-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On Feb 7, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Eightcap

Winner of the Award for Best Global MT4 Broker 2020, Eightcap is an ASIC-regulated, no-intervention market maker with variable spreads on two simple account types. Spreads are tight on both accounts, with spreads on the Raw Account often down to 0 pips in exchange for a small commission.

Both MT4 and MT5 are fully supported and deposits and withdrawals are fast and free. Forex education and analysis are not as comprehensive as some of Eightcap’s larger competitors, but customer service is available in 10 languages and is responsive and knowledgeable.

| 🏦 Min. Deposit | AUD 100 |

| 🛡️ Regulated By | ASIC, SCB, FCA, CySEC |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, TradingView |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Great platform choice

- Excellent education

Cons

- Limited demo account

- No swap-free account option

Is Eightcap Safe?

Founded in Melbourne in 2009, Eightcap offers multi-asset trading from 5 offices across the globe. Eightcap is the brand name of Eightcap Pty Ltd and Eightcap Global Ltd (Vanuatu).

- Eightcap Pty Ltd (ABN 73 139 495 944) is regulated by the Australian Securities and Investment Commission (ASIC) with the AFSL reg no. 391441.

- Eightcap Global Ltd (Vanuatu) is regulated by the Vanuatu Financial Services Commission (VFSC) with the company registration no. 40377.

While the VFSC is not a well-regarded regulator (it is in our lowest tier for client protection and proactive oversight), ASIC is considered one of the best regulators in the world and Eightcap will be required to meet strict client protection standards and is subject to regular audits. As per regulation, Eightcap ensures that all client funds are held in segregated accounts at Tier 1 banks.

Eightcap does not have any “formal” negative balance protection in place (it is not referred to in the client agreement). However, Eightcap is aware that the commercial reality of recovering negative balances from clients is extremely low given the legal and reputational costs associated with doing so and will usually reduce negative balances to nil on request. Traders who sign up with the ASIC-regulated entity (Eightcap Pty Ltd) will have negative balance protection from March 2021 due to the change in ASC’s rules for CFD providers.

Eightcap won the award for Best Global Forex MT4 Broker 2020 at the Global Forex Awards.

Eightcap Trading Conditions

While Eightcap is a market maker, it runs a no-intervention execution model. Eightcap’s trading servers are hosted in Equinix data centres providing lightning-fast execution and pricing is derived from several top-tier liquidity providers. Aside from a demo account, Eightcap offers two simple trading accounts with variable spreads on either the MT4 or MT5 platform – EAs, scalping, and hedging are allowed on all accounts.

In addition to Forex, Eightcap offers trading on a selection of indices, commodities, and Australian shares. Be aware that share trading is only available on MT5.

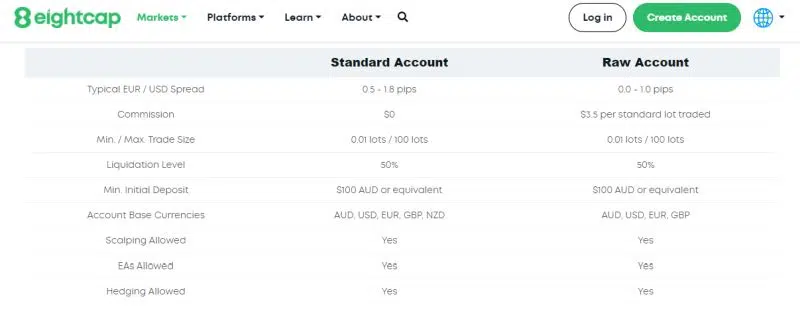

Account Types

The Standard Account is a commission-free account with wider spreads while the Raw Account charges a small commission in return for spreads down to 0 pips. Base currencies available are AUD, USD, EUR, or GBP. The Raw Account can also be denominated in NZD.

Maximum leverage on both accounts is set at 500:1. Traders who sign up with the ASIC-regulated entity (Eightcap Pty Ltd) will have their maximum leverage reduced to 30:1 in March 2021 due to the change in ASIC’s rules for CFD providers

- Demo Account – Both the Raw Account and the Standard Account are available as demo accounts. Without intervention, the demo account will expire after 30 days but can be converted to an unlimited demo account by contacting Eightcap customer service.

