-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On Oct 9, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Admirals

Founded in 2001, Admirals (formerly Admiral Markets) is renowned for its excellent education, industry leadership and wide range of tradeable instruments. Its industry leadership extends to platform support, where it has teamed up with MetaTrader to create Supreme Editions for MT4 and MT5, adding a range of practical tools to enhance the base platforms.

All Admirals accounts feature market execution, low minimum deposits and competitive spreads – and the company has one of the best cryptocurrency offerings on the market, with 30+ crypto pairs and cross pairs to trade; in addition, Admirals have not just one, but two complete Forex courses for beginners.

A global presence, a progressive approach to knowledge sharing and competitive trading conditions have attracted both beginner and experienced traders to the Admirals brand.

| 🏦 Min. Deposit | USD 25 |

| 🛡️ Regulated By | ASIC, CySEC, FCA, CMA |

| 💵 Trading Cost | USD 8 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, MT Supreme |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Excellent education

- Wide range of assets

Cons

- Expensive withdrawals

Is Admirals Safe?

Admiral Markets Pty Ltd is regulated by ASIC to carry on financial services business in Australia – (ABN 63 151 613 839) under the Australian Financial Services Licence (AFSL – 410681). Admirals keeps account funds in specifically segregated client trust accounts at an Australian Bank (National Australia Bank).

Admiral Markets UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA) – registration number 595450, and Admiral Markets Cyprus Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 201/13.

Admirals have won many industry awards over the years, including Best Forex Platform 2019 (ADVFN International Financial Awards), and Best CFD Broker 2019 (DKI’s 2019 CFD Broker Customer Survey). While awards in recent years have focused on the broad strength of Admirals as a brokerage, they are often recognised for their commitment to trading technology, user experience and customer service.

Trading Conditions

Admirals uses market execution as an ECN with no dealing desk. Raw accounts and commission-free accounts are available with a choice of either MT4 or MT5 platforms.

The maximum leverage on all accounts is 500:1 unless you are restricted because of your country of residence. In the UK, EU and Australia maximum leverage is set at 30:1, though professional clients in those regions can also receive maximum leverage of 500:1.

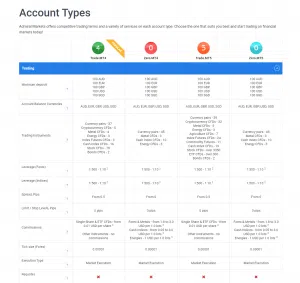

Account Types

Admirals offer one demo account option and four real accounts for Forex and CFD trading, two on the MT4 platform and two on the MT5 platform. An additional MT5 account for share trading is available that we have chosen not to review as it does not apply to CFD traders.

Demo Account – The demo account is a live market experience available for 30 days. Included is a balance of $10,000, offering a real trading experience. Additionally, demo accounts can mirror any of the live accounts offered.

Trade.MT4 Account – The Trade.MT4 account is an STP NDD MetaTrader 4 account – one of two accounts intended for the entry-level trader. It requires a 100 USD minimum deposit and offers traders 37 currency pairs and five cryptocurrency pairs.

Trading of other CFDs is also available including Spot Metal CFDs (4), Spot Energy CFDs (3), Index Futures CFDs (3), Cash Index CFDs (16), Stock CFDs (63) and Bonds CFDs (2).

Spreads start at 0.5 pips and maximum leverage on currency pairs is 1:500. No commission is charged on CFD and Forex trades. EAs (Expert Advisors) are available for automated trading on this account and Trading Central is free of charge to help clients find trading opportunities.

Zero.MT4 Account – The Zero.MT4 account is the ECN MT4 account. It requires a 100 USD minimum deposit and has more favourable trading conditions, replacing the wider spreads with a commission-based model.

Spreads tighten up to 0 pips, and Admirals instead charges a commission of between 1.8-3.0 USD per standard lot traded. This commission level is relatively standard for the industry and comparable with other similar brokers.

This account has 45 currency pairs to trade, which is slightly more than on the Markets account above, but the account does not provide cryptocurrency trading. Other CFD trading offered is Spot Metal CFDs (3), Cash Index CFDs (10), and Spot Energy CFDs (3).

