-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On Jul 11, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Go Markets

GO Markets was founded in 2006 and was the first Australian MetaTrader broker. Though it only offers two account options, one with a dealing desk and wider spreads and the other an ECN with tight spreads and commission, both are competitive. Though much of the education section is paywalled for customers only, the content is excellent GO Markets offer full support for MT4 and MT5.

GO Markets really shines with its suite of trading tools including a free VPS service, Autochartist and Trading Central. A technological innovator, GO Markets works hard to keep low-latency trading, reliable customer service and stable platforms at the core of their offering.

| 🏦 Min. Deposit | AUD 200 |

| 🛡️ Regulated By | ASIC, CySEC |

| 💵 Trading Cost | USD 4 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, Bonds, Shares |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Fast and free withdrawals

- Wide range of assets

- Excellent market analysis

- Innovative trading tools

Cons

- High minimum deposit

- No swap-free account option

Is GO Markets Safe?

GO Markets was founded in Melbourne in 2006 and has been regulated by ASIC (license: 254963) since 2004. All funds in client accounts at GO Markets are kept segregated from business funds as is required by ASIC regulation. All client deposits are placed in accounts at National Bank Australia, a top-tier Australian banking institution.

With offices in Melbourne, London, Taipei, and Hong Kong, and customers in over 150 countries GO Markets is a safe and established global broker.

GO Markets for Beginners

GO Markets has a reasonable selection of basic education material, but other ASIC-regulated ECN brokers have better education sections and better-structured courses.

A common theme in the GO Markets education section seems to be that registration is required to unlock the complete set of information.

Education Material

GO Markets publishes downloadable handbooks, a structured Forex course, educational videos, and technical instructional videos to assist with the MetaTrader software.

There are two downloadable handbooks covering Forex trading – one for beginners and the other for more advanced traders. The first book for beginners is a free download and covers basic terminology, chart reading and trader psychology. The advanced eBook requires registration and covers technical analysis and trading strategies.

The handbooks complement a number of videos on trading strategies. A few of the videos are unlocked for public consumption, but the remaining videos require account registration to continue.

A two-part structured Forex course in the form of a webinar is open to the public and only requires that you register your name and email.

The first course covers the Forex market and trade entries and exits. The second webinar covers technical analysis, how to read charts, using technical indicators to understand data, developing a profitable trading plan and advanced order types.

Elsewhere, there are 18 technical MT4/MT5 videos to assist traders with everything from setting up charts and layout on the platform, to placing the first trade on the market.

Analysis Material

GO Markets publishes news and analysis on their website regularly.

These include a daily review at the close of the US markets, a weekly look at the major talking points in the week ahead, frequent blog posts on important financial topics and tips for trading improvement, an interactive economic calendar and a regular podcast featuring guests working in the Forex industry.

All of this analysis and news is available for free, even if you are not a registered customer of GO Markets.

Customer Support

Support is open 24/5 which is in line with the Forex trading week. Contact with GO Markets customer support is available via email, webchat and phone (with local numbers in Australia, China and the United Kingdom)

For technical support GO Markets also have a Quick Support tool which allows their technical support team to remotely access your desktop and fix any issues with your platform/software.

Trading conditions

Apart from Forex, GO Markets also offers trading on Shares, Indices Metals and Commodities – with over 250 tradeable instruments available. GO Markets offers both dealing desk and ECN/STP trading depending on your preference and minimum deposit.

Account Types

Unusually for a broker, accounts can be funded in 9 different currencies (USD, AUD, CAD, CHF, EUR, GBP, HKD, NZD and SGD). GO Markets has two separate live accounts in addition to the demo account.

Both live accounts offer:

- A dedicated account manager

- A free VPS service (with 1 million USD trading volume pcm otherwise 30 AUD pcm)

- 500:1 leverage

- Hedging and scalping allowed,

- MT4 & MT5 platform choices

- EAs available

Standard Account

The standard account has spreads from 1.0 pips and requires a minimum deposit of 200 AUD (or equivalent). The standard account is the dealing desk, commission-free account option, created with the beginner in mind.

GO Plus+ Account

The GO Plus+ account is created with the professional trader in mind and requires a 500 AUD (or equivalent) minimum deposit. While the commissions on the trade are 3 AUD per standard lot per side, the spreads are raw and taken from a deep liquidity pool and can be as tight as 0.0 pips.

