-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On May 10, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on HYCM

HYCM’s parent company has been involved in asset trading for over 40 years and its various subsidiaries are regulated by the FCA, CySEC and the DFIC. Primarily a market-maker broker, HYCM still offers attractive trading conditions, and has a market-execution account for those who prefer commission over wider spreads. Support for both MT4 and MT5 is offered alongside a comprehensive market education suite that will be beneficial for all traders.

HYCM offers its clients an opportunity to trade on more than 300 financial instruments including wide range of currency pairs, commodities, stocks, and cryptocurrencies.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | CySEC, DFSA, BaFin, CIMA |

| 💵 Trading Cost | USD 12 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Wide range of assets

- Good range of accounts

- Fast and free withdrawals

Cons

- Limited currency pairs

Is HYCM Safe?

HYCM’s parent company, Henyep Group, has been in operation for more than 40 years, starting originally as a gold dealer in Hong Kong in 1977. The company branched out into property, capital markets, investments and Forex trading in the 1980s and launched an online trading platform in 2007.

A truly global broker, HYCM is regulated by various highly regarded institutions, including the FCA, CySec and the DFSA:

- Henyep Capital Markets (UK) Limited is authorised and regulated under the Financial Conduct Authority with reference number 186171.

- HYCM (Europe) Ltd is authorized and regulated under the Cyprus Securities and Exchange Commission under license number 259/14.

- HYCM Ltd is authorized and regulated under the Cayman Islands Monetary Authority under reference number 1442313.

- Henyep Capital Markets (DIFC) Limited is authorized and regulated by the Dubai Financial Services Authority with license number 000048.

- HYCM Limited is an International Business Company registered in Saint Vincent and the Grenadines with registration number 25228 (IBC 2018).

HYCM has collected many awards over the years, including Best Mobile Trading Platform 2017 and Best Forex Broker Middle East 2018 (World Finance) and Best Forex Broker Europe 2018 (FXDailyInfo).

With the financial backing of its parent company, worldwide regulation and frequent industry recognition HYCM is regarding as a very safe option for traders.

HYCM Trading Conditions

HYCM is a market maker broker with a good selection of trading accounts at low entry prices. In addition to its two commission-free accounts, a raw account is available offering tighter spreads in exchange for a commission. Overall, trading conditions are good, with a maximum leverage of 200:1 on all accounts and we like the range of choices available for traders.

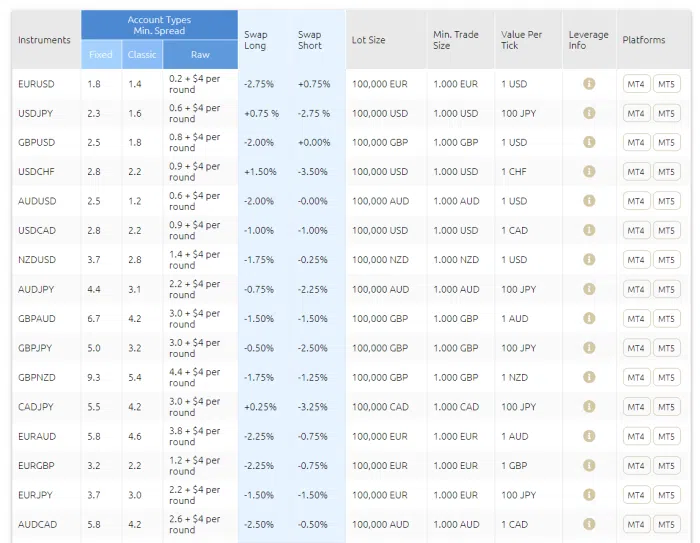

Account Types

HYCM offers two commission-free accounts, the Classic Account and the Fixed Account. Both accounts require a minimum deposit of 100 USD, but the Classic Account has a variable spread while the Fixed Account (as per the name) has fixed spreads. Because of the nature of the Fixed Account, expert advisors are not available. Finally, the Raw Account offers spreads closer to market rates (from 0.2 pips) but charges 4 USD commission per round and requires a minimum deposit of 200 USD. Max leverage on all accounts is 200:1.

VIP Accounts with dedicated account managers, a selection of free tools and tighter spreads are also available but will require a higher minimum deposit.

