For over a decade, FxScouts Kenya has been reviewing forex brokers and provided in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Kenyan markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

How did FxScouts choose the best TradingView brokers?

When comparing TradingView brokers, we:

- Ensured that the broker offered trading through the TradingView platform.

- Checked that the brokers offered TradingView’s advanced charting package, trading and analytical tools, and community features.

- Confirmed that the brokers were regulated by top-tier authorities to ensure trader protection.

- Assessed the brokers’ trading fees by opening a live TradingView account and comparing the spreads on each instrument to other brokers.

- Checked the number of tradable instruments available through the broker.

- Investigated the broker’s educational offering, including TradingView platform tutorials.

- Assessed the broker’s market analysis, including whether it is curated by an in-house research team or third-party providers, the quality of the material, and how frequently it’s updated.

Our team of experts analyses each broker according to over 200 metrics, scrutinising them to ensure we only recommend the best in the industry. Here is our review process.

These are the top Forex brokers for 2024 that offer TradingView.

TradingView – The Ultimate Charting Platform for Traders

What is TradingView?

Founded in 2011 by Denis Globa, Constantin Ivanov, and Stan Bokov, TradingView started as a simple charting application with social features that enabled users to interact and learn from each other’s trading strategies. Over the years, it has evolved into a comprehensive trading platform catering to a wide range of financial market participants.

View our full TradingView tutorial here:

What is TradingView used for?

Despite its advanced functionality, TradingView is primarily a platform for charting, analysis, and social networking among traders. It is suitable for all traders, from absolute beginners to experienced investment professionals. It is not a broker and does not directly facilitate trading financial instruments like stocks, forex, or cryptocurrencies. Instead, it provides tools for traders to analyse markets, create and test trading strategies, and share insights with a community of traders.

However, TradingView has integrated with various broker platforms. This means traders can execute trades from TradingView’s interface if they have an account with a supported broker and have linked that account to their TradingView profile.

Here are some critical aspects of TradingView’s evolution and current offerings:

- Powerful Charting Functions: From its beginnings as a charting tool, TradingView has continually enhanced its charting capabilities. It offers powerful, customisable, and user-friendly charting tools, enabling users to analyse market trends precisely.

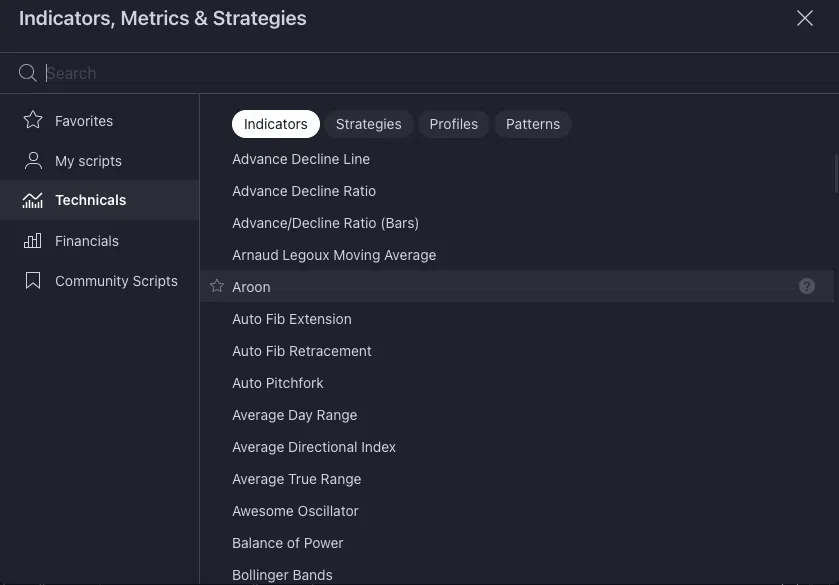

- Comprehensive Range of Analysis Tools: The platform has expanded its toolkit to include various technical analysis instruments, fundamental data overlays, and custom indicator options, making it suitable for both technical and fundamental analysts.

- Community Features: TradingView hosts a large and active community where traders and investors share insights, trading ideas, and strategies. You can see what other active traders are doing, ask questions, gather ideas, collaborate with others in similar markets, and even sign up for trading courses offered by experienced members. This social aspect of TradingView sets it apart from many other platforms, creating an environment of shared learning and collaboration.

