-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On May 10, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Trade.com

Built on the principles of the offering quality education to traders, making information and analysis central to informed decision making, and providing a secure open-access platform to clients, Trade.com opened in 2009 to deliver the best quality service possible in trading.

Regulated by CySEC and the FSCA, Trade.com has committed to a secure system for managing client funds and protecting the brokerage from illegal activity.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | CySEC, FCA, FSCA |

| 💵 Trading Cost | USD 19 |

| ⚖️ Max. Leverage | 300:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, Sirix |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Wide range of assets

Cons

- Limited education

- Wide spreads

Is Trade.com Safe?

Trade.com is a brand of Lead Capital Markets Ltd which has been regulated by CySEC (license 227/14) since 17/02/2014 and authorised by the FSCA (FSP No. 47857) since 05/02/2019.

In the absence of a direct order by a client, Trade.com relies on their best execution policy to execute the trading order in a way that suits the clients’ best interest. This policy incorporates the broker’s directive to have a general duty to act honestly, fairly and professionally.

Trade.com is a market maker broker which means that orders are executed on an over the counter basis and not on a regulated market. This is standard procedure for market maker brokers, and it can open up traders to a conflict of interest with their broker or liquidity provider as they are required to take the counterparty to the trade.

In line with regulation, Trade.com has processes in place to ensure traders get the best execution they can on behalf of their clients, and a conflict of interest policy published for reasons of transparency. With regulation by the major European regulator and the FSCA in South Africa, we consider Trade.com safe, but eagerly await a signal of approval from the industry to secure our belief.

Trade.com for Beginners

With decent 3rd party educational material and a support team that is dedicated to getting traders set up on MetaTrader, Trade.com is a worthy broker to get started, as long as the platforms and account suit your funding requirements.

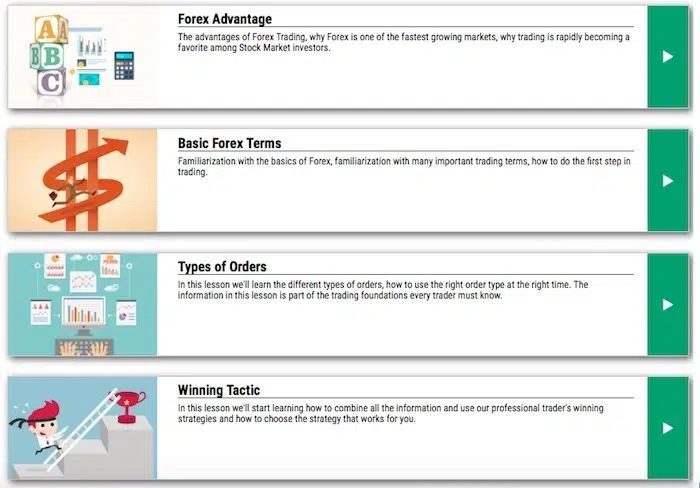

Educational Material

The education section at Trade.com is open to everyone and is broken down into four sections – beginners course, MT4 tutorials, trading tools and trading strategies. These are video tutorials, which are easy to understand and worth watching for any beginner.

The beginner course acts as an introduction to Forex trading including trading basics, what kind of trader are you, and an introduction to strategy.

MT4 tutorials concentrate on the installation and setup of the software and touch on some of the basic features of placing orders and configuring graphs.

Trading tools is a more prominent section that gets into more detail about who to trade. Included is an overview of the trading market, the phycology of trading, risk management and two chapters on basic and advanced technical analysis.

The trading strategies course offer both beginner and more advanced strategies in detail, concluding in a section about semi-automatic trading strategies.

Analysis Material

Trading Central is available for Gold and Platinum account levels, along with the premium market analysis.

Lower deposit accounts will need to survive with a daily market analysis email and a news feed that is aggregated from other news sources.

Customer Support

Support is available via live chat and email from Sunday 22:00 GMT till Friday 22:00 GMT – 24/5. A dealing desk phone number is available for making traders when away from the computer, but this number does not offer any technical support.

