For over a decade, FxScouts Kenya has been reviewing forex brokers and provided in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Kenyan markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

- AvaTrade - Best Mobile Trading Experience

- Pepperstone - Lowest Cost ECN Broker

- XM - Best Education

- FBS - Lowest Deposit ASIC-regulated Broker

- IG - Widest Range of Tradable Instruments

- IC Markets - Best Broker for Beginners

- Fusion Markets - Ultra-low Costs, 3 Copy Trading Platforms

- markets.com - Best Proprietary Platform

- Axi - ASIC Broker with Best MT4 Support

Best ASIC Regulated Forex Brokers in 2024

Broker | Broker Score | Official Site | ASIC | ASIC License | Min. Deposit | Max. Leverage | Beginner Friendly | EUR/USD - Standard Spread | Cost of Trading | EUR/USD - Raw Spread | Total CFDs | Currency Pairs | Platforms | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.59 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | Yes | 406684 | USD 100 | 400:1 | Excellent | 0.90 pips | USD 9 | 0.90 pips | 930 | 63 | MT4, MT5, Avatrade Social, AvaOptions | |

| 4.61 /5 Read Review | Visit Broker > 75.3% of retail CFD accounts lose money | Yes | 414530 | USD 0 | 400:1 | Excellent | 1.00 pips | USD 10 | 0.10 pips | 1597 | 90 | MT4, MT5, cTrader, TradingView | |

| 4.45 /5 Read Review | Visit Broker > 75.33% of retail CFD accounts lose money | Yes | 443670 | USD 5 | 1000:1 | Excellent | 0.60 pips | USD 6 | 0.60 pips | 1554 | 57 | MT4, MT5 | |

| 4.33 /5 Read Review | Visit Broker > 69.21% of retail CFD accounts lose money | Yes | 426359 | USD 5 | 3000:1 | Excellent | 0.70 pips | USD 7 | 0.70 pips | 573 | 72 | MT4, MT5, FBS App | |

| 4.69 /5 Read Review | Visit Broker > 69% of retail CFD accounts lose money | Yes | 220440 | USD 0 | 200:1 | Excellent | 0.60 pips | USD 6 | 0.85 pips | 19295 | 80 | MT4, L2 Dealer, ProRealTime | |

| 4.46 /5 Read Review | Visit Broker > 70.81% of retail CFD accounts lose money | No | 335692 | USD 200 | 500:1 | Excellent | 0.10 pips | USD 8 | 0.02 pips | 1744 | 64 | MT4, MT5, cTrader, TradingView | |

4.41 /5 Read Review | Visit Broker > 89% of retail CFD accounts lose money | Yes | 385620 | AUD 0 | 30:1 | Excellent | 0 pips | USD 4.50 | 0 pips | 247 | 81 | MT4, MT5, cTrader, TradingView | ||

4.68 /5 Read Review | Visit Broker > 70.3% of retail CFD accounts lose money | Yes | 424008 | USD 100 | 300:1 | Excellent | 0.70 pips | USD 7 | 0.60 pips | 1009 | 56 | MT4, MT5, markets.com | ||

| 4.44 /5 Read Review | Visit Broker > 75.6% of retail CFD accounts lose money | Yes | 318232 | USD 0 | 500:1 | Excellent | 1.00 pips | USD 10 | 0.00 pips | 188 | 70 | MT4 |

Avatrade – Best Mobile Trading Experience

Founded in 2006, Avatrade is a well-regulated broker with over 200,000 registered users and an average monthly trading volume of 60 billion USD. In line with the 2021 ASIC changes, Avatrade amended its product offering, which included reducing its leverage from 400:1 to 30:1 for retail traders. However, Malaysians will be onboarded through the British Virgin Islands-based entity, regulated by the BVI FSC. The regulatory rules of the BVI FSC are not as strict as those of regulators in the UK or Australia, but the ASIC oversight ensures that Avatrade will act reliably and transparently. Avatrade also provides a user-friendly trading environment on a range of trading platforms, including its innovative mobile app – AvaTradeGO. AvaSocial, Avatrade’s social trading platform is also available as a downloadable app.