- Asset Tracking and Trading: Initially focused on charting, TradingView now enables users to track a wide range of assets, including forex, stocks, cryptocurrencies, and derivatives. The integration with various brokerage platforms means users can analyse and execute trades directly through TradingView.

- Platform Accessibility: Over the years, TradingView has expanded its accessibility. It now has dedicated mobile and desktop applications so users can access TradingView’s features virtually anywhere.

- Custom Alerts: Traders can set up personalised alerts for price movements, news releases, or technical triggers.

- Extensive Indicator Library: Traders can access over 100 pre-built technical indicators or create custom tools.

- Continuous Feature Expansion: TradingView has been adding more features and tools, including social media integrations and a growing list of supported brokers, reflecting its commitment to meeting the evolving needs of its users.

How to use TradingView

- Choose a broker from the list above that integrates with TradingView and open an account with them.

- Connect the broker account to a TradingView account.

- Analyse the markets using TradingView’s tools and advanced charting package.

- To open a trade on TradingView:

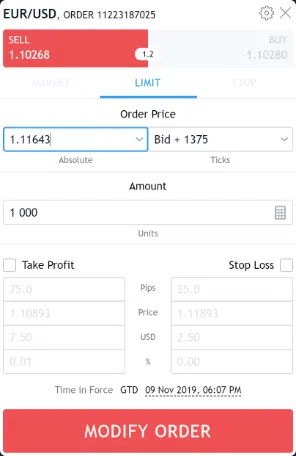

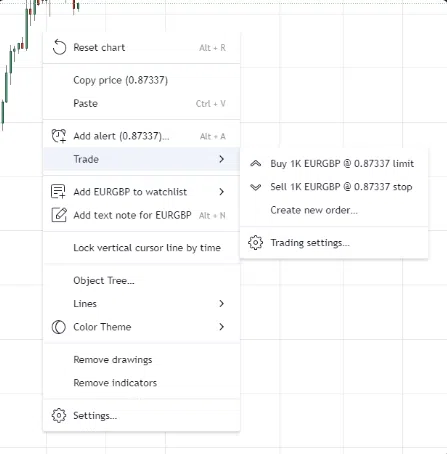

- Under the chart title, you will see red and blue buttons with the sell rate and buy rate, respectively:

- Clicking on one of these two buttons will display a panel with all the options you have before opening your position, including the trade size, whether you would like to open a market or limit order, take profit and stop loss tabs and the levels at which you’d like them set. At the bottom, you will see the tick value and trade value.

- The trade will be executed directly on the platform, which the linked broker will carry out.

- Under the chart title, you will see red and blue buttons with the sell rate and buy rate, respectively:

The actual trading hours and markets available for trading will depend on the broker you choose, the financial instruments they offer (like stock exchanges, forex markets, etc.), and the trading hours of those markets.

How much is TradingView?

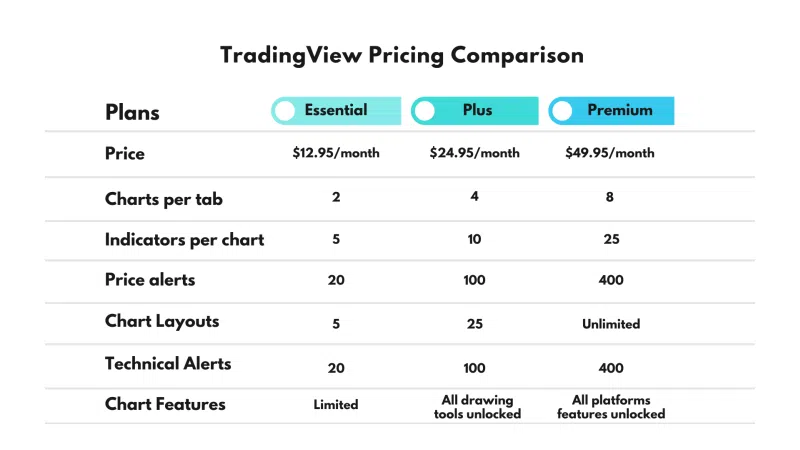

TradingView provides a complimentary basic version and several premium offerings with more advanced functionality and features:

Free Plan: This allows users to start with the essentials, including core charting and analysis tools and access to the community. Most beginner traders will find that TradingView’s Free Plan is more than enough for their needs. However, we find that the Free Plan has some limitations:

- You can only add three indicators per chart

- You can’t add custom timeframes (for example, 8-hour, 6-hour, or 3-day charts)

- There are plenty of ads and annoying pop-ups.

