-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On May 12, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Swissquote

Swissquote is an award-winning, FCA-regulated STP broker. Swissquote targets more experienced traders (and serious beginners) as the minimum deposits required are considerably higher than with other similar brokers. However, Swissquote’s trading conditions reflect what clients should expect from a professional brokerage.

Swissquote has an award-winning proprietary trading platform, but also offer support for the MetaTrader suite. In addition, premium analytical tools are available for clients for free.

| 🏦 Min. Deposit | USD 1000 |

| 🛡️ Regulated By | FCA, BaFin, Fi, DFSA |

| 💵 Trading Cost | USD 13 |

| ⚖️ Max. Leverage | 100:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, AdvancedTrader |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, Vanilla Options |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Great platform choice

- Wide range of assets

Cons

- High minimum deposit

- Limited education

- Poor customer service

Is Swissquote Safe?

Swissquote uses STP execution for trades, which is entirely free of conflict as trades are passed directly to the market without any dealing desk oversight.

Swissquote has been regulated by the FCA in the UK (license: 562170) since 2012 and Swissquote Bank is regulated by FINMA (Switzerland). The UK’s FCA is a world-class regulator with strict processes that guarantee security for consumers.

Swissquote is only one of four brokers in Europe with bank backing, and none of the other three has the financial stability of Swissquote Bank.

Swissquote has also been well-recognised by the industry, recently winning the award for Best Forex Platform 2015 and 2016 (ADVFN International) and the award as for Best Broker 2018 (Forbes Fintech Age Awards).

Trading Conditions

Swissquote targets experienced and professional traders, as the entry-level accounts require significant initial deposits. All accounts operate on an STP execution model and do not have dealing desk intervention.

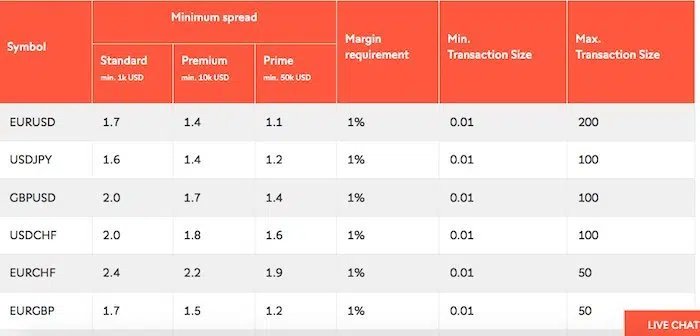

A client can trade in currency pairs, precious metals, stock indices, commodities and bonds. The maintenance margin on all accounts is 100%, and the stop-out level is 30%.

Account Types

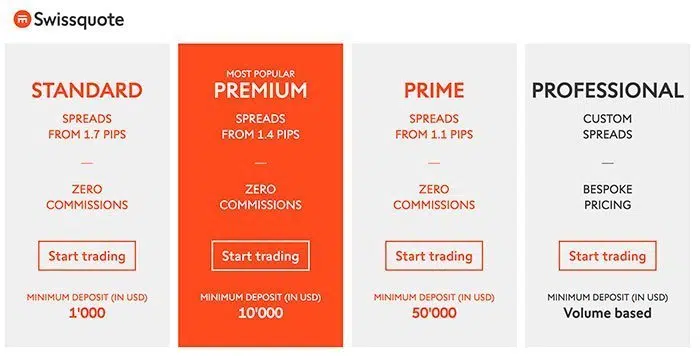

Swissquote offers four different live account options in addition to a demo account. The minimum deposits on these accounts are higher than other STP brokers but are normal for experienced and professional traders. There are three commission-free accounts.

The Standard account is the commission-free entry-level account at Swissquote. An initial deposit of 1000 USD is required and spreads start from 1.7 pips, and standard leverage up to 1:100.

The Premium account is the next step up in the commission-free accounts, with a 10,000 USD minimum deposit and offers spreads from 1.4 pips, and standard leverage up to 1:100.

The Prime account is the top of the range for commission-free trading. With a 50,000 USD minimum deposit, and standard leverage up to 1:100, spreads will get as tight as 1.1 pips.

The Professional account is a fully-customisable account option, where the minimum deposit is adjusted depending on the volume traded. Custom spreads and pricing can be discussed with your account manager. This account is targeted at professional traders looking to get the best trading conditions possible at a leading brokerage.

Spreads and Commissions

Depending on the account type, spreads can be as low as 1.1 pips on the commission-free accounts, while spreads will get tighter on the professional account which then blends tighter spreads in exchange for a commission charged on volume traded.

Deposit and Withdrawal Fees

Deposits and withdrawals are free of administrative charges. Deposits can be made via bank transfer, credit cards, and Skrill. Skrill can only be used for deposits.

All withdrawals require filling out a form and emailing it to the back office team.