AvaTradeGO: An award-winning application, AvatradeGO allows traders to connect to global trading markets, create their own watchlists, and view live prices and charts. AvatradeGO also provides free access to analysis tools such as Autochartist, Duplitrade, a copy trading tool, and AvaProtect, its own state-of-the-art risk management system. Avatrade’s trading fees are average compared to other similar brokers, with a minimum deposit requirement of 1500 ZAR, spreads that start at 0.90 pips pips on the EUR/USD, and no commissions charged on Forex trades.

Avasocial: Avasocial is Avatrade’s social and copy trading platform. Available on both Android and iOS, the mobile app allows traders to replicate the trades of other successful traders. Traders can opt to trade manually or to use a fully automated service. Traders can also interact with other traders and ask questions on specific strategies, find out more about various markets, and seek out a mentor, making it a great tool for beginner traders.

Pepperstone – Lowest Cost ECN Broker

An ASIC-regulated broker (ASFL: 414530), Pepperstone was founded in 2010 in Melbourne and has grown to be one of the largest ECN brokers in the world, with over 300,000 clients and 12+ billion-dollar daily trading volume. Pepperstone’s Kenyan clients will be trading under the Pepperstone subsidiary regulated by Kenyan CMA, and local regulation means that Pepperstone will act in the best interests of all Kenyan traders. Pepperstone is well-placed to benefit from CMA regulation with its low fees, ultra-fast execution, and three popular trading platforms.

Lowest Trading Fees: Pepperstone offers two accounts with some of the lowest trading fees in the industry – a Razor Account with spreads that average at 0.10 pips (EUR/USD) in exchange for a commission of 7 USD, and a commission-free Standard Account with spreads starting at 1.00 pips on the EUR/USD. Trades are executed in under 0.3 seconds, which means that orders are filled as close to the quoted price as possible. Additionally, there are no minimum deposit requirements, making both accounts accessible to beginners.

Trading Platforms: Pepperstone’s trading platforms include MetaTrader 4 (MT4), Metatrader 5 (MT5), and cTrader, a broader range of platforms than is typically found at other brokers. MT4 is the most popular trading platform while MetaTrader 5 (MT5) has more tools, such as an embedded economic calendar and chat system. cTrader is a more modern trading platform and is easier for beginners to learn but still has all the sophisticated automation tools found in MT4 and MT5. While trading conditions vary slightly depending on the trader’s preferred platform, trading costs are still lower than those of other similar brokers.

XM – Best Education

Founded in 2009 in Cyprus, XM has over 5,000,0000 traders on its books from 192 countries. With a long history of regulatory oversight, XM gained its ASIC licence (AFSL number: 443670) in 2014 and set up a regional office in Melbourne. Kenyans will trade under XM’s Belize-based entity, regulated by the IFSC. Although the IFSC’s rules are not as strict as other international regulators, the ASIC regulation provides traders with confidence that their funds will be safe and that they will be treated fairly. Under the strict regulatory regime, XM offers an Ultra-Low account with low trading fees and provides some of the best educational support in the industry.

Daily Live Education: XM excels in its educational offering, which includes educational videos, courses, platform tutorials, Forex seminars, and live Q&A sessions available every hour from Monday to Friday. Topics include the basics of Forex trading, technical analysis, trading strategies, fundamental analysis, and major currency fundamentals. XM also offers comprehensive market analysis, providing traders with a daily market overview, frequently updated news, trading ideas, technical summaries, podcasts, and regular research updates.

XM’s Ultra-Low Account: Available on the MT4 and MT5 trading platforms, XM’s Ultra-Low Account has competitive trading fees, with spreads that start at 0.8 pips on the EUR/USD, no commissions for Forex trading, and a minimum deposit of 50 USD. XM also boasts a strict no requotes and no rejections policy: 99.35% of all trading orders are executed in less than one second, meaning traders usually receive the quoted trading prices.

FBS – Lowest Deposit ASIC-regulated Broker

ASIC-regulated since February 2021, FBS is a popular CFD broker with very low minimum deposits, very high leverage, two low-risk accounts for beginners, ECN accounts for experienced traders, and excellent education and market analysis. Well-regulated worldwide, FBS also holds licences from CySEC in Europe, the FSCA in South Africa, and the IFSC in Belize.

