-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On May 10, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on FxPrimus

FXPRIMUS is an STP market maker founded in 2009 and fully regulated in South Africa since 2018. Globally acclaimed for offering one of the fastest and most secure online trading environments, the company has a strong focus on customer satisfaction with free deposits and withdrawals and negative balance protection for all clients.

A multi-asset broker, FXPRIMUS offers multiple tradeable instruments including Forex, Commodities, Energies, Indices on the MT4 platform. Both Standard and ECN account types are available, with spreads starting at 1.5 pips on the standard account and 0.3 pips on the ECN account.

| 🏦 Min. Deposit | USD 15 |

| 🛡️ Regulated By | CySEC, VFSC |

| 💵 Trading Cost | USD 15 |

| ⚖️ Max. Leverage | 1000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, cTrader |

| 💱 Instruments | Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Wide range of assets

- Fast and free withdrawals

- Great customer support

Cons

- High commission

- Limited education

- Limited market analysis

Is FXPRIMUS Safe?

FXPRIMUS was founded in Cyprus in 2009 and obtained an FSCA licence to operate in South Africa in 2018. FXPRIMUS has offices in Cape Town and Johannesburg and South African clients can count on local customer service and support.

FXPRIMUS is the brand name used by:

- Primus Global Ltd, regulated by CySEC, with licence no. 261/14.

- Primus Markets INTL Limited, regulated by VFSC, with registration no. 14595.

- Primus Africa (Pty) Ltd, regulated by FSCA, with licence no. 46675.

All FXPRIMUS clients in South Africa have negative balance protection, so that they can never lose more money than they have in their trading accounts. Furthermore, all client funds are segregated from FXPRIMUS’ operational funds.