- Standard Account – The Standard Account is a commission-free trading account with variable spreads and 100 USD minimum deposit, the average spread on major pairs is 1 pip but can fall to 0.5 pips at times.

- Raw Account – The Raw Account is a commission-based account with tight spreads but is otherwise similar to the Standard Account. The minimum deposit is 100 USD and spreads can be as low as 0 pips on major currency pairs.

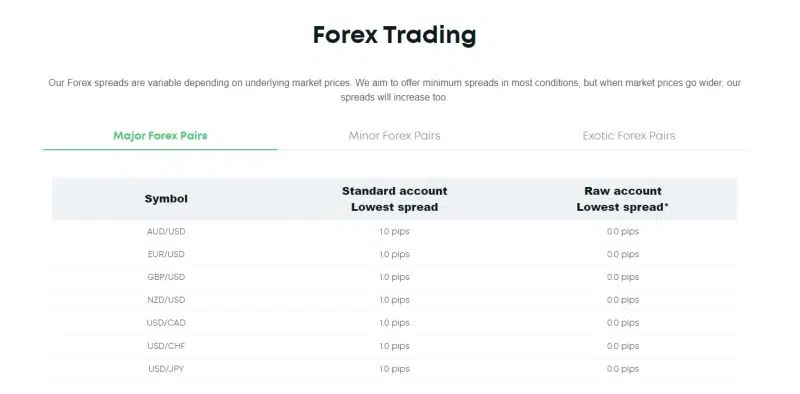

Spreads and Commission

As Eightcap derives its prices from its liquidity providers, spreads are variable. Spreads on the Standard Account vary between 0.5-1.8 pips on the EUR/USD but average above 1 pip most of the time. Spreads on the Raw Account can be as low as 0 pips on the EUR/USD but can sometimes be as high a 1 pip. Commission on the Raw Account is the industry standard 3.5 USD per lot per side (7 USD round turn).

Deposit and Withdrawal

Eightcap offers several deposit and withdrawal methods and charges no fees for any deposits or withdrawals. Note that international bank transfers (from outside of Australia) will attract fees from intermediary banks and Eightcap will pass these costs on to the customer.

- Bank Transfer: Deposits generally take 1-3 business days, but international bank transfers may take longer. Bank withdrawals take 2-5 business days, but international transfers may take longer.

- Visa/Mastercard: Deposits are instant, 24/7 and withdrawals take 1 business day for Australian cards or 2-5 business days for international cards

- Skrill: Deposits take 1-2 business days, be aware that the only available currencies are USD and EUR. Withdrawals via Skrill are charged at 1% of the transaction value and take 2-3 business days.

- Neteller: Deposits are instant, but the only available currencies are USD and EUR. Withdrawals are also instant, but Neteller will charge a small fee.

- POLi: Only available for AUD deposits, POLi account funding is free and instant 24/7.

- BPAY: Like POLi, only available for AUD deposits, BPAY funding is free and takes 1-2 business days.

- China Union Pay: Only available to Chinese deposits in RMB, China Union Pay is instant 24/7 and free.

Eightcap for Beginners

Eightcap has a strong focus on simplicity and transparency, which is ideal for beginner traders. The website is easy to navigate and all the information new traders might need is explained in a clear and concise manner. Eightcap’s education section is small but well-written, useful, and updated every few days with new material. Likewise, the market analysis section is updated infrequently, but thoughtful and written by Eightcap’s in-house team. Customer service is available 24/5 in 10 languages.