Swissquote for Beginners

Swissquote cannot be considered a broker for new traders. While educational material does exist, it is not as extensive as other brokers, and no support is provided to find trading opportunities besides access to additional tools.

Customer service hours are also limited to regular office hours instead of the 24 hours service that is more common among similar brokers.

Education Material

The education section at Swissquote is broken down into two parts – the learning centre and webinars. While the videos in the learning centre are in English only, the webinars are available in multiple languages.

The learning centre is made up of 2-3 minute short videos in the following sections:

- Introduction to Forex

- Introduction to CFDs

- Technical Analysis

- Fundamental Analysis

- Risk Management

- MetaTrader

- Advanced Trader

These videos are a very high-level introduction to Forex trading, and more reading should be done on each of these topics before trading. An 11-page ebook is downloadable as well to supplement the videos, but additional resources will be needed to get a complete picture.

Webinars are available in English, French, German and Arabic, and topics cover items from a Weekly Market Update to the occasional educational question. Educational issues are coordinated between languages to ensure clients of all languages have the opportunity to learn the material.

Analysis Material

Swissquote is an execution-only broker. Execution-only means that they don’t offer any assistance to traders in finding trading opportunities.

However, the Research Section of the website issues market analysis and news on subjects that affect the currency market – from fundamental to political and technical intelligence.

Swissquote also offers regular analysis with a Daily Market Brief and a Daily Market Outlook.

Customer Support

Customer support is available via phone, email and chat.

Toll-free numbers for some countries are available for phone contact, and the service centre is opening during office hours from 9 am to 6 pm UK time. Chat is open during office hours. The dealing desk is open during market hours.

Trading Platforms

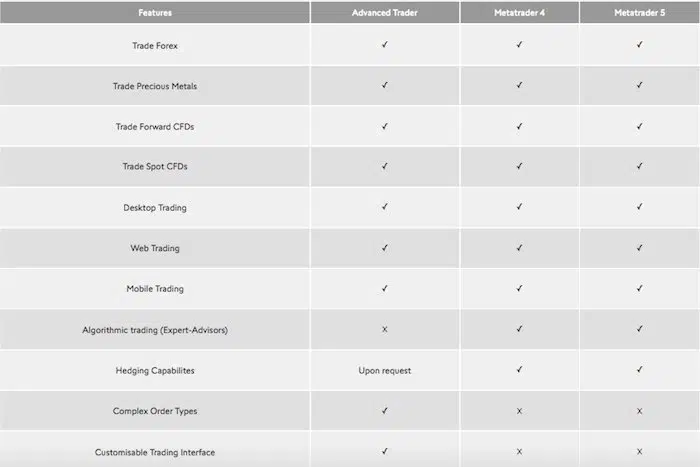

Swissquote supports multiple trading platforms: Advanced Trader – a proprietary platform created by Swissquote, and MetaTrader 4 & 5 – the industry standard CFD trading platforms.

Advanced Trader is a JavaScript platform compatible with both PC and Mac where no download is required. The platform supports conditioned orders, advanced charts analyse tools, FX Insider and an economic calendar; all included by default.

Significantly, the order inputs are by notional value rather than lots, mini, and micro-lots. Advanced Trader allows FIX API connection, has hedging capabilities on request and does not support EAs (Expert Advisors).

Metatrader, on the other hand, allows hedging, full access to a signal community and plugins able to align the basic version to the Advanced Platform. We list more of the advantages of MT4 here.

While the regular versions of MT4 and MT5 are available on both Mac and PC, the MetaTrader Extended Edition which makes MetaTrader a little more beginner-friendly is only available for Windows PCs.

Trading Tools

Swissquote offers a small set of premium tools to traders free of charge. These tools help traders find trading opportunities by analysing the markets for patterns or by presenting additional data that can help traders draw trading conclusions.

Autochartist

Autochartist is a 3rd party tool that monitors market charts looking for patterns. It is particularly helpful for traders looking to trade specific pattern or currency pairs, as it will send alerts in real-time making it possible to take advantage of the data immediately.

Autochartist is a powerful tool for traders who actively spend time looking for trading opportunities and technical traders who appreciate the assistance with finding patterns.

FIX API

The Financial Information eXchange (FIX) protocol is a platform created to pass information between systems in trading, and Swissquote gives clients access to an API to pull information from this database. This data includes historical price quotes, as well as other trading information, which will allow traders to get real-time information from the markets to either assist directly in trading or as a part of algorithmic trading.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Swissquote offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

SwissQuote Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Swissquote would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Overall

Swissquote is a leading STP broker in Forex & CFD trading. Targetting mainly the experienced trader and offering limited but mainstream MetaTrader platform choice, Swissquote has created a stable and fast trading solution. Premium tools are issued for no charge, and a wide range of CFDs are available to trade without commission, but with wider spreads than with their competitors. In contrast to other STP brokers, the minimum deposits required at Swissquote are substantially higher than with their competitors.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Swissquote stacks up against other brokers.