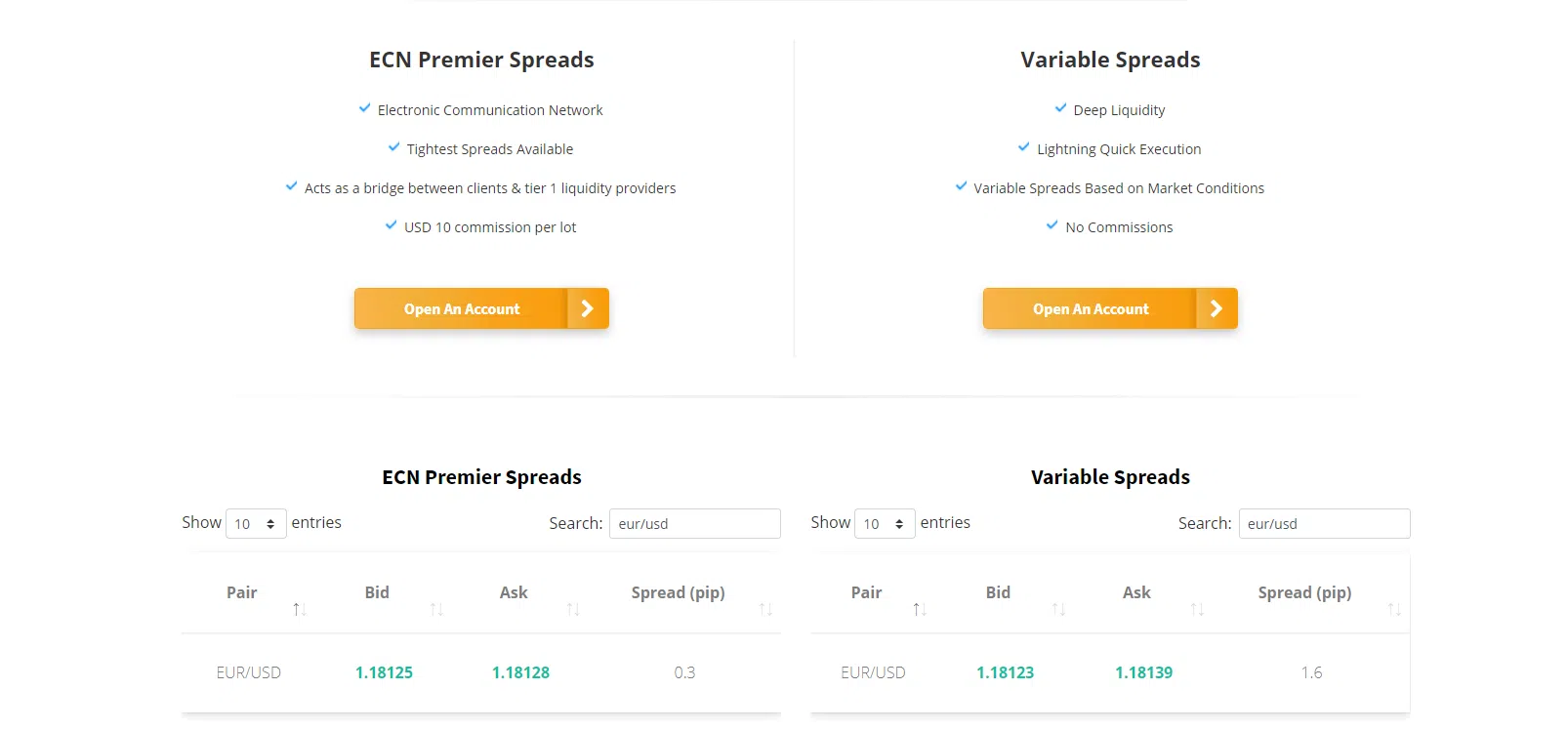

Trading Conditions

FXPRIMUS’ is a market maker but provides STP execution and offers an ECN account for raw spreads direct from liquidity providers. FXPRIMUS maintains a data centre in Cape Town to provide low latency and fast execution on all trades, regardless of the account type.

Account Types

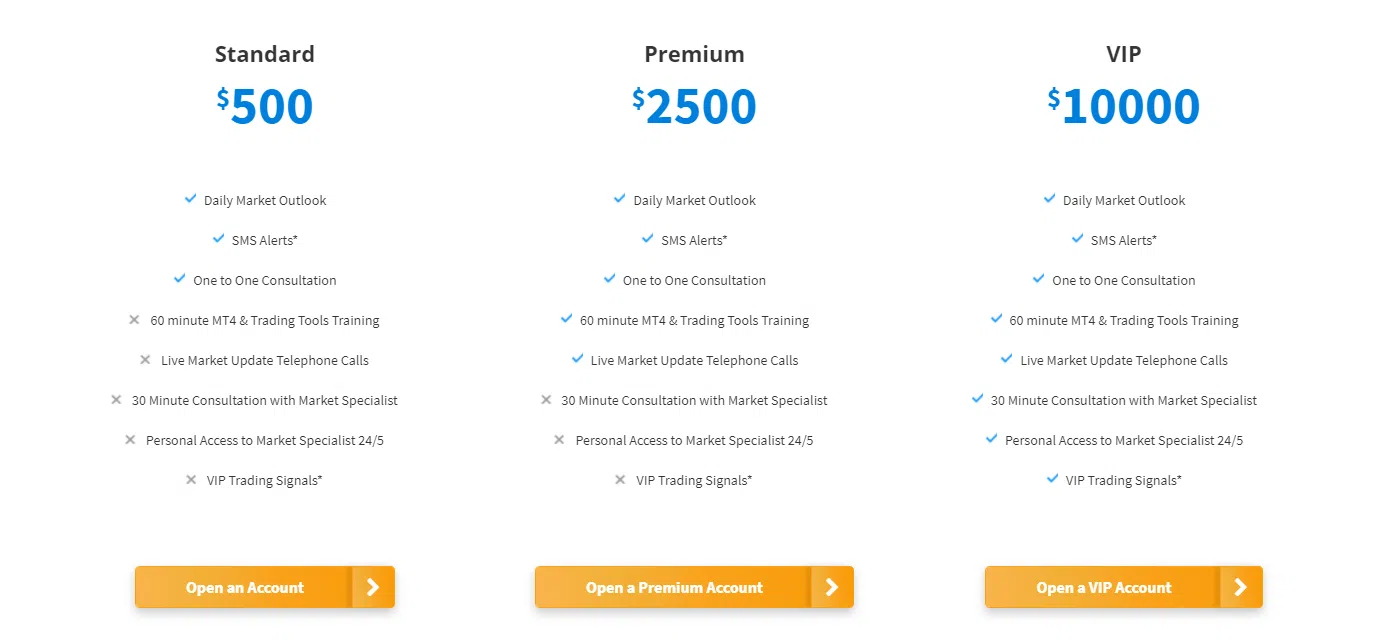

FXPRIMUS offers a demo account alongside a two different live account types, the Variable Account, and the ECN Premium Account. All accounts have three tiers, Standard, Premium and VIP. Though the spreads do not change between these account tiers, each level requires a higher minimum deposit and provides more perks such as one-on-one customer support and VIP trading signals.

Leverage is set at a maximum of 1:1000 for all accounts, though this is on a sliding scale and leverage will decrease with the size of your trade (1:500 for trades over 1000 USD and down to 1:100 for trades over 100,000 USD)

All accounts have USD, EUR, GBP, and SGD as base currency.