Trading costs and minimum deposits are low: The Cent Account has a minimum deposit of 1 USD, the Micro Account is 5 USD, and the Standard Account is 100 USD.Under its IFSC-regulated entity, FBS can offer leverage of 3000:1 on three of its five account types. While this increases risk for traders, it can also greatly increase profitability.

FBS also has 100 cryptocurrency pairs to trade at a leverage of 5:1. Cryptocurrencies available include Bitcoin, Ethereum, Litecoin, Dogecoin, and Ripple – and many less common crypto coins. FBS is also one of the better brokers in terms of education and market analysis. The education section is helpful and well-structured, and market analysis is frequent and well-explained.

IG – Widest Range of Tradable Instruments

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | ASIC, CFTC, BaFin, BMA |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

Founded in London in 1974, IG has a regional HQ in Melbourne and has been regulated by ASIC since 2002 (ASFL: 220440). The largest broker in the world by revenue and regulated by 17 authorities worldwide, IG is also one of the few brokers that supported ASIC’s introduction of tighter regulations in early 2021. In addition to being one of the best-regulated ASIC brokers, IG has the widest range of financial instruments and some of the lowest trading fees in the industry on three trading platforms.

Widest range of financial instruments: IG offers over 17,000 financial instruments, many more than most other brokers. Tradeable CFDs include 13,000 share CFDs, 6000 ETFs, and 80 Forex pairs. IG also offers weekend trading on major Forex pairs and 24-hour trading on Australia’s leading stock index, the ASX 200. Both of these are unique services that are not available at other brokers. IG Market’s single account has low fees compared to other brokers, with no minimum deposit requirements, spreads starting at 0.85 pips on the EUR/USD, and no commission charged on Forex trading.

Trading Platforms: IG’s trading platforms include MetaTrader 4 (MT4), its own web-based platform, and L2 Dealer. This specialist share trading platform offers direct market access (DMA) to clients with an account balance of 2000 AUD/USD. MT4 and the IG trading platforms are more user-friendly and suited to beginner traders, while the L2 Dealer offers advanced analytical tools and charting packages for more experienced traders.

IC Markets – Best Broker for Beginners

IC Markets (ASFL: 335692) is a leading ASIC-regulated online retail Forex and CFD broker founded in 2007 and headquartered in Sydney. One of the largest Australian brokers, IC Markets’ daily trade volume averages over 15 billion USD and is available in over 162 countries worldwide, including Kenya. IC Markets was one of the first brokers to amend its product offering in line with ASIC’s 2021 restrictions. While Kenyans will be trading under the Seychelles-based entity, the ASIC regulation provides additional confidence that IC Markets will behave responsibly and fairly. IC Markets provides a welcoming environment for beginner traders with its well-structured educational section developed by a team of in-house experts and two beginner-friendly accounts.

Education: With a comprehensive library of course material, including video tutorials, articles, frequent webinars, and IC Markets’ Web TV, traders will receive extensive instruction in CFD trading. IC Markets also has a dedicated support department operating 24/7 to help beginner traders answer any technical or trading-related questions.

Beginner-friendly accounts: IC Markets offers three live accounts, all with a minimum deposit of 200 USD, making them accessible to beginner traders. IC Markets’ trading fees are some of the lowest in the industry – its commission-free Standard Account has fees included in its variable spreads, which average at 1 pip (EUR/USD), while the Raw accounts offer spreads that average at 0.02 pips on the EUR/USD in exchange for commissions of between 6 and 7 USD (round turn), depending on the platform.

Fusion Markets – Ultra-low Costs, 3 Copy Trading Platforms

Founded in 2017 in Melbourne, Fusion Markets is an ASIC-regulated broker (AFSL 226199) with a range of copy-trading options, exceptionally low trading costs and no minimum deposit requirements. Its Fusion+ copy trading platform is only available in a proprietary trading platform, but it also offers Duplitrade and Myfxbook Autotrade – two of the largest Forex social trading communities in the world.

In terms of traditional trading, Fusion Markets is one of the lowest-cost brokers in the world. EUR/USD spreads start at 0 pips on its Zero Account with a very low commission of 4.50 AUD (round turn). Most other brokers offering raw spreads will have a commission of 6 AUD or higher. The only drawbacks are a relatively limited number of CFDs and very limited education, so beginners will have to educate themselves elsewhere.