- You only have one server-side alert

- There is limited community access

- You can only access a basic stock screener with three filters.

Premium Plans: These offer numerous advantages not found in the free version, including expanded customisation options, more indicators, additional chart types, and the ability to save multiple chart layouts. The table below provides more detail on each of the plans: From our extensive experience with TradingView, we’ve observed that the free version of TradingView generally suffices for casual users or those not extensively involved in trading. However, for frequent or professional traders, the upgraded versions provide valuable tools and features that enhance the trading experience.

From our extensive experience with TradingView, we’ve observed that the free version of TradingView generally suffices for casual users or those not extensively involved in trading. However, for frequent or professional traders, the upgraded versions provide valuable tools and features that enhance the trading experience.

How to get TradingView’s pro tiers for free

TradingView’s paid plans can cost up to 719.40 USD per year. However, most brokers listed above offer free TradingView Essential, TradingView Plus, or TradingView Premium plans, depending on the trader’s trading volume.

For example, BlackBull Markets offers Tradingview Essential for free if you trade 1 lot per month, which could cost you up to 155.40 USD per year. Pepperstone also offers 12-month TradingView Premium subscriptions based on your trading activity.

How do you paper trade on TradingView?

In our experience, paper trading on TradingView is similar to trading on a demo account on other platforms – it allows you to simulate trading in the financial markets without risking real money. Here’s how to get started with paper trading on TradingView:

- Create or Log In to Your TradingView Account: You need a TradingView account to use the paper trading feature. If you don’t have one, sign up for free on their website. If you have signed up with a broker, you can open a TradingView paper trading account through their portal.

- Access the Trading Panel: Once you have logged in, you will find the trading panel at the bottom of the screen. This panel is where you’ll manage your trades.

- Select the Paper Trading Account: If you haven’t signed up with a broker, you will select ‘Paper Trading’ from the list of available brokers. This will activate the paper trading mode.

- Set Up Your Virtual Account: When you first start paper trading, TradingView provides you with a default virtual account balance (the amount can vary, e.g., $100,000 in virtual funds). You can reset this amount and change the settings, such as leverage, etc., to suit your trading strategy.

- Start Trading: Use the charting tools and analysis features of TradingView to identify trading opportunities. When you’re ready to place a trade, click the ‘Buy’ or ‘Sell’ button on the chart or in the trading panel. Here, you will determine your position size and take-profit and stop-loss levels.

- Manage Your Trades: Monitor open positions, adjust stop-loss and take-profit orders, and close trades as necessary, all within the trading panel.

- Review Your Performance: Regularly check your trading performance. TradingView provides tools to analyse your paper trading history, helping you learn from both successful and unsuccessful trades.

- Experiment and Learn: Use paper trading as a learning tool. Experiment with different strategies, indicators, and asset classes without the risk of real trading.

Remember, while paper trading on TradingView simulates actual market conditions, there are differences in emotion, psychology, and market dynamics when trading with real money. Paper trading is an excellent educational tool, but it’s essential to understand these differences before transitioning to live trading.

What are the main benefits of using TradingView compared to other trading platforms?

- A broad selection of analytical tools: It offers a comprehensive set of technical analysis tools, encompassing many different indicators, drawing instruments, and charting choices, all of which are customisable.

- Tools for fundamental analysis: TradingView provides real-time data feeds and news updates to help traders make well-informed decisions.

- Easy instrument comparison: Traders can effortlessly compare various instruments on a single chart. This function allows users to spot correlations, trends, and patterns among multiple assets, helping them develop more effective trading strategies.

- Community Driven: Traders can benefit from the collective knowledge of a large trading community.

Are there any cons to using TradingView?

While Tradingview has outdone its competitors on many fronts, including its functionality and features, we have found a few drawbacks to using the platform:

- Limited Broker Integration: TradingView does not integrate with many brokers. This limits some users’ ability to execute trades directly from the platform. However, you can choose a broker from the list above, all of which are highly rated.

- Basic Features Require Subscription: Many of TradingView’s more advanced features are not available in the free version. Access to these features requires a paid subscription, which may not be ideal for all traders, especially those just starting out.

