-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

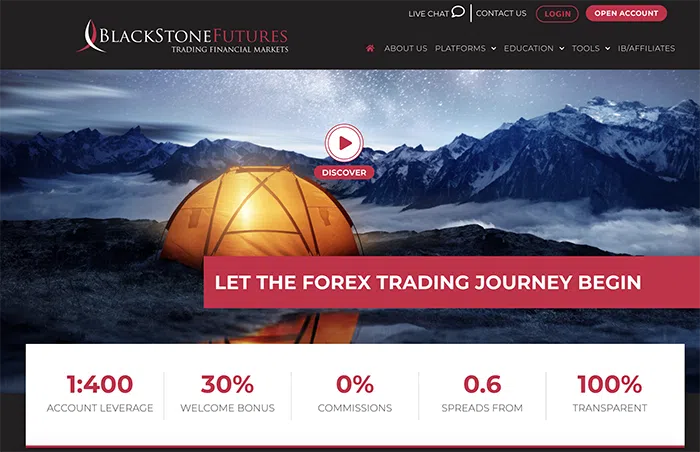

Blackstone Futures Broker Review

| 🏦 Min. Deposit | ZAR 1000 |

| 🛡️ Regulated By | FSCA, ASIC, FCA, SCB |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, Cloud Trade |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Shares |

Last Updated On May 10, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Blackstone Futures

Founded in 2009, BlackStone Futures is an established FSCA-regulated broker based in Johannesburg. It offers USD accounts on MT4 and the proprietary CloudTrade platforms, and STP execution ensures no conflict of interest. Beginner traders are well-catered for with excellent educational support, really emphasising the duty of care BlackStone Futures feels for their clients. Spreads are tight and leverage is kept sensibly low until traders can prove their ability, thereby limiting the chance of account wipe out for beginners.

| 🏦 Min. Deposit | ZAR 1000 |

| 🛡️ Regulated By | FSCA, ASIC, FCA, SCB |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, Cloud Trade |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Shares |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- South African broker; FSCA regulated (FSP 49846) since 2009

- Fast STP trade execution and negative balance protection for all traders

- Tight spreads starting at 0.6 pips and no commission

- ZAR accounts available; trade in Rand with fast deposits and withdrawals

Cons

- Limited trading platform choice: MT4 and CloudTrade only.

Is BlackStone Futures Safe?

BlackStone Futures has been operating in South Africa since 2009 and is the trading name of Trade Nation Financial Pty Ltd, which is the South African subsidiary of FINSA Europe, an FCA and ASIC regulated broker based in London, UK. FINSA Europe is better known as the operator of the Core Spreads brokerage service, which also has operations in South Africa under the Trade Nation Financial umbrella.

Trade Nation Financial Pty Ltd has been regulated by the FSCA in South Africa since June 2019 with the FSP 49846, though from 2009-2019 BlackStone Futures was regulated by the FSCA as BlackStone Marketing Pty Ltd.

BlackStone Futures has not won any awards, but all clients are offered negative balance protection and, as an STP broker, will never be counterparty to your trades – removing any conflict of interest.

Because BlackStone Futures is based in South Africa, all client deposits are kept in South African banks and FSCA regulation means that the repayment of funds in case of broker bankruptcy is much simpler.

Trading Conditions

BlackStone Futures advertises itself proudly as an STP only broker, which allows for near-instant execution. Both accounts have the option of using either BlackStone’s proprietary online platform Cloudtrade or MT4, though trading conditions vary depending on your platform choice.

Account Types

Demo Account – Demo Accounts are available for both account types and both platforms. Demo Accounts are not time limited and will only be disabled after 30 days on inactivity.

USD Account – BlackStone’s USD Account is recommended for more experienced traders who are willing to bear the exchange rate risk and trading risk associated with this account. With a 100 USD minimum deposit, this account also has a much higher minimum deposit and you will also have to deal with delayed deposits and withdrawals.

A Note About Platform Choice

BlackStone Futures offers both CloudTrade and MT4 on both accounts, and trading conditions differ depending on which platform you use. While CloudTrade offers over 750 tradeable instruments, users will find that leverage is fixed at 100:1 or lower (50:1 on the USD/ZAR for instance).

On the MT4 platform, leverage is also initially limited to 100:1 but can be increased to 400:1 once you have a track record of responsible trading.

We will discuss the two platforms in more detail below.

