-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FCA, ASIC, IIROC |

| 💵 Trading Cost | USD 20 |

| ⚖️ Max. Leverage | 100:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Energies, Stock CFDs, ETFs, Forex, Indices, Metals |

Last Updated On Oct 9, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Fortrade

Founded in 2013, ForTrade is an FCA, ASIC, CySEC, IIROC and NBRB regulated brokerage, which operates internationally from its headquarters in London. Fortrade offers a single live account with a recommended minimum initial deposit of 500 USD, though accounts can be opened with as a little as 100 USD. No commission is charged on trades and ForTrade offers maximum leverage of 1:100 on FX pairs. Its trading platforms include MT4 and an in-house proprietary platform.

ForTrade offers two trading accounts: a standard and demo account, which never expires. Fortrade’s educational materials are comprehensive and provide support for beginner and advanced traders alike, and in-house market analysis of the EU and US sessions is provided frequently. Lastly, Fortrade provides responsive customer service and support via email and live chats.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FCA, ASIC, IIROC |

| 💵 Trading Cost | USD 20 |

| ⚖️ Max. Leverage | 100:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Energies, Stock CFDs, ETFs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Good for beginners

- Great platform choice

- Well regulated

- Wide range of assets

Cons

- Wide spreads

Is ForTrade Safe?

ForTrade is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Investment Industry Regulatory Organization of Canada (IIROC) and was included by the National Bank of the Republic of Belarus (NBRB) on the Register of Forex companies in 2018. Being a well-regulated broker, ForTrade will not manipulate market prices. See the following list of ForTrade Group registered companies:

- Fortrade Ltd. is regulated by the FCA under registration number FRN:609970

- Fort Securities Australia PTY LTD (T/A Fortrade Australia) is licensed and regulated by the ASIC under registration number AFSL number: 493520.

- Fortrade Cyprus Ltd is regulated by the Securities and Exchange Commission (CySEC) under company registration number 392231.

- Fortrade Canada Limited is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) under BC1148613.

- Fort Securities Belarus is authorized and regulated in Belarus by the NBRB, FRN: 193075810.

In addition to being well-regulated, ForTrade deposits all client funds in segregated bank accounts and uses tier-1 banks (the safest and most secure) for this purpose. ForTrade also offers negative balance protection, which means that clients can lose all, but not more than the balance of their Trading Account.

ForTrade’s Trading Conditions

Fortrade is a market maker with two account types, a Standard Account which requires a minimum deposit of 100 USD, the industry-standard, and a Demo Account with a virtual currency balance of 10,000 USD. Demo accounts do not expire. Leverage on the standard account is up to 1:100 on forex currency pairs, which is lower than that offered by other similar brokers. A swap-free Islamic account is available for all clients that wish to have one.

ForTrade does offer ECN-style spreads, however, this must be requested through a representative at the brokerage. Traders can choose between USD, GBP or EUR as an account/base currency. Deposits made in other currencies will be converted.

Fortrade also offers a wide variety of trading instruments, including more than 50 currencies, almost 250 CFDs, dozens of indices and commodities.

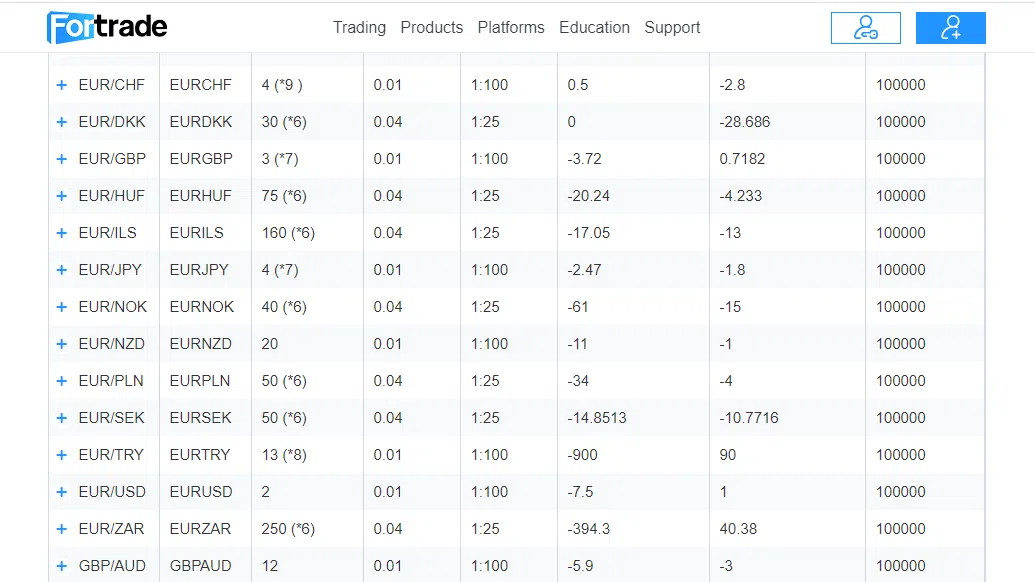

Spreads and commissions

Fortrade does not charge a commission on its standard account, but spreads are variable and wider than many of Fortrade’s peers’. Spreads start from 2 pips on popular currency pairs such as the EUR/USD.

Currency pairs have a different night spread from 20:55 to 21:25 GMT, and currency pairs have variable evening spreads from 16:00 to 19:30 GMT; from 19:30 to 03:00; and from 03:00 to 06:00 GMT.

Deposits and withdrawals

Due to Anti-Money Laundering regulations, ForTrade only remits funds back to source – the amount that was deposited using said bank card can only be withdrawn to that same card, and only for the amount deposited. Likewise, if funds were deposited via wire transfer, funds must be withdrawn back to the same bank account. The following methods can be used for deposits and withdrawals:

- Visa/Mastercard: Email Fortrade a copy of your deposit receipt to fund and activate your trading account. Withdrawals may take up to fifteen (15) business days (not as quick as other brokers). In some cases, withdrawals of funds deposited by credit or debit card are limited by the card issuer, and cannot exceed the original amount deposited.

- Bank Wire Transfer: Deposits are free, and estimated transaction time is five (5) business days. Withdrawals may take up to seven (7) business days to reach your account. Most International Wire Transfers and TTs are approximately 40 USD.

- Neteller: Deposits need to be approved by emailing a copy of the deposit receipt to the broker. Withdrawals can take 2 – 6 hours to be processed.

- Skrill: Email Fortrade a copy of your deposit receipt to fund and activate your trading account. Withdrawal requests must be made via email with the Skrill Account ID.

Withdrawals can be made from within the client area by filling out the online withdrawal form. Requests are processed within 2 days of being submitted.

Please note that if you request a withdrawal with a value higher than your Free Margin, you will be notified of the maximum amount you can withdraw based on your current Free Margin calculation. Free Margin is the amount calculated from the value of the equity of the account less the used margin of open positions. This is a dynamic calculation that changes with the changing values of the open positions.

Lastly, all account dormancy fees are charged for inactive accounts after a 6 month period (the fee is either 10 USD, 10 EUR or 10 GBP per month depending on account currency).

Bonus Structure

Fortrade offers discretionary Deposit and Credit Bonuses for new clients. Potential clients should get in touch with Fortrade customer service for more information.

ForTrade for Beginners

ForTrade is a good broker for beginners and has an excellent repository of educational material, up-to-date market analysis, online trading seminars and trading courses. Their demo accounts do not expire and allow one to practice trading risk-free with virtual money. The responsive international customer service team is available 24-hours a day, 5 days a week for all client account and technical questions.

Educational Material

ForTrade’s educational content is presented in downloadable PDF and video formats. Their core educational offerings are divided into beginner and advanced trading courses. You do not need to register a ForTrade account to access this material.

ForTrade also has an extensive library of other educational videos and materials which have been translated into over 14 languages. They provide training webinars covering forex terminology, strategies and recent trading events.

Analysis Material

ForTrade’s research and analysis section provides an up-to-date morning and evening market preview, a weekly analysis and a microanalysis. Daily stories are related to future market movements. Other sections include an economic calendar for planning and historical overviews which assist clients in identifying trading opportunities.

Customer Support

The responsive customer support team at ForTrade is available 24/5 via telephone, live chat and email, but, as with all regulated brokers, cannot offer investment advice.

Trading Platforms

ForTrade offers traders the industry-standard MT4 platform in addition to its own proprietary ForTrade platforms which are optimized for desktop or mobile use. These allow immediate and accurate access to international financial markets and deliver feature-rich, user-friendly interfaces designed to fulfill all trading needs and boost trading performance. ForTrade supports mobile versions of all MT4 and ForTrade platforms, and customer service is available 24/5 to answer questions about the software and help with setting it up.

MetaTrader 4

Whether you are a novice or a seasoned trader, the MetaTrader 4 (MT4) platform is an award-winning favourite. The platform hosts a selection of features that provide a powerful trading experience to suit a variety of strategies.

Users benefit from 30 built-in technical indicators and 24 graphical objects, plus nine timeframes and three charting types. Automated trading is available through Expert Advisors (EAs) along with multiple order types and one-click trading. MT4 also provides access to full trading histories.

Web Fortrader

Fortrade offers its own proprietary platform – Fortrader Webtrader, accessible from any PC with an internet connection. The platform delivers real-time data with high speed and precision. The One-Stop-Shop function allows traders to track, analyse, and trade using a cross-device platform, saving time and hassle.

Mobile Fortrader

Mobile Fortrader allows you to stay connected and manage your account from anywhere, any time. Easily turn your Android or iOS device into a virtual trading desk. It affords you to make smart and successful trading decisions from the palm of your hand.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the ForTrade Group offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

ForTrade’s Risk Statement

ForTrade warns its clients that when performing transactions in the OTC Forex market, the possibility of making a profit is inextricably linked with the risk of losses. Conducting transactions can lead to the loss of part or all of the initial investment. Before commencing operations, they urge you to make sure you understand the risks involved and have sufficient skills to invest.

Furthermore, the information on ForTrade’s site is not directed at residents of the United States or Belgium and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Overview

ForTrade is a serious market maker broker that is well-regulated by multiple top-tier authorities. It offers both the industry-standard MT4 platform alongside its own proprietary ForTrader platform. ForTrade does not charge commission, but its spreads are wide compared to other brokers.

An open approach to education is a part of ForTrade’s marketing strategy and traders can access this material before opening an account. The demo account never expires and customer support is responsive, which is a real benefit for beginners with many questions.

Overall, ForTrade is a dependable choice for beginners looking for a traditional broker. Expect consistent trading conditions, excellent support, up-to-date market analysis and education from ForTrade, but be aware of the wide spreads.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Fortrade stacks up against other brokers.