-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On Jul 16, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on FBS

FBS is a well-regulated international broker with low costs, including a 5 USD minimum deposit, a single trading account and an easy-to-use mobile trading app. Kenyan traders should be aware the FBS is not regulated by the Kenya CMA, and that they will be onboarded through FBS’ Belize-based entity.

Beginners should also be wary of the high leverage available at FBS. Without proper risk management, high leverage can quickly wipe out smaller accounts, though FBS does offer negative balance protection. Otherwise, FBS provides a welcoming environment for beginner traders, with an excellent selection of educational and market analysis materials and 24/7 customer support.

| 🏦 Min. Deposit | USD 5 |

| 🛡️ Regulated By | CySEC, ASIC, FSC |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 3000:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, MT5, FBS App |

| 💱 Instruments | Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Low minimum deposit

- Excellent education

- Excellent market analysis

Cons

- Limited range of assets

- Extreme leverage

FBS Overall Rating

FBS stands out for its low minimum deposit, comprehensive educational materials, and 24/7 customer support. It offers support for both MT4 and MT5 and its own mobile trading app. It has a good range of assets, including 72 currency pairs and 400+ shares, and it offers high leverage of up to 3000:1, which can pose a significant risk to beginners. FxScouts rates FBS 4.33 out of 5.

Is FBS Safe?

All Kenyan residents trade with FBS’ subsidiary in Belize and will not have local protection from the Kenyan Capital Markets Authority (CMA), but all FBS clients are offered negative balance protection.

No CMA protection: Kenyan traders will trade with FBS Markets Inc., authorised and regulated by the FSC in Belize. This arrangement means that Kenyan funds are not held in Kenyan banks, and disputes cannot be handled locally by the CMA.

Safety Features: The FSC requires brokers to keep client funds in separate accounts and issue monthly statements to their clients, and FBS offers negative balance protection so traders cannot lose more money than they have in their trading account. The FSC does not require FBS to restrict leverage.

Company Details:

![]()

![]()

FBS’ Financial Instruments

The choice of financial assets offered by FBS is limited compared to other similar brokers, but it offers a wider range of cryptocurrencies.

High leverage: FBS offers some of the highest leverage levels available at any broker – up to 3000:1 on Forex pairs. It also only requires a minimum deposit of 5 USD, which, in combination with the high leverage, makes it difficult to hold a substantial trading position without getting stopped out and losing the money in your trading account.

![]()

![]()

- Forex: FBS has only 72 currency pairs available for trading which is higher then the industry average. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics.

- Share CFDs: FBS offers 474 share CFDs, which is an average range compared to other large international brokers. The selection available includes some of the major US, UK, and European Exchanges.

- Indices: There are 11 indices available for trading at FBS.

- Metals: FBS offers trading on 8 metals, which is about average compared to other brokers.

- Energies: FBS offers trading on three energies, which is limited compared to other similar brokers.

- Cryptocurrencies: Cryptocurrency trading is only offered on the FBS App, and FBS offers trading on over 5 pairs, which is limited compared to other brokers.

Overall, the selection of trading instruments available at FBS is about average, but it has a wide range of Forex pairs and a limited range of cryptocurrencies.

Accounts and Trading Fees

FBS has a single trading account and its trading fees are around the industry average.

Trading Fees: FBS is unusual amongst brokers in that it offers a single account type, whereas most brokers will offer two or more. Trading costs are average on the single account and the minimum deposit is low at 5 USD.

See below for more details:

![]()

![]()

Standard Account

The single Standard Account is a commission-free account with a minimum deposit of 5 USD, variable spreads that average at 0.7 pips (EUR/USD), which is about average compared to other similar brokers, and leverage of up to 3000:1.

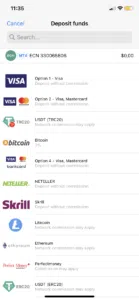

Deposits & Withdrawals

Although we were pleased to find that FBS charges no deposit fees, it charges high withdrawal fees for certain payment methods.

In line with Anti-Money Laundering policies, deposits and withdrawals at FBS cannot be made to/from third-party accounts.

Trading Account Currencies: We were disappointed to find that although deposits can be made in most national currencies, they are subsequently converted into USD and EUR. Because FBS does not support accounts denominated in KSH, Kenyans will have to pay conversion fees on all deposits and withdrawals. Conversion fees can make trading expensive, and affect profitability.

Deposit and Withdrawal Fees: FBS does not charge for making deposits to a live trading account, but it charges fees for withdrawals under certain conditions. Deposits made via electronic payment systems are processed instantly, and deposit requests via other payment systems are processed within 1-2 hours.