Spreads and Commission

BlackStone Futures charges no commission on either account, but instead makes it money through the spread. Minimum spreads are tight for a South African broker, down to 0.6 pips on the EUR/USD, 1 pip on the USD/JPY and 10 pips on the USD/ZAR.

Deposit and Withdrawal

BlackStone Futures only allows withdrawals via bank transfer, withdrawals are processed same day if received before 15:00 and will usually post to your bank account in 24-72 hours.

BlackStone Futures supports the following methods for deposits:

- Bank Transfer: For South African bank accounts this will usually reflect in 24-48 hours

- Debit/Credit Card: This method is instant.

BlackStone Futures for Beginners

In a refreshing change of pace, BlackStone Futures devotes much of its website to educational material for new traders across several sections – we especially like the focus on helping beginner traders avoid the mistakes that lead to account wipeouts.

Market analysis is also available on a near-daily basis through BlackStone’s Telegram and Instagram accounts.

Education Material

As mentioned, BlackStone Futures offers a range of educational material across the website. The three main sections are:

- Masterclass: BlackStone holds regular Masterclasses at its offices in Rosebank, there is no fee to attend and new traders have universally excellent feedback regarding the quality of these sessions.

- Webinars: Alongside the in-person Masterclass, BlackStone Futures also offers weekly webinars. These are free to register, and all the previous webinars are free to watch on BlackStone Future’s webinar channel.

- Education: Under the Education header, BlackStone Futures offers a guide to consuming the educational content available with links out to the relevant articles and tools. Particularly useful are the short description under each listing telling traders what they can expect to learn. Also in the education section are short guides to the MT4 and CloudTrade platforms, an FAQ section and links to BlackStone Futures Market Sentiment and Economic Calendar tools.

Overall, this is a very impressive educational offering from BlackStone Futures and something we would like to see replicated by more South African brokers. It shows a real sense of care for the South African trading community and provides traders with the security of knowing that their broker truly wishes them success in the Forex market.

Analysis Material

Apart from the Economic Calendar and Market Sentiment tool, BlackStone Futures also offers daily market analysis via its social media channels. Analysis is available in video and text format on the Facebook page and as text across Instagram, Telegram and WhatsApp. The analysis is brief, informal and both useful and thought-provoking for new traders in particular.

While we don’t expect South African brokers to be able to compete with large international brokers in terms of analytical output it is good to see regular guidance on offer, even if it necessarily briefer and less detailed than from BlackStone Future’s larger international peers.

Customer Support

Customer support is available 7am-10pm Monday-Friday and 12pm-10pm on Saturday/Sunday; the trading desk is available 24/5. Both customer support and the trading desk are available by live chat, telephone, email, Telegram, WhatsApp and via a call back service. BlackStone Futures is also very active on social media via Twitter, Facebook and Instagram.

Trading Platforms

BlackStone Futures offers its proprietary browser-based CloudTrade platform and also supports MT4, the industry-standard trading platform.

MetaTrader 4 – The MT4 trading platform is the most widely used Forex trading platform and can also be used to trade other instruments like commodities, cryptocurrency, stock index, and stock CFDs. Though it is now showing its age, MT4 is still very popular for its auto trading features that enables algorithmic trading and strategy backtesting with expert advisors (trading robots).

CloudTrade – BlackStone Future’s browser-based CFD trading platform, CloudTrade is also available as a mobile app and offers an advanced charting package. It has been designed with ease of use, efficiency and simplicity in mind and allows clients to trade multiple asset classes, not just Forex.

Mobile Trading Apps

Both MT4 and CloudTrade are available as mobile apps. The MT4 mobile app offers basic trading, research, and account management functionality. Traders can open/close/edit positions, add stops to open positions and delete working orders. Research and analysis are available on real-time charts, and automated alerts can be used to identify trading opportunities.

The CloudTrade app offers real-time quotes of financial instruments, the full set of trade orders, including pending orders and support of all types of execution modes and your complete trading history.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the BlackStone Futures offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. BlackStone Futures would like you to know that: Trading foreign exchange and/or contracts for difference on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade the products offered by BlackStone Futures you should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin.

Overview

BlackStone Futures is a proudly South African broker with a long history of responsibly assisting traders to launch successful Forex trading careers. With a low minimum deposit, tight spreads and a clear focus on its educational support, BlackStone Futures is a great choice in a broker for South African beginner traders.

With MT4 and CloudTrade both supported and USD Accounts available for those with higher deposits, there is enough flexibility here to recommend BlackStone Futures to more experienced traders too.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Blackstone Futures stacks up against other brokers.