: Axi clients can also subscribe to an MT4 Forex VPS hosting service from external third-party providers, helping ensure trades are never disrupted by technological or connectivity issues. Prices and exact services offered vary by provider, but some are free once you hit a minimum trading volume of 20 lots pcm.

Evaluation Process

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Axi offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Axi Risk Warning

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Axi would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

For experienced traders who value simple account options, strict international regulation and a heavily customisable MT4 platform, Axi is a very tempting option. The limited demo account, single platform support and sheer variety of trading tools on offer may put off some beginner traders, but they should remember that there is no required minimum deposit and all clients get a dedicated account manager.

Education and market analysis are both good and experienced traders will appreciate the wide range of currency pairs; overall Axi is good for serious beginner traders and more experienced MT4 users looking for a new broker.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Axi stacks up against other brokers.