-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On Aug 11, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Fibo Group

Founded in 1998, FIBO Group is a CySEC-regulated, NDD broker with 6 different account types and full support for MT4, MT5 and cTrader. Beginners will like the MT4 Cent Account with its tight spreads and tiny minimum deposit while professional traders will be tempted by the MT5 and cTrader accounts, which feature some of the best trading conditions available. Commissions are competitive with other NDD brokers and the minimum deposit on most accounts is only 50 USD.

On the downside, education and market analysis are basic, FSC BVI and CySEC regulation are the bare minima of what is considered acceptable by way of oversight, and withdrawals are slow and expensive.

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | CySEC, BaFin, B.V.I FSC, FSC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 1000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, cTrader |

| 💱 Instruments | Commodities, Cryptocurrencies, Forex, Indices, Metals, Shares |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Great platform choice

- Low minimum deposit

Cons

- Limited education

Is FIBO Group Safe?

Founded in 1998, FIBO Group Holdings is a hybrid ECN/NDD market maker which has been authorised and regulated by CySEC since 2010 (licence number 118/10) and is a member of the Investor Compensation Fund (ICF). In the unlikely event of FIBO Group’s bankruptcy, the ICF will compensate traders to a maximum of 20,000 EUR.

In addition, FIBO Group Ltd is also incorporated in the British Virgin Islands and has been regulated by the BVI FSC since 2016 (No. SIBA/L/13/1063). FIBO Group uses it is BVI office to provide services to customers outside of the EU. Clients using the BVI regulated entity for trading will not be covered by the ICF compensation scheme.

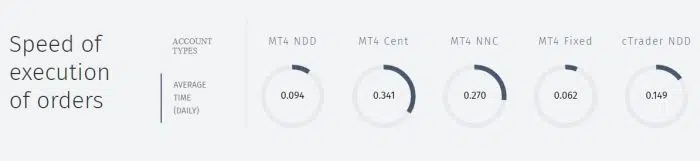

In a welcome show of transparency, FIBO Group publishes all trading statistics for all accounts, including execution speed, average and minimum spreads, and slippage percentages.

FIBO Group operates as an either an ECN or a No Dealing Desk (NDD) market maker. Either way, all client trades are executed without any dealing desk interference, preventing any conflict of interest. All clients are also provided with negative balance protection, so traders cannot lose more than they have in their accounts.

FIBO Group Trading Conditions

FIBO Group’s trading conditions are varied depending on which account you choose to open. In general, minimum deposits and commissions are low and NDD execution ensure low spreads. Execution speeds also vary, but are generally under 0.2 seconds, even on the ECN accounts.

Account Types

FIBO Group offers 6 account types and supports all 3 major trading platforms (MT4, MT5 and cTrader), though 4 of the accounts use the MT4 platform. Leverage and minimum deposit vary between the account types. All accounts are available as demo accounts but only the MT4 Fixed Account is available as an Islamic Account (swap-free).

Base currencies for most accounts are limited to USD and EUR. The exception being the MT4 Fixed Account, where RUR, CHF and GBP are also acceptable base currencies. The MT4 NDD Account also supports the BTC and ETH cryptos as base currencies.

FIBO Group also offers PAMM (Percentage Allocation Money Management) Accounts, where professional traders manage the funds of many investors (for a fee) on a single trading account. PAMM Accounts are available on the MT4 Fixed, MT4 NDD, and MT4 NDD No Commission Accounts.

MT4 Cent: The MT4 Cent Account is an ideal account for beginners or traders looking to test new trading robots. The minimum deposit is 1 cent, maximum leverage is 1:1000, and the average spread on the EUR/USD is 0.6 pips.

MT4 NDD: The MT4 NDD account requires a minimum deposit of 50 USD, maximum leverage of 1:400 and has an average spread on the EUR/USD of 0.3 pips. This account has a commission of 3 USD/lot. This account is available as a PAMM Account.

MT4 NDD No Commission: This account has all the same parameters as the MT4 NDD Account except the trading cost is captured in the spread and no commission is charged. As such, the average spread on the EUR/USD is higher, at 0.8 pips. This account is available as a PAMM Account.