See below for a list of FBS payment methods:

- Visa: Deposits are instant and free. Withdrawals take 15 – 20 minutes and may take as long as 5 -7 business days to reach your bank account. Withdrawals are charged at a 1 USD commission.

- Local Bank Transfer : FBS allows deposits and withdrawals from and to banks across Kenya. FBS charges a commission of 2% on deposits and withdrawals, which is expensive considering this fee does not include conversion fees.

- Skrill: Deposits are instant and free. Withdrawals take 15 – 20 minutes to be processed, and a commission of 1% + 0,32 USD is charged.

- Neteller: Deposits are instant and free. Withdrawals can take 15-20 minutes to be processed, and a 2% minimum, and 30 USD maximum commission is charged.

- Sticpay: Deposits are instant, but are charged at a 2.5% + 0.3 USD commission. Withdrawals can take up to 15 – 20 minutes to be processed, and a 2.5% + 0.3 USD commission is charged.

- Perfect Money: Deposits are instant, but commissions may apply depending on the payment system. Withdrawals take 15 – 20 minutes to be processed, and a 0.5% commission is charged.

Overall, while FBS provides a wide range of funding methods and deposits are generally free, withdrawals are expensive, and all currencies are converted into EUR or USD, so most traders will have to pay currency conversion fees.

FBS’ Mobile Trading Apps

FBS offers a wider range of trading platforms than is typically available at other brokers, including its in-house mobile trading app.

FBS App

The new FBS App is an all-in-one mobile trading platform for iOS and Google devices.

FBS App Features: We enjoyed how easy it is to use the FBS App. After registering an account, you will be taken through a tutorial to help you easily navigate the platform. The app also has an intuitive home screen and a sophisticated dashboard that allows you to easily skip between a real or demo account. The app allows you to view educational videos, has an integrated economic calendar, and allows you to contact customer support. Traders can also track real-time stats, open/close/edit positions, add stops to open positions and delete working orders.

|

|  |  |

FBS MT4/MT5 Mobile Trading App

FBS offers support for MT4 and MT5 mobile trading apps for Android and iOS. Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Other Trading Platforms

With both MT4 and MT5 available, FBS’ platform support is average.

MT4 and MT5

The main benefit of using third-party platforms such as MT4 and MT5 is that traders can keep their own customised versions of the platforms should they choose to migrate to another broker. Both MT4 and MT5 are available for Windows, Android, iOS, and web browsers.

Platform Comparison:

![]()

![]()

Opening an Account at FBS

The account opening process is easy, hassle-free, and fast.

It took us about 5 minutes to open an account at FBS, and once we submitted our documentation, our accounts were ready for trading immediately.

As a Kenyan trader, you are eligible to open an account at FBS as long as you meet the following minimum deposit requirements:

- Standard Account: 5 USD

Opening a live account at FBS is easy and fast.

- Initially, you will need to click on “Open Account” and register your name and email address.

- You will be given a temporary password, and a confirmation email will be sent to your registered email address. Open the link in the confirmation email in the same browser as your initial registration.

- Thereafter, you will choose between a Real or a Demo Account, your MetaTrader version, your account currency, and leverage.

- Next, you must fill in your full name, phone number, email address, and date of birth. You must also choose your base currency, platform, and leverage.

- We advise you to read FBS’ risk disclosure, customer agreement, and terms of business before you start trading.

Overall, the account opening process at FBS is hassle-free, and accounts are generally ready for trading in 48 hours.

Trading Tools

FBS’ trading tools are average compared to other similar brokers, and it doesn’t offer technical analysis tools such as Autochartist or Trading Central.

Under its trading tools section, FBS lists an Economic Calendar, a Trading Calculator, and a Currency Converter, which are all fairly standard. It also offers a VPS service for traders with a higher minimum deposit.

VPS

FBS offers a VPS service to traders who deposit more than 450 USD and who trade three lots within the first month of use. Traders who do not trade these volumes will be charged a fee of 33 USD per month to use the service, which is around the industry average.

VPS hosting allows traders to run automated algorithmic strategies, including expert advisors 24 hours a day 7 days a week on a virtual machine. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges.

Overall, FBS offers an average number of trading tools compared to other large international brokers.

Trading Tools Comparison:

![]()

![]()

FBS for Beginners

FBS is one of the better brokers for beginners – the education section is comprehensive and well-structured, and the market analysis is up-to-date and well-explained. Unusually, customer service is available 24/7 – a welcome development, where the norm is 24/5. This is extremely beneficial for beginner traders who will likely set up trading accounts on weekends.