Markets.com – Best Proprietary Platform

Markets.com is a global broker founded in 2008 and regulated by ASIC with AFSL number: 424008. Markets.com offers one live account, with a minimum deposit requirement of 100 USD and spreads starting as low as 0.8 pips on the EUR/USD. Traders can choose from three trading platforms, including MT4, MT5, and markets.com’s proprietary platform, considered by many to be one of the best in-house trading platforms in the industry.

The intuitive platform includes fundamental, technical, and sentiment analysis tools and advanced charting with several indicators, like Forecasting, Long/Short position tracking, Elliott Wave and Gann.

Traders will also find a wide range of financial instruments available, including shares, ETFs, Indices, commodities, Forex, cryptocurrencies, and bonds.

Axi – ASIC Broker with Best MT4 Support

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Founded in 2007, Axi (formerly Axitrader) is an Australian-owned online forex broker regulated by the Australian Securities and Investments Commission (ASIC AFSL number: 318232). Axi adheres to ASIC’s seven disclosure benchmarks to ensure that traders understand the risks of CFD trading. Although Malaysian traders will be trading under Axi’s Seychelles-based entity, the ASIC regulation ensures that the broker provides a reliable and fair trading environment. While Axi only supports the MT4 trading platform, the MT4 NexGen plugin transforms MT4 into a superior trading platform. It also offers lower-than-average trading costs on two live accounts.

Trading Platforms: Although trading platform support is limited to MT4, Axi offers a range of tools and plugins that can be added to the trading platform to make it more powerful. Traders who maintain an account balance of more than 1000 USD can access the MT4 NexGen plugin, which includes a sentiment indicator, a correlation trader, a more intuitive terminal window, and an automated trade journal. Traders also have free access to Autochartist and PsyQuation, an advanced data analytics plugin that analyses your trading style, identifies mistakes, and helps you avoid making similar mistakes again.

Trading Fees: Axi’s trading fees are highly competitive. It offers two live accounts with no minimum deposit requirements (although Axi recommends depositing an initial sum of 200 USD) – the commission-free Standard Account with spreads that average at 1.00 pips pips on the EUR/USD and the Pro Account with spreads that average at 0.1 pips (EUR/USD) in exchange for a round turn commission of 7 USD.

Why Trade with an ASIC Regulated Forex Broker?

There are few genuinely strong regulators in the world; the UK’s Financial Conduct Authority is one, the Cyprus Securities and Exchange Commission is another, and most would agree that ASIC is also a member of this group. ASIC has already built a reputation for guaranteeing trader security and dealing harshly with bad brokers, but recent reports show that ASIC is planning an even stricter regulatory environment in the coming months. We will talk about what that environment might look like in more detail below, but first, let’s look at the current benefits of trading with an ASIC-regulated broker.

- Segregated Accounts: Like most good regulators, ASIC ensures that all brokers keep client funds segregated from broker operational funds and in Tier 1 Australian banks.

- No Leverage Limit: There are currently no limits on maximum leverage offered by brokers, though this is likely to change in the next year. While leverage limits can protect traders, especially beginners, it can make scalping strategies more difficult.

- Dispute Resolution and Customer Satisfaction: The Australian Financial Complaints Authority (AFCA) handles all disputes between traders and brokers and are known for efficiency and fairness. Importantly, brokers are responsible for the cost of the resolution and not the trader – this provides an incentive for brokers to respond quickly and fairly to all customer complaints. Unsurprisingly, ASIC Forex brokers are consistently rated very highly for customer satisfaction.

- No Conflict of Interest: ASIC has banned all Forex brokers from being counterparty to their client’s trades, furthermore all brokers are required to offer a fast and efficient platform with no broker interference. It is perhaps as a result of these restrictions that Australia hosts many of the world’s best ECN brokers.

How To Choose an ASIC Regulated Broker?

All ASIC brokers are safe due to the strict regulatory environment in which they operate, and most of them are very strong all-round. But it is essential to look at the detail of each broker to find out what differentiates them from each other. When looking for an ASIC-regulated Forex broker, it is important to judge them on the following areas:

- Broker Type: Most brokers are either ECN/STP or Market Makers, but some can be a combination of both. You will find that many brokers will provide an ECN/STP service on their higher-deposit account types while acting as a Market Maker for their Cent and Standard accounts. Many of the best ASIC regulated brokers are ECN/STPs.

