Introduction

Over the last two decades, the explosion of online Forex (FX) and contract for difference (CFD) trading has attracted millions of traders with its low cost of entry, high leverage, convenient mobile access, and tempting bonuses and promotions. According to the Bank for International Settlements, “trading in OTC FX markets reached $7.5 trillion per day in April 2022,” making it the largest financial market in the world. But in the 2000s, when online Forex trading was in its infancy, regulators had only just started to take an interest in how Forex brokers operated.

After the subprime mortgage crisis of 2007 and the great recession that followed, financial regulators in Europe and North America decided to more closely monitor and regulate complex financial products. While most of their focus was on mortgage-backed securities (MBOs) and collateralised debt obligations (CDOs), which lay at the heart of the crisis, online CFD trading was also included in their review.

Regulators quickly realised that many retail CFD traders, i.e. non-professional traders with little financial education, were losing more money than they could afford and that Forex and CFD brokers were engaged in various unethical practices that contributed to these losses. An important aspect of a financial regulator’s duties is consumer protection, so regulators enhanced their monitoring of Forex and CFD brokers and quickly sought to put safeguards in place to protect consumers.

These efforts to protect traders first bore fruit in 2018 when the European Securities and Markets Authority (ESMA) passed a law requiring all EU financial regulators to set restrictions on Forex and CFD trading. These included:

- leverage limits (maximum of 30:1 for Forex)

- a margin close-out rule (50% of the amount of initial margin required)

- negative balance protection for all non-professional traders

- a complete ban on bonuses and other incentives

- a requirement for all brokers to display a risk warning detailing the percentage of traders who lose money

EU regulations already prohibited brokers from commingling client and company funds and banned non-EU-regulated brokers from advertising their services to EU residents. With the additions of the new restrictions, losses made by retail traders began to fall – along with the profits made by EU-regulated brokers.

ESMA’s restrictions on Forex and CFD trading are now seen as the gold standard of regulation worldwide, and many regulators have followed their lead – implementing some or all of the restrictions. In 2021, the Australian Securities and Investment Commission (ASIC) implemented the same regulations, except for the risk warning requirement. Likewise, in 2021, the Securities Commission of the Bahamas (SCB) instituted almost all of the same restrictions, though it limited maximum leverage to 200:1. In some cases, regulators have gone even further, with the FCA in the UK recently banning the sale of cryptocurrency CFDs for retail traders in addition to all other ESMA restrictions.

Why is regulation important in Forex trading?

Forex and CFD transactions occur over-the-counter (OTC) with no central exchange monitoring trades, unlike stock markets. This makes it very difficult for national regulators to monitor Forex brokers and protect consumers. If a Forex broker is not located in the same country as the regulator, the regulator has no authority over the broker’s products or behaviour.

As a result, brokers based in “offshore” localities (such as the British Virgin Islands, the Marshall Islands or Vanuatu) with weak, or completely absent, regulation can engage in scams, charge exorbitant fees, commingle client and company funds, expose clients to extreme leverage, and engage in other unethical practices.

For this reason, it’s not only the quality of a broker’s regulator that a trader should be aware of, but also the regulator’s location.

It is usually, though not always, preferable to trade with a broker regulated by the financial authority of your country of residence. This means that if you have a dispute with your broker, you can complain to your regulator, and they will intervene – or at least pass your case on to the financial ombudsman for arbitration.

Unfortunately, some national regulators – like the Central Bank of Nigeria or the CVM in Brazil – do not regulate Forex or CFD trading at all, or they lack the power to enforce regulations. In this case, it is better to trade with a broker regulated by a good overseas regulatory authority. At least this way, you will be safe knowing that you will not be scammed or fall victim to unethical business practices, though you will not have local protection.

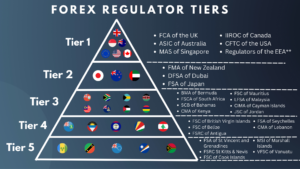

Regulation Quality: Our Tier System

Below is a depiction of the various regulators and their jurisdictions. Regulators at the top of the triangle are the world’s top regulators, while those at the bottom provide virtually no regulatory oversight.

