-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | CySEC, FSC, DFSA |

| 💵 Trading Cost | USD 24 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Last Updated On May 10, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on TrioMarkets

Triomarkets is a respected ECN/STP broker for the serious beginner or experienced trader. Offering tight spreads for larger depositors, and both raw and commission-free account types, TrioMarkets continues to maintain a devoted portfolio of clients.

Supporting MT4, with fast and reliable trade execution, plus two different types of algorithmic trading, this CySEC-regulated broker should be considered by those clients who don’t mind the higher minimum deposit.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | CySEC, FSC, DFSA |

| 💵 Trading Cost | USD 24 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Broad range of financial instruments including Forex cryptocurrencies and CFDs

- Provides advanced trading tools like TrioExtend

- Offers social trading and account management services (MAM/PAMM accounts)

Cons

- High minimum deposit and trading costs making it a less attractive option for beginners and low-volume traders.

- Only supports the MT4 trading platform

- Limited educational and market analysis materials

- Poor customer support responsiveness

- No negative balance protection

Is TrioMarkets Safe?

Triomarkets, a brand of EDR Financial Ltd, has been regulated by CySEC (license # 268/15) since 2015. CySEC is a major regulator and is credited with active regulation of the markets, and proactively making changes to protect clients. TrioMarkets stays out of the limelight in the Forex trading industry and does not engage in marketing activities like award shows, and has thus not won any awards. That said, their reputation among professional traders is a good one, and from our industry contacts and experience, we believe TrioMarkets to be a safe broker.

TrioMarkets for Beginners

Triomarkets focuses on an experienced trading audience and offers traders a light version of training material for beginners, and limited analysis material. Beginners are welcome at TrioMarkets, but STP brokers, in general, do not focus on providing additional client services and instead focus on reducing the costs of trading for their client base.

Educational Material

Triomarkets supports beginner clients with a 3rd party set of ebooks and video tutorials, along with corresponding sections on the fundamentals of trading and using the MT4 trading platform. This set of education articles will be helpful to new Forex traders, but not as beneficial as other brokers that do better with onboarding beginner clients.

Analysis Material

Analysis Material is fed directly into the MT4 platform, but there is no additional research area inside TrioMarkets as with some other ECN/STP brokers. This minimal approach is very typical for pure STP brokers who focus on bringing down the costs of trading for experienced traders, who subscribe to other premium news services and who are not dependent on analysis coming from the broker. A limited set of education material is less common at ECN/STP brokers.

Customer Support

TrioMarkets support is of high-grade, and the more advanced your account, the more attentive service you’ll receive. Help is available 24/6, there are also video tutorials in 15 languages, and extra training material is available on their website.

Trading Conditions

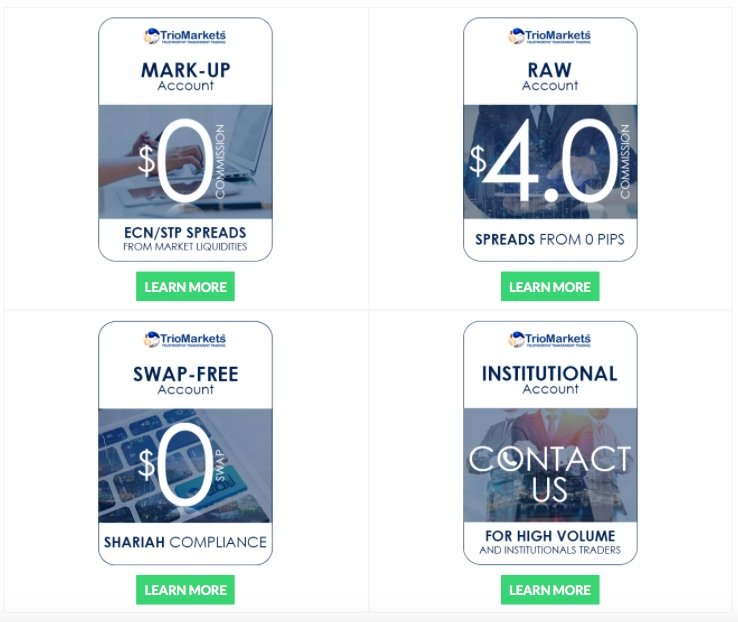

Experienced traders are attracted to TrioMarkets for favourable STP trading conditions. The account types offered by TrioMarkets give experienced traders a good variety to chose from, with different combinations of spread only, and spread and commission combinations.