Educational Material

FBS offers a good selection of educational materials compared to most other brokers, and it is suitable for both beginners and more experienced traders alike.

The education section at FBS is well-structured and well-organized, and all material is free. Education is split into five sections:

- FBS Academy – the core of the education section, this is one of the better guides to Forex trading we have seen. It is split into chapters for Beginner and Advanced traders. This guidebook will be helpful in some form for almost all readers.

- Traders Blog – a frequently updated blog with useful posts covering various aspects of trading in an erudite and informal format. Recent blog posts include Top 5 Types of Doji Candlestick Patterns and ESG Investing.

- Webinars – includes a schedule and register of upcoming webinars. FBS partners hold webinars weekly from its offices around the world, and registration is a simple procedure.

- Video Tutorials – as you would expect, this is a collection of short videos covering various aspects of Forex trading – good for those who prefer watching to reading, but not as comprehensive as the Academy

Overall, the education section at FBS is more comprehensive than other brokers.

Education Comparison:

![]()

![]()

Analytical Material

FBS’ market research is average compared to most other large international brokers.

The FBS Market Analysis is broken down into technical analysis and fundamental analysis. The technical analysis is somewhat limited, but the fundamental analysis is more detailed and offers Forex traders basic coverage of key topics.

Market analysis materials at FBS are free of charge for all visitors, and are divided into three separate sections:

- Forex News – A regular news feed of the day’s important events that will have fundamental effects on Forex trades. It is concise, updated frequently, and well written.

- Daily Market Analysis – Here you will find short analytical articles on the day’s events, which is very useful for new traders.

- FBS Analytics channel on Telegram – FBS daily shares educational insights on strategies and risk management and accurate trade ideas, runs live trading sessions, daily market news updates, and runs Q&A with analysts.

Overall, FBS offers a range of market analysis materials that are useful for traders of all experience levels.

Customer Service

Available 24/7, FBS’ customer support is better than that offered by other brokers.

Customer service is available in multiple languages, 24/7 – exceptional for an industry where the standard is 24/5. Support is available by email, live chat, and social media in 9 different languages, including English, Spanish, Portuguese, Indonesian Bahasa, Malay Bahasa, Thai, Swahili, Filipino and Tagalog.

We found the customer service responsive, polite, and resourceful. They were able to answer all our questions quickly and to our satisfaction.

Safety and Industry Recognition

Regulation: The FBS CFD trading platform was founded in 2009 by investors who were interested in trading research and technical analysis. Today, FBS is an international brand present in over 150 countries with over 27 million traders on its books. The brand unites several companies offering trading on Forex and CFDs. The companies include FBS Markets Inc. (licensed by the Belize FSC), Tradestone Ltd. (licensed by CySEC), and Intelligent Financial Markets Pty Ltd. (licensed by ASIC). See below for more details:

- Intelligent Financial Markets Pty Ltd is regulated by ASIC, license number: 426359.

- FBS Markets Inc is regulated by FSC, license 000102/124; Address: 2118, Guava Street, Belize Belama Phase 1, Belize.

- Tradestone Ltd. is authorised and regulated by the Cyprus Securities and Exchange Commission of the Republic of Cyprus, with company registration number 353534.

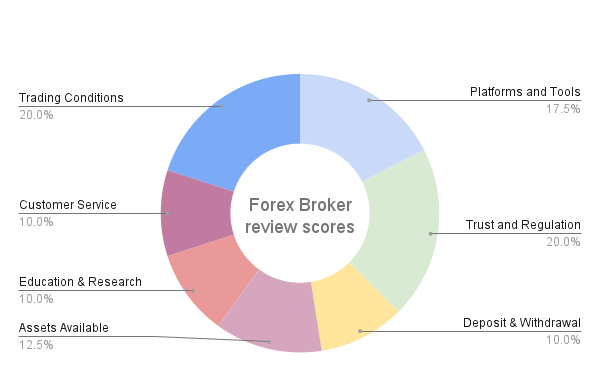

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

FBS Disclaimer

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. FBS would like you to know that: CFD’s are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.21% of retail accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFD’s work and whether you can afford to take the high risk of losing your money.

Overview

FBS is a large online international broker with a single trading account, low costs and excellent education and customer support. It offers low minimum deposits and micro-lot trading. However, FBS only offers accounts denominated in USD and EUR.

FBS offers support for MT4 and MT5 in addition to its proprietary trading app and offers a VPS service for traders who deposit more than 450 USD. Exceptionally FBS’ customer support is available 24/7.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how FBS stacks up against other brokers.