- Overwhelming for Beginners: TradingView’s extensive range of tools and data can be overwhelming for beginners. The platform has a steep learning curve, and navigating the myriad features and options can be challenging for new users.

- Reliance on Community Scripts: Many of the indicators and tools available on TradingView are community-generated. While this can be a strength, it also means the quality and reliability of these tools can vary significantly.

- Performance Issues with Complex Analysis: Users conducting complex or data-intensive analyses might experience performance issues, such as slower loading times or lag, especially on less powerful computers.

FAQs

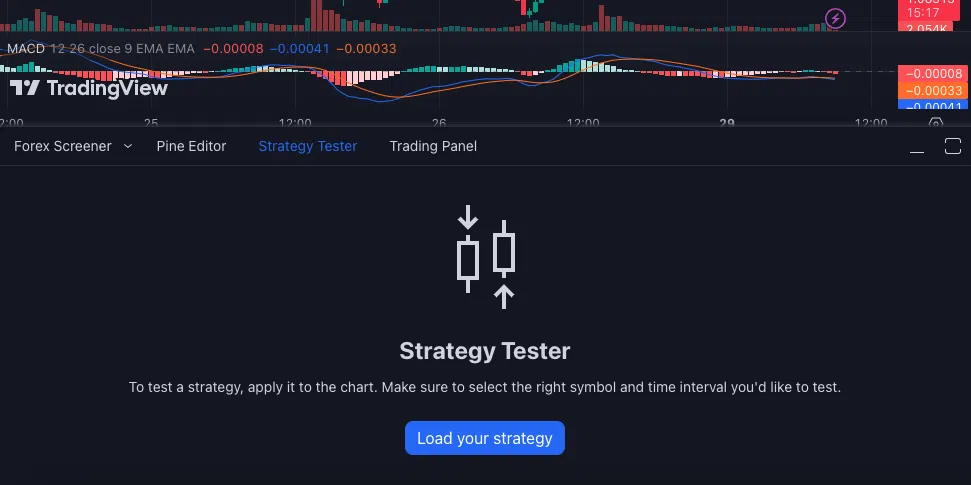

How do you backtest on TradingView?

Backtesting is a way to test if a trading strategy or setup would have made money in the past. A trader needs to backtest a strategy to determine if it’s likely to be profitable and worth the effort.

TradingView offers a very effective backtesting functionality. You can use its Strategy Tester tab to backtest strategies based on indicators.

This tool shows you how the strategy would have worked in the past. You can use the rewind tool to go back in time and look for trades from a year, month or week back. It also gives you a performance summary and details of each trade. There are 23 built-in strategies, and you can also make your own or use others shared by the TradingView community.

Can I access TradingView on mobile devices?

Yes, TradingView is available on both Android and iOS through its mobile app. The mobile TradingView app allows traders to monitor their trades, view charts, and perform analysis while on the go.

Where can I find tutorials and educational resources about using TradingView?

TradingView provides an extensive Help Center on its website, featuring tutorials, guides, and FAQs to help users navigate the platform efficiently. The TradingView community forum and blog also serve as valuable resources for information and perspectives shared by fellow traders.

How do I make TradingView dark?

You can choose whether to have light or dark charts and interfaces. To turn on the dark theme, click on your name at the top left corner of the chart. A drop-down menu will appear. The 5th item down on the menu says, “Dark Mode.” Click on this toggle, and the interface will go dark.

TradingView vs Autochartist

Traders can access TradingView independently of a broker by taking out a subscription. The cost ranges from free to US$59.95 per month. Other charting and analytical tools such as Trading Central and Autochartist can only be accessed via a broker’s platform. However, once you’ve joined the broker, you can then access the services provided by Trading Central and Autochartist for free.

One of the main advantages of TradingView over Autochartist is its ability to execute trades. While Autochartist can highlight a potential trade and give you information about possible changes, it is the trader who has the final say about opening and closing positions. With TradingView, by contrast, you can see the buy/sell button directly on your chart. You can also place limit or stop orders directly from your charts.

The other advantage of TradingView is that you can interact with other traders, follow their ideas or even post your own ideas – an option that is not available on Autochartist.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the UK’s regulator, the FCA, or the Australian regulator, ASIC).

Our Rating & Review Methodology

Our State of the Market Report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.