Trade.MT5 Account – The Trade.MT5 account is the second entry-level account for those who would rather trade with the latest, but a less popular, version of the MetaTrader platform. The minimum deposit is 100 USD, and spreads are the same as the Trade.MT4 account as this account is also STP; starting at 0.5 pips and commission-free trading.

The Trade.MT5 account has 40 currency pairs and 32 cryptocurrencies to trade with market execution. This account has significantly more CFDs to trade because of the newer technology on the MT5 platform.

- Spot Metal CFDs – 5

- Spot Energy CFDs – 3

- Spot Agriculture CFDs – 7

- Index Futures CFDs – 3

- Cash Index CFDs – 16

- Stock CFDs – over 3000

- ETF CFDs – over 300

- Bonds CFDs – 2

Zero.MT5 Account – This account behaves much the like Zero.MT4 Account, the only real difference being the trading platform on offer. A minimum deposit of 100 USD is required, and wider spreads are replaced with a commission of 1.8 – 3 USD per standard lot traded, depending on the asset.

Cryptocurrency Trading

The cryptocurrency offering at Admirals is stronger than most of their closest competitors, but if it is cryptocurrency pairs you are interested in trading, you should choose your account type wisely.

Leverage on these pairs is up to 1:10, long and short are both available and spreads are flexible. Expect wide spreads here, but this is standard for these pairs. As of writing 22 cryptocurrency pairs with Fiat currencies are offered and 10 cryptocurrency cross pairs.

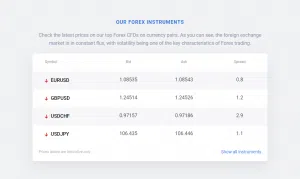

Spreads and Commissions

As Admirals only uses market execution, spreads on all accounts are variable. The Trade.MT4 and Trade.MT5 accounts offer commission-free trading, where the broker takes the administration fee from the wider spreads. Spreads on these accounts start at 0.5 pips.

The Zero.MT4 and Zero.MT5 accounts offer raw spreads and charge a commission of between 1.8 – 3 USD per standard lot traded in exchange for spreads as tight as 0.0 pips.

Deposits and Withdrawals

The balance from deposits by credit card is applied to trading accounts immediately. Wire transfers are also accepted, but this will take 1-3 business days for the balance to show. Both deposit options are without commission, though your bank may have charges for wire transfers. Admirals also offers a range of free and instant deposit options including:

- Skrill

- Neteller

- SafetyPay

- AstroPay

- Trustly

- Bitcoin

- Rapid Transfer

- POLi

Withdrawals are only available via wire transfer, Skrill or Neteller. Wire transfers can take up to 3 business days and two free withdrawals are allowed a month. Skrill and Neteller withdrawals are instantaneous and two free withdrawals are allowed a month.

Admirals reserves the right to charge an inactivity fee of 10 USD per month for an account that is deemed to be inactive. An account is considered inactive should it have a positive balance and no transactions for 24 months.

Admirals for Beginners

Admirals has invested heavily in helping new traders find their feet, offering an extensive library of educational articles, tutorials and webinars. For clients looking for active support, the MetaTrader Supreme Edition provides Trading Central chart analysis and analyst recommendations.

Educational Material

The educational material available through Admirals is extensive and varied. Split into different sections, Admirals offer a structured course, a knowledge base, an overview of risk management and frequent webinars.

Admirals provides a free, structured Forex and CFD trading course called Forex 101 designed to help beginners learn how to trade. It is a collection of nine online lessons split into beginner, intermediate and advanced stages and all lessons are taught by professional traders. The course covers everything from setting up MT4 to managing risk and is an excellent resource for new traders.

The articles and tutorials section covers Forex Basics, Forex Analysis, Forex Strategy, Forex Indicators, Trading Psychology, Trading Software, Automated Trading and Cryptocurrencies. This section is best used as a knowledge base or as an additional resource once the Forex 101 course has been completed. A separate glossary is on hand to help beginners with new terminology.

The risk management section covers best practices, an introduction to leverage and leverage effect, and how rapidly moving markets can create gaps in charts. Risk management tools are available at Admirals, and this section explains their use as well as introducing the stop out and other automated systems that protect traders.

Admirals also provide expert-led webinars. Webinar topics include commentary on the upcoming week or educational webinars like Mastering the 4Ms of Trading which help traders develop trading skills and build confidence.