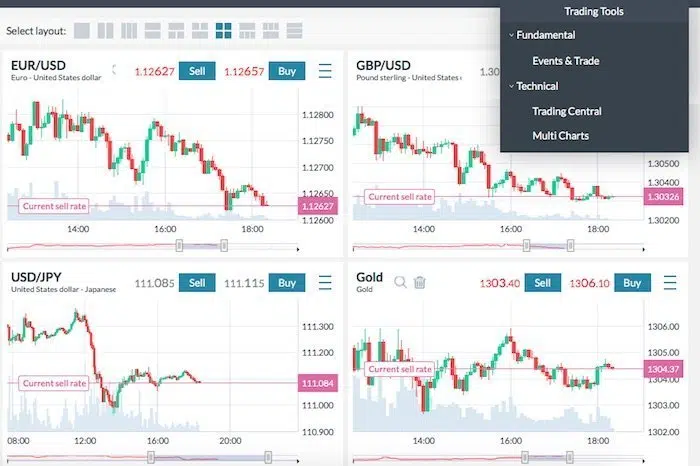

Trading Conditions

Trading conditions are what clients should expect from market maker brokers, where the spreads are wider than their ECN counterparts, but in line with what other market makers offer, but without deposit and withdrawal fees. While numerous accounts are offered, it is only the bigger accounts that get the quality analysis needed for professional trading.

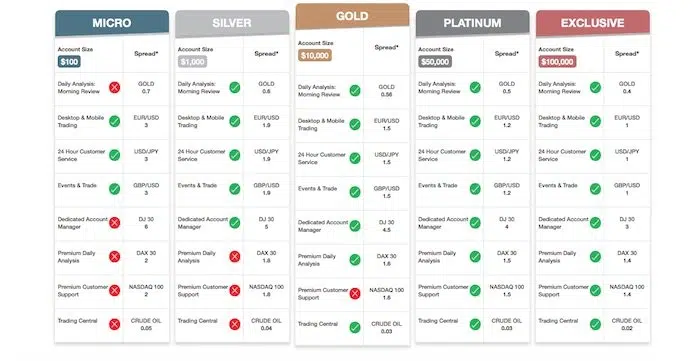

Accounts Types

Four live account options are available in addition to the free demo account. Each of the accounts has an increase in the minimum deposit required, and additional features or analysis

Demo Account

Trade.com also has a free $10,000 demo account. With this account, you will be able to practice before spending real money, access educational videos, experience the dedicated account management, and practice trading on their platform without needing to make a deposit.

Basic Account

The most entry-level of the accounts that Trade.com offers require a minimum deposit of 100 USD. This account has daily morning analysis and video tutorials for beginner traders.

Classic Account

The classic account requires a minimum deposit of 2,500 USD which gives clients daily analysis, a dedicated account manager, video tutorials, and webinars/seminars. This account does not offer Autochrartist software or any premium analysis service, which are included in the larger accounts.

Gold Account

The gold account adds to the classic account with premium daily analysis, trading central and Autochartist. The minimum deposit for this account is 10,000 USD.

Platinum Account

The premium account is the same features as the gold account, but with premium extended customer support and a higher minimum deposit of 50,000 USD.

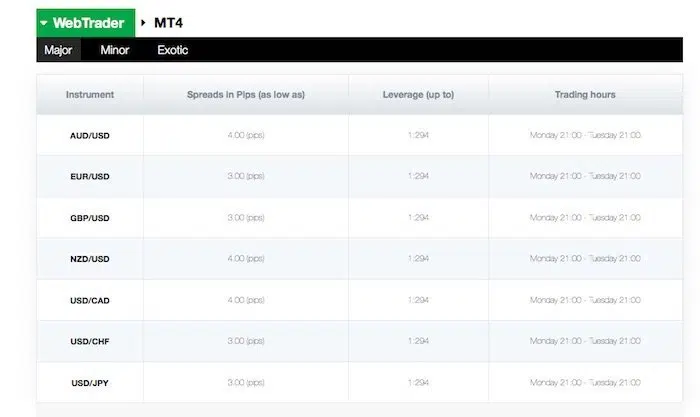

Spreads and Commissions

No commissions are charged on the trades, as is standard for market maker brokers. Instead, all fees are built into the spreads which are the same on the MT4 (downloaded) version and the WebTrader version. Spreads on EURUSD start at 3.0 pips, which are wider than ECN brokers, but similar to other market makers.

Deposit and Withdrawal Fees

The minimum withdrawal amount for all method, excluding bank transfer, is 20 USD, where the minimum is 100 USD. Any request below this amount will have charge of 10 USD for all methods, excluding bank transfer, where a 50 USD will be charged for the wire transfer.