Variable Account

- Standard: A minimum deposit of 500 USD (or equivalent) is required for this account and there are few added extras. Expect a Daily Market Outlook, SMS Alerts, and a one-on-one consultation when you open your account.

- Premium: This account requires a minimum deposit of 2500 USD, but account holders will also receive MT4 training as well as live market update telephone calls.

- VIP: The highest tier of account, the minimum deposit here is 10,000 USD. Account holders will have personal access to a market specialist and will also be provided with VIP trading signals.

ECN Premium Account

The ECN Premium Account at FXPRIMUS offers tighter spreads in exchange for a commission per trade. Commission if 5 USD (10 USD round turn) and 4 USD (8 USD round turn) after 250 lots traded per month. Spreads start at 0.3 pips on the EUR/USD and all the perks associated with the account tiers (Standard, Premium and VIP) apply.

Spreads and Commission

Spreads are about average in comparison with FXPRIMUS’ peers. For the Variable Account expect spreads to start at 1.5 pips on the EUR/USD with no commission charged. Spreads on the ECN Premium Account start at 0.3 pips and 5 USD per trade is charged in commission (10 USD round turn).

Deposit and Withdrawal Fees

FXPRIMUS charges no fees on deposits and withdrawals and accepts fund transfers across a variety of methods:

- Banks Transfer: Deposits and withdrawals are free and FXPRIMUS will cover any bank fees charged by its bank. It will not, however, cover any fees charged by your bank or any intermediary banks involved in the fund transfer. South African clients should also be aware that bank transfers can only be made in USD, EUR, SGD, GBP, PLN, or HUF. The minimum deposit and withdrawal amount for bank transfers is 100 USD and processing time in 2-5 business days.

- Credit Cards: FXPRIMUS accepts both Visa and Mastercard and no fees are charged for deposits or withdrawals. The minimum deposit and withdrawal amounts are 100 USD. Deposits can only be made in USD, EUR, SGD, GBP, PLN, and HUF. Processing time for deposits is 5 minutes or less and for and withdrawals will take about 24 hours.

- E-wallets: FXPRIMUS supports withdrawals and deposits from Neteller, Skrill, and ecoPayz wallets. No fees are charged for deposits or withdrawals, but the minimum transfer amount is 100 USD. Deposits and withdrawals can be made in USD. Deposits will take less than 5 minutes, but withdrawals can take up to 24 hours.

FXPRIMUS for Beginners

FXPRIMUS offers little in the way of educational support or market analysis but customer service is excellent.

Educational Material

Education material at FXPRIMUS is split into Educational Videos, Weekly Outlook, Seminars and Expert Guests. Educational videos are only available for clients but the Weekly Outlook is available for all visitors to the site.

Analysis Material

Analysis at FXPRIMUS is published on a blog and via the weekly outlook. Neither are detailed or particularly useful for new traders.

Customer Support

Customer support is excellent, responsive, and available 24/5 via WeChat, Zalo, Line, Telegram, Live Chat, WhatsApp, Facebook Messenger, Email, and telephone. For the purposes of this review, we conducted two support sessions and found that our questions were answered swiftly and accurately by people with a good knowledge of the company.

Trading Platforms

FXPRIMUS only offers support for the MetaTrader 4 (MT4) trading platform. MT4 is one of the most widely used Forex trading platforms and can also be used to trade other instruments like commodities, cryptocurrency, stock index, and stock CFDs. One of the features that make MT4 popular is its auto trading feature that enables algorithmic trading and strategy backtesting with expert advisors (trading robots).

Trading Tools

FXPRIMUS offers several trading tools for the MT4 platform. These include a Market Manager which allows you to keep tabs on the markets without keeping your platform open and a Sentiment Trader, which tracks the bias or direction of traders using FXPRIMUS.

In addition, FXPRIMUS offers a VPS service for clients with an account balance of over 500 USD, the VPS service costs 30 USD per month and provides optimal latency between a traders MT4 account and the FXPRIMUS servers.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the FXPRIMUS offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

FXPRIMUS Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. FXPRIMUS would like you to know that: Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors. Trading in financial instruments may result in losses as well as profits, and your losses can be greater than your initial invested capital. Before undertaking any such transactions, you should ensure that you fully understand the risks involved and seek independent advice if necessary.

Overview

FXPRIMUS are a well-regulated STP broker with both standard and ECN accounts. South African traders will be happy to have a quality broker with a ZAR account option as well as excellent customer service. Though the only platform supported is MT4, there are several useful tools available to supplement the platform, such as a sentiment indicator and a market analysis plugin. Other advantages at FXPRIMUS are free deposits and withdrawals and negative balance protection, both of which really highlight FXPRIMUS’ commitment to their clients.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how FxPrimus stacks up against other brokers.