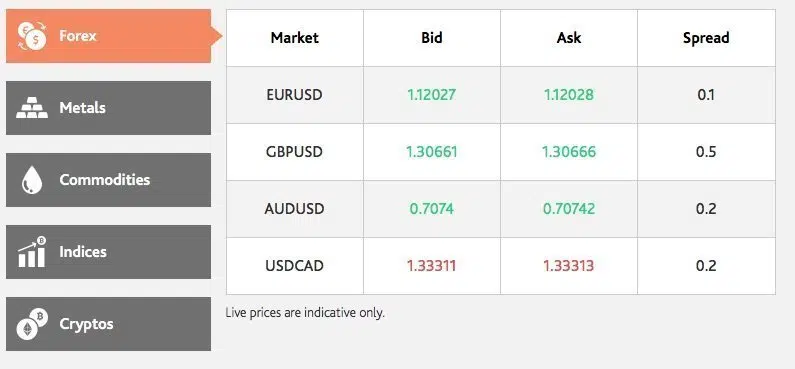

Spreads and Commissions

The spreads vary depending on your account type. Raw spreads are as low as 0.0 pips on the GO Plus+ account, and the Standard account has spreads from 1.0 pips.

A commission of 3 AUD is charged on both sides for all trades on the GO Plus+ account in exchange for tighter spreads.

Deposit & Withdrawal Fees

Deposits can be made with credit cards, BPay, bank-to-bank transfer, and e-wallets like Skrill and Neteller.

GO Markets does not directly charge for deposits or withdrawal, but the funding companies may charge fees. There are no fees charged by GO Markets on deposits made by credit cards and no fees if you are transferring from an AUD bank account in Australia.

Trading Platforms

GO Markets is a MetaTrader broker, supporting both MT4 and MT5, including mobile and tablet applications for your Android or IOS device, and the WebTrader version of the same software.

GO Markets was the first Australian broker to start using the MetaTrader suite of tools, and in 2017 they were recognised as the Best Forex Platform Australia at the FX & Broker Awards hosted by the Global Market Financial Review.

While MetaTrader is the industry favourite because it offers fast execution, advanced charting, expert advisors and VPS options, GO Markets supports an additional add-on called MT4/MT5 Genesis. This add-on installs an extra set of trading tools that enhance specific features that already exist on the platform.

One of our favourite features is an advanced order management system that gives traders the ability to multi-task by keeping the trades active on the screen while doing other tasks. Trading from the terminal view is also possible.

Without the Genesis add-on, the trading alert system is hidden. With the Genesis add-on, trading opportunities are presented in a way that clients are alerted to them, while at the same time making a more complete range of EAs available for more efficient management of automated trading.

Trading Tools

In addition to the trading platforms that GO Markets offers clients, they provide additional trading tools that include Autochartist, Myfxbook and Trading Central. These tools collectively highlight trading opportunities using fundamental and technical analysis and do so in their unique way.

Autochartist is a powerful tool for detecting chart patterns by watching key support and resistance levels. This automated technical analysis simplifies chart analysis for beginners and opens up the opportunity to profit from price action changes for new traders.

Myfxbook is a cross-broker copy trading tool for all levels of traders. This trading tool is similar to using EAs but different in that it is not following an algorithmic pattern and follows other traders instead.

Trading Central is a selection of trading analysis reports, which are prepared by industry analysts, as well as technical analysis that is delivered with the supporting data and the strategy suggested.

A private VPS service for MT4 & MT5 is available to traders. The service fee of A$30 will be charged for the service, but the fee will be waived should the client trade a minimum of 5 lots.

Mobile Trading Apps

GO Markets supports the mobile version of MT4 and MT5. These platforms integrate with the broker in the same way as the desktop versions of the software do, so all trading activity is synced.

GO Markets Risk Statement

According to regulation, brokers are required to be transparent with Forex traders about their the complexity of financial products and also disclose the extent to which traders can lose their money. GO Markets wants you to know: Trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. The effect of leverage is that both gains and losses are magnified. You should only trade if you can afford to carry these risks. Trading Derivatives may not be suitable for all type of investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary.

Conclusion

GO Markets only offers two similar account types, but if you want to use an established, traditional broker, then you could do much worse. It is a no-frills, MetaTrader only broker, but that is deliberate.

With reasonable fees and spreads, along with a strong set of free tools to help clients find trading opportunities, this is a good broker for both new and experienced traders.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Go Markets stacks up against other brokers.