Account Types

TrioMarkets offers 60+ currency pairs to trade on three live account types – Standard, Advanced, Premium. All accounts come with a swap-free Islamic option. The initial minimum for a TrioMarkest account of $500 is higher than most brokers, and all accounts offer 1:1 coaching to get traders started. The combination of a broker with a good reputation, coaching, and tight spreads means a smooth start with TrioMarkets.

Demo account

TrioMarkets has a demo training account funded with $10,000 to sharpen your trading and test your strategies before committing your money. TrioMarkest will keep the demo account open indefinitely once you start trading the live markets.

Basic account

The entry-level commission-free account offers traders a spread as low as 2.4 pips with a leverage of up to 1:300 in exchange for $500 minimum deposit.

Standard account

The standard account is suitable for beginner traders with larger initial deposits in exchange for tighter spreads. With a minimum spread of 1.4 pips and leverage up to 1:300, this level of account offers 1-to-1 coaching in addition to the ebook and video training material. The minimum deposit on this account is $5000 which is high considering the minimum spreads.

Advanced account

A leverage of 1:100 and a raw spread of 0.0 pips make this a compelling choice for those moving from another broker where fees were high. In addition to the Standard account training, TrioMarkets will give you a daily market briefing along with free trading signals.

Premium account

The premium account is for traders trading high frequency and high volumes, and need priority access to customer service and fast withdrawal of funds. There is a markup subaccount as well as a Raw Account, where the Markup Account charges only the spread, while the raw accounts charges traders a combination of tighters spreads and commission-free based on the volume traded.

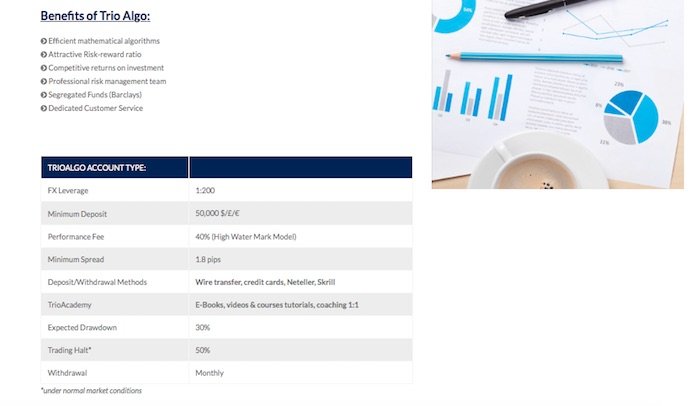

Asset Management Program

Triomarkets offers traders an algorithmic trading platform called the Asset Management Program which provides clients with two different algorithmic strategies.

Trio Algo

With higher risk of tolerant traders, Trio Algo has expected 7-8% monthly performance with risk at 50% and a high watermark performance fee.

TrioMatrix

TrioMatrix is the flexible risk option, which comes with lower expected performance targets. Expect a 2-3% monthly performance target, with flexible risk from 20 to 50% with a high watermark performance fee.

Spreads and Commissions

The Standard Account types use offer spreads from 1.4 Pips with 1:300 leverage on FX products, while the Premium Account has a Markup and Raw subaccounts that offer spread only charges or a combination of spreads and commission respectively. The Advanced accounts setup is the same as the Premium Account with wider spreads and commissions on the trade.

Deposits and Withdrawals Fees

The speed of withdrawal depends on which account type you have signed with, but the standard accounts have a 24-hour payout period, while the premium account has a 6 hour waiting time.

Triomarkets will charge a fee of 1.5% per withdrawal with a minimum charge of $25 and a maximum of $50. Clients can make deposits and withdrawals with major credit cards, major e-wallets like Paypal, Netteller, Skrill, and Webmoney as well as creating an EFT from your Bank Account to the TrioMarkets Barclays bank account in London.

Trading Platforms

TrioMarkets offers the MetaTrader 4 platform, and the corresponding Web Trader software that loads in a browser. MT4 is the industry standard for CFD trading, and while not the easier software for beginners, it means a seamless transition from one broker to another should trading conditions change.

Mobile Trading Apps

The MT4 mobile trading platform has IOS and Android apps. These are intuitive apps with a simple interface for secure trading and integration with a single TrioMarkets account.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the TrioMarkets offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

TrioMarkets Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. TrioMarkets would like you to know that: Trade Responsibly: 82.16% of retail investor accounts lost money when trading CFDs with this provider

Overall

TrioMarkets is the experienced trader’s Forex broker. There are hints of additional client features that would attract the beginner trader, but the focus at TrioMarkets is to run a steady MT4-only broker that seeks to retain serious traders by offering a distinguished trading service without the marketing gimmicks.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how TrioMarkets stacks up against other brokers.