Analysis Material

The Trader`s Blog, which is open to all clients, provides daily economic news and context or analysis to help traders find new opportunities through insightful and practical market information.

Other articles include a more in-depth analysis of a specific subject. A recent example was Trading the DAX30 with the Open Range Breakout Strategy which taught a detailed step-by-step trading strategy using graphs and data to back up analysis.

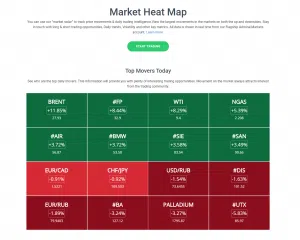

The Market Heat Map is a real-time visual method of following asset price movements and getting daily trading data from the FX and CFD markets. This tool highlights the most volatile assets, and thus presents trading opportunities.

The Market Sentiment tool is a visual interpretation of aggregated data from multiple service providers showing the relationship between open long and short positions. Market sentiment data is useful to help understand macro trends and the mood of the trading collective. This information is especially useful for traders holding positions for long periods and scalpers.

Launched in September 2019, Premium analytics was launched with free access for demo and live accounts. With it, premium data feeds are used to deliver the best information to traders. This video (33 minutes) is a full tour of the product.

The Forex calendar, or economic calendar, is a list of scheduled events that could affect the currency markets.

Customer Support

Customer support is available from 08.00 to 19:00 five days a week via live chat, email, and phone. Drop-in appointments are also available at any of their office locations.

Remote support for technical issues related to MetaTrader or MetaTrader Supreme Edition is also available to clients during opening hours.

Trading Platforms

Admirals clients will be using MetaTrader software, the CFD trading industry-standard platform, they also offer their own customised plugin for MetaTrader. The platforms include:

- MT4 – MetaTrader 4 – the industry standard and most popular Forex and CFD trading platform.

- MT5 – MetaTrader5 – a newer version of the software that offers more features, but is not yet fully adopted as the standard by the industry.

- MetaTrader Webtrader – a version of the MetaTrader software that runs in a web browser.

- MetaTrader Supreme Edition – a customised plugin for MT4 and MT5 that offers many new features, these are discussed below in the Trading Tools section.

- IOS and Android Apps – Use the apps when you are on the go to either monitor trades or take advantage of major news events when you are out and about and want to get a trade open.

Trading Tools

Most of the Trading Tools available through Admirals are included in their own plugin for MetaTrader – the MetaTrader Supreme Edition. This custom plugin was built by MetaQuotes specifically for Admirals and it adds powerful features for both MT4 and MT5, on both live and demo accounts.

Admirals has partnered with Trading Central to have their indicators (Forex Featured Ideas and Technical Insight) built into MetaTrader Supreme Edition. These two high customisable tools provide pattern recognition and technical analysis for almost all financial instruments, providing traders with a real sense of control over their investments.

Also included in the MetaTrader Supreme Edition is the Global Opinion toolset. These tools scan and contextualise millions of financial news stories and social media posts on a daily basis, giving traders a dynamic view of market sentiment. They can drastically reduce the length of time traders need to spend on daily research by flagging-up the best assets to trade and warning of changes in mood that may impact trade success.

Additionally, a new mini-terminal facilitates trade management by making commonly-used trading features more accessible than in the native version of the software. A mini-chart feature also lets traders see multiple time frames and chart types in a single chart.

An additional Trade Terminal feature assists traders with managing multiple orders concurrently, using the same advanced trade management features of the mini-terminal.

Tick Chart Trader allows clients to trade tick charts fast and accurately. An additional Indicator Package with the latest in indicator technology delivers more chart information and trading signals directly in the trading tool.

Finally, a trading simulator is available to backtest strategies on historical price data. Until this feature was conceived, traders were limited to testing strategies with a demo account in real-time. The trading simulator enables traders to test multiple strategies on the same data set, to find the optimal strategy for different market situations.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Admirals offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Admirals Risk Statement

According to regulation, brokers are required to be transparent with Forex traders about the complexity of financial products and also disclose the extent to which traders can lose their money. Admirals wants you to know: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Conclusion

Admirals is a global, modern, and well-regulated broker. With varied platform choices for traders, accounts to keep both newbies and professionals happy and a broad offering of CFDs to trade besides Forex CFDs, Admirals can accommodate for most traders.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Admirals stacks up against other brokers.