Outside the above restrictions, you will not be charged any deposit/withdrawal fees, as they are all covered by Trade.com.

Inactivity Fee

If there is no trading or funding of an account over 90 days, your account will be considered inactive and will a monthly administrative fee of 25 USD will be charged for the maintenance of the account.

Should the account be inactive after 12 months, an administrative fee of 100 USD per quarter will replace the monthly inactivity fee.

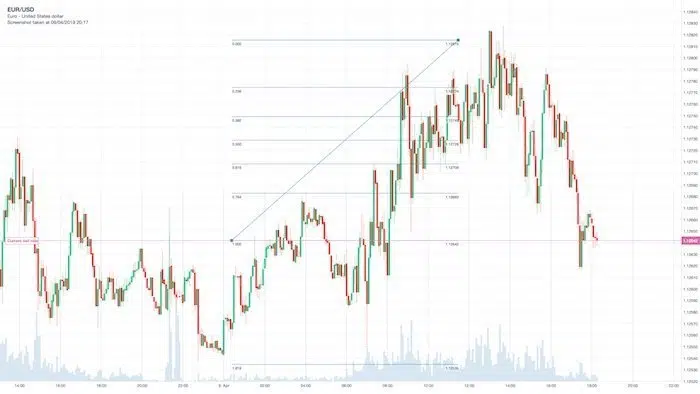

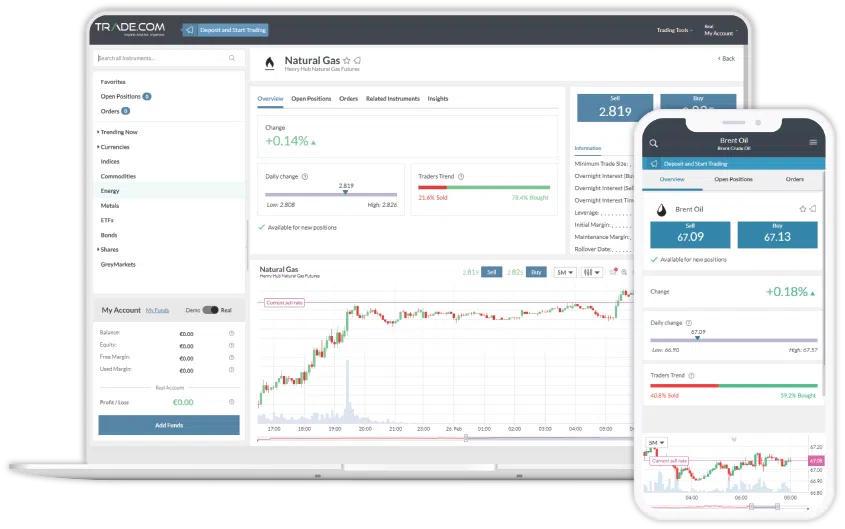

Trade.com Trading Platform

Trade.com offers clients a single choice of trading platform – MetaTrader 4 and the accompanying WebTrader that runs in your web browser. While not the most beginner-friendly software, MT4 has been the industry standard for trading Forex and CFDs since 2005.

Clients at Trade.com have dedicated account managers who can help clients install the software, adjust the settings, and answer questions to get you going. This support is available for all account types including demo accounts.

Mobile Trading Apps

Trade.com supports MetaTrader4 mobile application for Android and IOS, which offers clients seamless integration with MT4 desktop and Web Trader.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Trade.com offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Trade.com Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Trade.com would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70.13% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

Trade.com is a reliable choice for those who are looking for a broker with excellent customer service along with educational resources.

When comparing Forex brokers, more substantial account deposits are exchanged for better trading conditions, that make trades even more profitable. This improving of trading conditions does not happen with Trade.com accounts; which makes it less attractive for professional traders.

Strong broker support for MT4 makes the Trade.com appealing to those who are moving from another MT4 broker, or those who want the assurance of using state-of-the-art software.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Vanessa Marcos

Financial Writer

Vanessa joined the team in 2023. Born and raised in southern Portugal, she has a BA in Journalism and a Master’s in Literary Theory, both from Lisbon University. Since 2011, she has worked in social media, copywriting, content management, ghost-writing, and SEO. Vanessa loves to write, and although she is a generalist in digital marketing, she always draws on her creativity in her work. She is constantly researching new subjects and finds the analytical depth of Forex trading fascinating.

Compare Brokers

Find out how Trade.com stacks up against other brokers.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.