Spreads and Commission

On the Fixed Account spreads start at 1.8 on the EUR/USD though generally, you will see spreads much wider than that, regularly into the high double-digits on the exotics. On the Classic Account, the spreads will vary depending on volatility, but you will often see spreads of 1.2-1.4 on major pairs.

Spreads on the Raw Account are obviously much tighter obviously – this being a market execution account – but a commission of 4 USD per round is charged.

Spreads on (Fixed) VIP Accounts are advertised as being tighter but are not listed.

Deposits and Withdrawals

Payment methods accepted at HYCM include Mastercard, Visa, Skrill, Webmoney and Wire Transfer. Fortunately, both deposits and withdrawals are free, the only exception being Skrill and Neteller Withdrawals over 5000 USD, which are subject to a 1% charge. In other good news, all deposit and withdrawals (except bank wire) only take an hour to complete.

Considering the charges some brokers for making deposits and withdrawals, and the time they take to complete them, it is very refreshing to see HYCM looking after their customers’ interests so well.

HYCM For Beginners

HYCM takes the time necessary to cater to new traders, with a carefully structured educational section, daily video analysis, a dedicated news-feed with commentary, and 24/5 customer service.

Educational Material

The education section is replete with articles and videos on the various concepts and skills involved in Forex trading; as well as more prosaic topics such as MT4 tutorials. Webinars are also offered every Monday and Tuesday and live seminars seem to be held on a semi-regular basis in Dubai. HYCM hosts an excellent range of cutting-edge educational tools designed to develop trading skills and boost knowledge of the financial markets. All the material offered is free of charge on its website –both the videos and reading material available.

The topics are geared towards helping both beginner and advanced traders and cover Risk Management, Tips for Traders, Trading Tools, Strategies (both simple and advanced) and a good introduction to Capital Markets. A well-structured course for beginner traders is also available.

In addition, HYCM also has a dedicated Help Centre website, this site is fully searchable and not only answers many FAQs, but also has a dedicated education section.

Overall, new traders should find more than enough material to get them started trading here, though more experienced traders may be disappointed by the lack of more advanced topics.

Analysis Material

Though not hugely furnished with analytical material, HYCM does have a news feed, offering brief snippets of the day’s important events, a daily commentary piece offering a brief analysis of some aspect of the market, and a daily market review in video format. We also like the small tool showing the day’s top 10 movers. In terms of its peers, HYCM’s overall analytical offering seems slightly thin, though it will be adequate for most traders.

Customer Service

Customer service is available 24/5 via telephone, email, live chat and a number of messaging services, including:

- Viber

- Skype

- Messenger

- Telegram

HYCM also accepts walk-in visits at its offices in London, Cyprus, Dubai, Kuwait and Hong Kong.

HYCM Trading Platforms

HYCM provides two trading platforms – MetaTrader4 and MetaTrader5.

MetaTrader 4 (MT4) is still the industry standard even though its successor, MetaTrader 5 (MT5), has been available for some time. The advantages of using MT4 are numerous but most centre around the community support and the number of users that the tool boasts.

The primary difference between MT4 and MT5 is that MT4 is a Forex-only platform, while MT5 is a multi-asset trading solution. With MT5, you can trade not only Forex but also stocks, stock indices and precious metals. MT5 also has a built-in news feed and economic calendar, and trades can be made on a chart.

Mobile versions for both MT4 and MT5 are supported and are good choices for those traders using mobile devices to carry out their trades or those who have limited time to trade on their desktop.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the HYCM offer. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

HYCM Risk Statement

According to regulation, brokers are required to be transparent with Forex traders about their the complexity of financial products and also disclose the extent to which traders can lose their money. HYCM wants you to know: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

Conclusion

HYCM is a large, well-regarded and long-established market maker. The fact that HYCM is part of a larger financial services group, with more than 40 years of experience, gives this broker an advantage for its customers and potential clients. Trading conditions are decent without being spectacular and deposit and withdrawals are best in class. Educational material available is comprehensive and well-structured and the offering of both MetaTrader platforms is a real bonus. Overall, HYCM is a quality broker for both new and experienced traders.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how HYCM stacks up against other brokers.