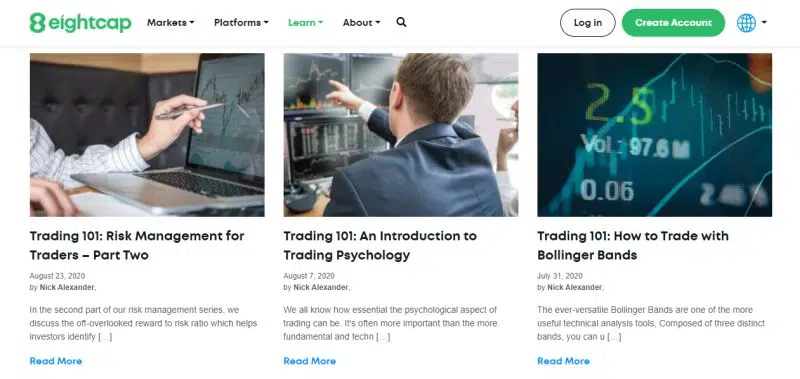

Educational Material

Eighcap’s Trading Education section is well-presented and accessible. Three main categories are presented to the reader: MetaTrader Guides, Fundamental and Trading Strategies. Further investigation reveals that all the material is written as blog posts but is of a high-standard and useful for beginners. The MetaTrader Guides and Trading Strategies section will particularly be helpful for new traders. Unfortunately, no video material or webinars are available at this time, and the addition of a structured course for beginners would be welcome.

Analysis Material

Eightcap’s Analysis section is presented in a similar fashion to the Trading Education section. Blogposts are arranged chronologically, and three main categories are presented: CFD News, Forex News and Market Updates. While analysis is not provided daily, there is always a detailed outlook for the week ahead and other analysis is published throughout the week on a range of markets. The analysis is provided by an in-house team and will be useful for new traders looking for a better understanding of the markets and new trading opportunities.

Customer Support

Customer support is available 24/5 from Eightcap’s five global offices via email, live chat, and telephone. Support is available in English, Chinese, Thai, Korean, French, Spanish, Italian, German, Vietnamese, and Portuguese.

For the purposes of this review, we found the Customer Support at Eightcap to be responsive, polite, and resourceful.

Eightcap Trading Platforms

Eightcap offers support for MT4 and MT5, the two most popular trading platforms in the Forex industry.

MetaTrader 4 – The MT4 trading platform is the most widely used Forex trading platform and can also be used to trade other instruments like commodities, cryptocurrency, stock index, and stock CFDs. Though it is now showing its age, MT4 is still extremely popular for its auto trading features that enable algorithmic trading and strategy backtesting with expert advisors (trading robots).

MetaTrader 5 – The MT5 trading platform is being adopted by more Forex brokers all the time, it has a more modern interface, allows for an unlimited number of charts to be used, shows Depth of Market and has a built-in Economic Calendar. It also has a larger number of pending order types than MT4 and features an embedded chat system. In addition, the MQL5 scripting language is more efficient than its precursor and MT5 has more advanced charting tools than MT4

Eightcap Mobile Apps

Eightcap’s mobile trading platform support is excellent compared to other brokers.

MT4, MT5, and, recently, the TradingView platforms are available as mobile and tablet downloads on Android and iOS – allowing traders to keep track of their open positions while on the move.

MT4 and MT5

The advantage of using the MetaTrader platform is the cross-device and multi-broker functionality, making it easier to change brokers or use multiple brokers.

Eightcap’s MT4 and MT5 apps allow traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. The functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading further empowers traders while on the move.

TradingView

TradingView is a charting platform and social network used by 50 million traders and investors worldwide to spot opportunities across global markets. TradingView also works with select brokers, allowing traders to trade directly from TradingView’s charting platform.

The TradingView platform offers a fully customisable experience, with 12 chart types, custom time intervals, 100,000+ community-built indicators, integrated financial analysis, and its own programming language, PineScript, allowing traders to share their automated trading strategies.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Eightcap’s offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Eightcap would like you to know that: Margin trading involves a high level of risk and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Eightcap, and seek independent advice if necessary. Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing substantially more than your initial investment).

Overview

Eightcap is an ASIC-regulated market-maker with tight spreads, full support for MT4 and MT5, and two simple accounts. Minimum deposits are low, and deposits and withdrawals are fast and free. Education and analysis are not as strong or as well-structured as Eightcap’s larger competitors, but beginners will find the material available helpful and informative. Eightcap’s simple account structure and transparent approach are very welcome in an industry where many brokers confuse their clients in a storm of options and small print.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Eightcap stacks up against other brokers.