- Trading Conditions: This includes what kind of spreads are available, how much leverage is offered, and how many currency pairs are available. These factors will directly impact your profit or loss, so you don’t want any surprises.

- Trading Platform: MetaTrader 4 is still the industry standard, but many brokers offer MetaTrader 5 and/or their proprietary platforms. ECN/STP brokers will often support cTrader as it is built specifically for market execution and only allows for minimal broker interference.

- Minimum Deposit: This changes by account type for many brokers, with higher minimum deposits often linked to better trading conditions. We will always highlight the minimum deposit available regardless of the account type.

- Deposit and Withdrawal Methods: All brokers accept traditional payment types such as debit/credit cards and bank transfers, many accept online payments through Skrill and Neteller and some will also accept Bitcoin. Always check for deposit and withdrawal fees, a few brokers charge a percentage fee for some withdrawals methods, making large drawdowns very expensive.

Changes in ASIC Regulation

The Australian Securities and Investments Commission (ASIC) released its annual report for the 2018/19 fiscal year on October 17th, 2019 against the backdrop of its highly critical review of the CFD sector in August.

The August review of the Australian OTC retail derivative market found a considerable increase in the number of traders since 2017 and an equally large increase in turnover at ASIC regulated brokers.

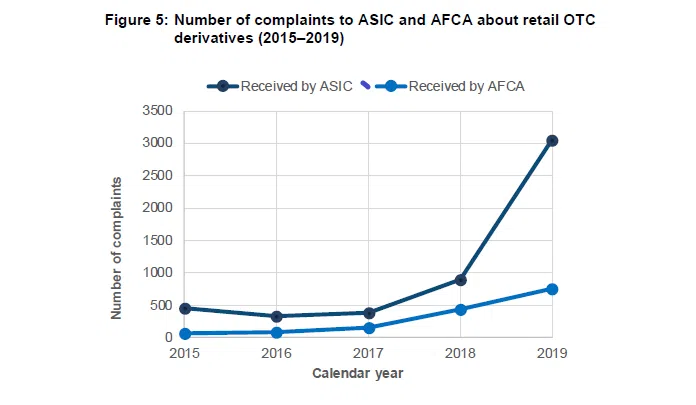

ASIC also published the data on complaints filed against CFD brokers over the same period, and the results were shocking.

From 2017-19 complaints received by ASIC had increased by 600%, a situation that ASIC has concluded is not sustainable in a sector where the majority of customers are known to lose money.

As a response to this damning set of data, and citing the 2018 tightening of regulation in Europe by ESMA, ASIC has laid out a new set of regulations for CFD brokers operating under its jurisdiction:

- A complete ban on binary options

- Varying leverage restrictions for all CFDs: 20:1 for forex and gold, 15:1 for stock indices, 10:1 for commodities (excluding gold), 2:1 for cryptocurrencies and 5:1 for equities and all other instruments.

- A forced stop-out at 50% of the total initial margin of all open trades

- Mandatory negative balance protection

- A complete ban on all bonus schemes, promotions and other incentives to traders.

- All brokers must place visible and honest risk warnings showing the percentage of traders who lose money on their platform

- All broker trading platforms must always display total position size and overnight funding costs related to open positions in real-time.

- ASIC also stated that they expect all brokers to publish their pricing methods

Though these restrictions have not yet been made into law, ASIC made it very clear that they expect the new set of rules to be on the books within the next few months – ASIC further reinforced this stance at the launch of the annual review, stating that:

“We continue to respond to a high incidence of misconduct in the retail OTC derivatives sector, involving large client losses.”

ASIC has also warned Australian brokers away from working with offshore investors illegally, especially as regulators in China, Japan and Europe and North America have placed restrictions or bans on CFDs for retail investors. ASIC has also started working more closely with CFD brokers to ensure compliance with foreign laws and is actively engaged with multiple international regulatory bodies in this matter.

Overall, we can expect significant changes in the Forex industry in Australia, and across the Asia-Pacific region, in the next few months. If you want to know more about how these changes might affect your trading, we recommend getting in touch with ASIC or your broker to discuss the options available to you.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the UK’s regulator, the FCA, or the Australian regulator, ASIC).

Our Rating & Review Methodology

Our State of the Market Report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.