**Regulators of the EEA in alphabetical order:

How we determine the regulatory tiers

We consider numerous factors when deciding which tier a regulator belongs to.

Rules and Regulations: These are the legal obligations regulators place on brokers and other financial services companies. For example, all regulators require brokers to segregate their operating capital from their clients’ trading funds to prevent client losses in the event of broker bankruptcy. Tier 1 regulators, like the FCA or CySEC (of Cyprus in the EU), also require brokers to limit the leverage they offer and provide all their clients with negative balance protection. Most regulators in Tier 2 and below have more relaxed leverage limits or do not require negative balance protection. Those in Tier 4 and below either have very few rules for brokers or none at all. The organisations in Tier 5 are not regulators at all, they allow any financial company to register within their jurisdiction but do not provide any oversight or management.

Enforcement: How well a regulator enforces rules and regulations is equally important. There is no point in regulators requiring brokers to treat traders fairly if they don’t follow up on complaints, conduct audits and carry out surprise on-site visits. This is where some regulators struggle. Most of the Tier 3 and 4 regulators are well-intentioned but fail to enforce their rules consistently. All Tier 1 regulators are proactive, strict and ruthless when enforcing regulations.

Consumer Protection: A central pillar for all regulators is protecting consumers. This includes education and outreach, working closely with brokers to ensure that an appropriate level of due diligence is carried out on clients, passing on valid complaints to the financial ombudsman for arbitration, and taking rule-breakers to court and removing their licences to operate.

Notable Regulators and their Forex Trading Regulations

Because one of the most important criteria for traders when choosing a Forex broker is its regulatory status and under which authority it is regulated, we have curated a list of the major regulatory bodies by country and summarised the rules applicable to Forex brokers in that region. We will start with the Kenyan regulator, Capital Markets Authority (CMA).

Captial Markets Authority (CMA)

Trading with a CMA-regulated Forex broker is an advantage for Kenyan traders. CMA-regulated brokers must have a physical office in Kenya, ensuring that Kenyan laws govern disputes. If your CMA-regulated broker goes bankrupt, you can walk into any branch of your broker’s local bank and remove all your funds from your segregated account – this is not so easy if your money is in a foreign bank account. Local bank accounts also mean bank transfers between Kenyan clients and brokers are faster and cheaper.

However, while it has improved remarkably in recent years, the Kenyan CMA is still a weaker regulator than those of Europe, the UK, and Australia – especially regarding proactive investigation and enforcement. Forex brokers that are regulated by the CMA, as well as another strong regulator, tend to be safer and more reliable.

Checking if the CMA regulates a Forex broker is easy. All CMA-regulated brokers must hold a CMA licence. Traders can check the list of CMA-regulated brokers here.

UK Financial Conduct Authority (FCA)

A tier-1 regulator, the UK’s Financial Conduct Authority is one of the world’s best financial regulators and has a reputation for guaranteeing trader security. It has more restrictions than regulators in lower tiers and enforces its rules efficiently.

All FCA-regulated brokers must segregate client funds, provide negative balance protection, process withdrawals instantaneously, and provide compensation of up to 50,000 GBP to protect traders against broker-related matters. It also restricts leverage to 30:1 and bans Forex brokers from offering bonuses and promotions.

It’s no surprise that their search function is the easiest to use and the most thorough; you can access it here: https://register.fca.org.uk/s/.

Like other major regulators, all brokers with an FCA licence must publish their FCA reference number on their website.

Watch this video for more information on how to check if your broker is FCA-regulated:

Australian Securities and Investment Commission (ASIC)

Also a tier-1 authority, the Australian financial regulator has an excellent global reputation and closely monitors brokers to reduce fraud and manipulation. Many of the most respected Forex brokers worldwide are Australian, and having an ASIC licence automatically signifies that the broker is trustworthy.