MT4 Fixed: As one might expect, this MT4 account features fixed spreads, instant execution, and no commission. While traders lose the advantages of market execution with this account – such as tight variable spreads and no-requotes – this account suffers less slippage and volatility. The minimum deposit is 50 USD and maximum leverage is 1:400. Spreads are fixed and start at 2 pips on the EUR/USD. This account is available as an Islamic Account and as a PAMM Account.

MT5 NDD: This is the only MT5 account and has a much higher minimum deposit of 1000 USD. All trades are executed on the market, with average spreads on the EUR/USD at 0.2 pips. A commission of 5 USD is charged per lot and traders will be unable to open new positions if their balance falls below 100 USD.

cTrader NDD: This account is almost an exact replica of the MT4 NDD Account but using the cTrader platform. Minimum deposit is 50 USD, maximum leverage is 1:400 and spreads on the EUR/USD average 0.2 pips. Commission is 3 USD per lot.

Spreads and Commission

Spreads and commission vary depending on account type. The average spread on NDD accounts is 0.2 pips on the EUR/USD (the exception being the MT4 NDD No Commission Account) while spreads on the MT4 Fixed Account start at 2 pips. Commission is generally 3 USD per lot on NDD accounts, though the MT5 NDD Account charges 5 USD.

Both the spreads and commissions are competitive with other NDD brokers, though the 5 USD per lot on the MT5 NDD Account is a bit higher than one might expect.

Deposit and Withdrawal

FIBO Group allows deposits and withdrawals in EUR, USD, GBP, CHF, and range of cryptocurrencies and via a wide variety of methods. While FIBO Group states that it does not charge for deposits or withdrawals, most deposit and withdrawals methods do have a commission or fee:

- Bank Wire: Deposits can be made in EUR and USD, are charged a fee of 35-50 USD, and can take 2-5 days. Withdrawals can be made in EUR, USD, GBP, and CHF, are charged a fee of 35-50 USD, and can take 5-8 business days to complete.

- Visa/Mastercard: FIBO Group uses Connectum and RegularPay to handle credit card funding payments. Via both methods deposits can be made in EUR and USD and are free and instant. With Connectum, withdrawals can be made in EUR and USD, will be charged a 2.5% + 1.5 EUR commission, and can take up to 5 days. With RegularPay, withdrawals can be made in EUR and USD, will be charged a commission of 10 USD, and can take up to 10 days.

- Neteller: Neteller deposits can be made in USD and EUR and are free and instant. Withdrawals can be made in USD and EUR, will be charged a 2% commission, and can take up to 2 days.

- Skrill: Skrill deposits can be made in USD, will be charged a 3.9% commission and are instant. Withdrawals be made in USD, will be charged a 1% commission and can take 1 day.

- WebMoney: Deposits can be made in EUR and USD and are free and instant upon payment of the invoice. Withdrawals can be made in EUR and USD, a commission of 0.8% is charged and can take up to 2 days.

- CashU: Deposits can be made in USD, a commission of 7% is charged and are instant upon payment of the invoice. Withdrawals can be made in USD, are free of charge and can take 2 days.

- Fasapay: Deposits can be made in USD and IDR and a commission of 0.5% is charged (up to a maximum of 5 USD) and are instant within working hours. Withdrawals are not allowed.

- ecoPayz: Deposits can be made in USD and are free and instant upon payment of the invoice. Withdrawals are not allowed.

- paysafecard: Deposits can be made in USD and are free and instant upon payment of the invoice. Withdrawals are not allowed.

- PerfectMoney: Deposits can be made in USD and are free and instant. Withdrawals are not allowed.

FIBO Group also accepts payment in a range of cryptocurrencies, including BTC, ETH, BCH, XRP and RFC. Accepted payment providers are Raido Finance, bitpay, BLOCKCHAIN and Raido Spare. Deposits are generally free and instant, but withdrawals can be charged a 0.5% commission and can take up to two days.

FIBO Group for Beginners

In terms of trading conditions for beginners, FIBO Group really excels. The MT4 Cent Account has excellent trading conditions and will appeal to beginners who want to get a feel for the live markets in a low-risk environment. In addition, a range of PAMM Accounts are available for beginners who want to invest with professional traders.

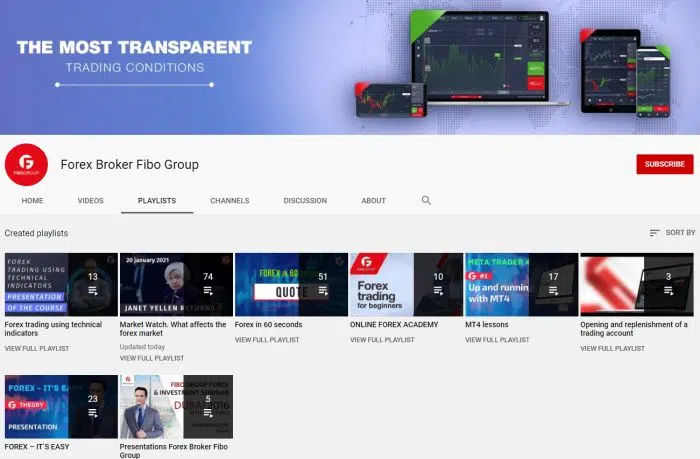

Unfortunately, in terms of training and analysis, FIBO Group is not the most welcoming environment for beginner traders. Most of the educational material is left to FIBO Group’s YouTube channel, and market analysis is infrequent. Customer support is available 24/5 via telephone and live chat.

Educational Material

The education section at FIBO Group consists of a single page with an explanation of the basics of Forex trading. The most useful parts of this page are the links out to FIBO Group’s YouTube channel where traders will find a selection of helpful videos in a structured course format.

Playlists included are FOREX – IT’S EASY and ONLINE FOREX ACADEMY, which are both good video primers for new traders. More advanced educational playlists include Forex Trading Using Technical Indicators and MT4 Lessons. The information presented in all videos is accurate and detailed.

Analysis Material

Market analysis at FIBO Group consists of a weekly video forecast looking forward to the week ahead. Beginners who require deeper market analysis should use other third-party market research to supplement this information.

Customer Service

Customer support is available via live chat, telephone, and email 24/5. For the purposes of this review, we found the customer support responsive, helpful, and knowledgeable of the company’s products.

FIBO Group Trading Platforms

FIBO Group is unusual in that it offers all three of the major trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader. While 4 of the 6 account types at FIBO Group are on the MT4 platform, there is only a single account each for MT5 and cTrader. All three platforms are available via web browser, desktop applications and mobile apps.

MetaTrader 4 – The MT4 trading platform is the most widely used Forex trading platform and can also be used to trade other instruments like commodities, cryptocurrency, stock index, and stock CFDs. Though it is now showing its age, MT4 is still very popular for its auto trading features that enables algorithmic trading and strategy backtesting with expert advisors (trading robots).

MetaTrader 5 – The MT5 trading platform is being adopted by more Forex brokers all the time, it has a more modern interface, allows for an unlimited number of charts to be used, shows Depth of Market and has a built-in Economic Calendar. It also has a larger number of pending order types than MT4 and features an embedded chat system. In addition, the MQL5 scripting language is more efficient than its precursor and MT5 has more advanced charting tools than MT4.

cTrader – cTrader is built and managed by Spotware and functions only as a NDD platform (market execution only with no broker intervention). Because it is NDD-only, traders will have to pay a commission on cTrader accounts. The user interface is more intuitive and modern than the MetaTrader platforms and the application is constantly being updated and improved by Spotware in response to user feedback. cTrader comes with many modern features such as automated trading with cAlgo, depth of market feature, one-click trading and advanced charting.

FIBO Group Mobile Apps

All three trading platforms are available on iOS and Android devices.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the FIBO Group’s offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. FIBO Group would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 58% of investor accounts lose money when trading CFDs with this broker. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

FIBO Group is an NDD broker with a long history of client satisfaction and excellent trading conditions across a wide range of accounts. MT4, MT5 and cTrader are all fully supported, and minimum deposits are low. Forex education and analysis are not as detailed as many of FIBO Group’s competitors, but customer service is responsive and helpful. Deposit and withdrawal fees are higher than many brokers too, but options do exist for instant and free funding.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Fibo Group stacks up against other brokers.