ASIC has a reputation for guaranteeing trader security and dealing harshly with bad brokers, but in March 2021, ASIC deployed an even stricter regulatory environment, including restricting leverage to 30:1, banning bonuses and promotions, and ensuring that traders are granted automatic negative balance protection.

Checking a broker’s regulatory status with ASIC is similar to the South African FSCA’s; the ASIC search tool can be found here: https://connectonline.asic.gov.au/.

Cyprus Securities and Exchange Commission (CySEC)

CySEC is the foremost regulator in the EU, and Cyprus has a long history of regulating online Forex brokers. As a European regulator, all brokers with a CySEC licence must abide by the EU’s MiFID II legislation. Among other things, this requires limits on leverage, automatic negative balance protection, and a ban on trading bonuses.

CySEC’s broker search tool functions much like the FCA’s, and all CySEC licenced brokers must publish their licence number on their website. CySEC’s database and search tool can be found here: https://www.cysec.gov.cy/en-GB/entities/investment-firms/cypriot/

Although CySEC is the most prevalent regulator in the EEA, all other European regulators, such as the Finansinspektionen (FI) of Sweden and the Bundesbank and the Federal Financial Supervisory Authority (BaFin) of Germany, are also required to follow the MiFID legislation and are also considered excellent regulators.

Commodity Futures Trading Commission (CFTC)

There are very few Forex brokers operating in the United States. Only brokers regulated by the Commodity Futures Trading Commission (CFTC) can carry out services in the US. All CFTC-regulated Forex brokers must also be members of the National Futures Association (NFA), a self-regulatory organisation. The CFTC has very strict regulatory requirements, which protect traders, but also limit their trading freedoms.

Regulatory Rules:

- Maximum Forex leverage is 1:50 on major currency pairs and limited to 20:1 on minor currency pairs.

- All CFD trading is banned. This includes, but is not limited to, shares, cryptocurrencies, precious metals, commodities, indices and bonds.

- The CFTC ensures brokers segregate client trading accounts from their operating capital to protect client funds from mismanagement or default.

- The CFTC requires brokers to maintain a 20 million USD security deposit, which means that should the firm be liquidated, it can afford to pay its traders.

- All brokers are subject to fraud investigation processes and are regularly audited.

- Brokers cannot allow traders to hedge their positions, and ensure that traders adhere to the first-in-first-out (FIFO) rule, which prevents traders from holding simultaneous positions in the opposite direction.

Offshore Regulators

There are many other less strict regulators around the world, and Forex brokers will hold licences with them to avoid the restrictions placed on them by ASIC, CySEC and the FCA. These regulators are often based in small island states and are known as “offshore” regulators.

Common offshore regulators include the Seychelles FSA, the Mauritius FSC, the St Vincent and Grenadines FSA, the Belize IFSC and the Bahamas SCB. While being regulated by one of these smaller regulators does not mean that a broker is bad, it does mean that traders are not as well protected.

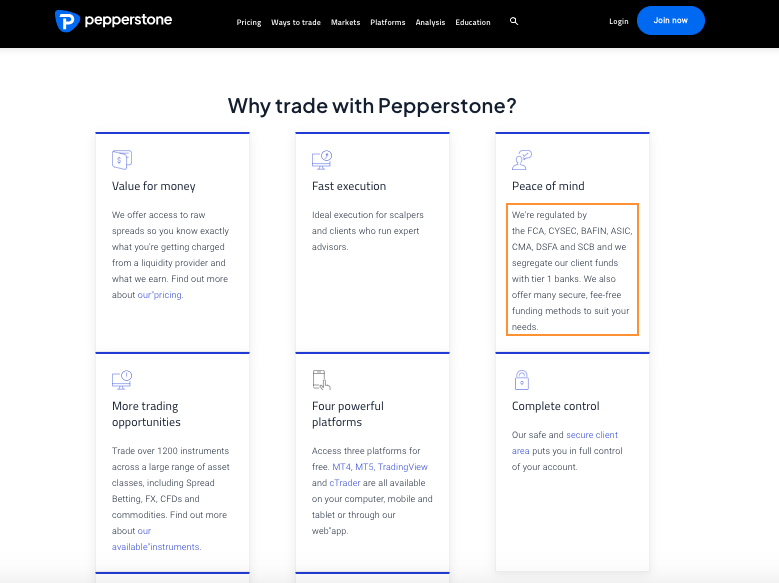

The best and most trustworthy brokers are regulated by at least one of the three major regulators (FCA, CySEC, ASIC) and the CMA. It is common for brokers to have multiple regulators, one for each region in which they operate. A good example of this is Pepperstone. Below is a screenshot from the bottom of their website:

We can see that the FCA, CySEC, ASIC, Germany’s BaFIN, the Dubai DFSA, the SCB of Bahamas, and the CMA of Kenya regulate Pepperstone and its subsidiary companies. Traders will, therefore, register an account with the relevant subsidiary based on their country of residence. For example, traders in Kenya will be onboarded through the subsidiary regulated by the CMA, while Australians will be onboarded through the ASIC-regulated entity.

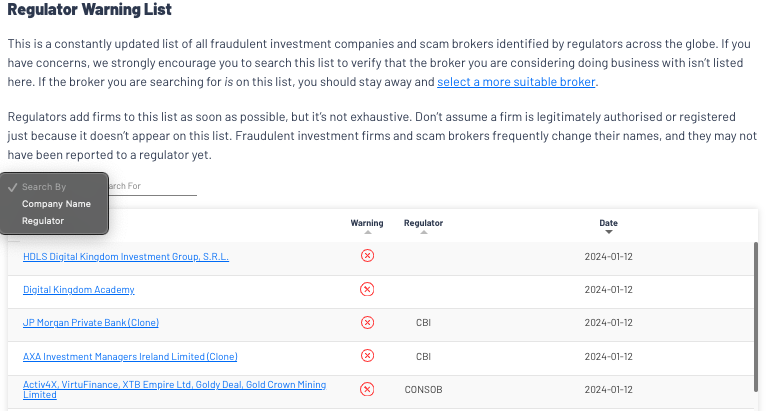

IOSCO Investor Alerts Portal

When checking a broker’s regulation, there is another useful tool available. The International Organization of Securities Commission (IOSCO) maintains a list of every investor warning issued by every regulator in the world, and it is available on our website: IOSCO PORTAL

✔️If you are concerned about a broker for any reason, check this database before you part with any funds.

This list contains a huge number of entries, so the easiest way to search is using the keyword tool; see below:

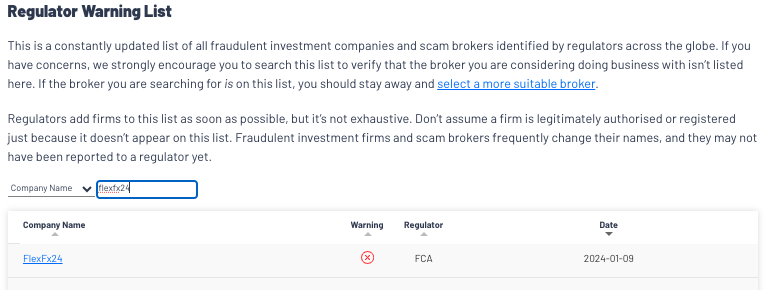

We recently had a question from a trader regarding a broker called FlexFx24. They had contacted him out of the blue, and he was suspicious. So, we searched for this company using the IOSCO keyword tool.

As you can see, the FCA (the UK’s financial regulator) released a warning about FlexFx24 on January 9th, 2024. Obviously, not a broker to trust!

Scam Brokers

If you have been the victim of a scam, you should always contact your local regulator to make a complaint. If your complaint concerns an offshore broker, contact the relevant financial regulator in that region. Although they may not be able to retrieve your money, financial regulators will become aware of these brokers and can take action against them.

We also collect information on scam brokers. Please inform us of any fraudulent activity you have encountered by filling in the scam broker report. Also, check out our warning list of CFD brokers to avoid.

Watch our video on how to spot a scam broker: