-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

In a previous article, “What are lots and leverage” we’ve said that through leverage you can control more substantial amounts of money than your account equity would typically allow. Now we’re going to explain how you can do that.

What is Margin?

Usually, if something costs $10,000, you need to pay $10,000 for it. That’s common sense. However, when trading the Forex market, you don’t need to have the entire amount to pay for what you are buying. You only have to deposit the amount to cover any possible losses. This deposit is called Margin.

A margin is a deposit required to open and to maintain open positions in the Forex currency market. A margin doesn’t represent a fee or a transaction cost; it’s merely a portion of your account balance set aside and allocated as a deposit to initiate the trade.

The margin is multiplied by leverage to determine the lot size. The margin is a real money amount from your trading account.

For example, you want to trade one micro lot or 0.1 lots which is equivalent to $1000, and your Forex broker is offering you 50:1 leverage. To control one micro lot, you’ll need approximately $20 of margin from your account.

The margin will be released back to you regardless if you win or lose on your trade.

How to Calculate Margin

The margin requirement is consistent with the leverage your broker provides you. The margin requirement to open a trading position can also be expressed as a percentage as a full amount for a position.

Example 1: A 50:1 leverage ratio means a margin requirement of 1/50 = 0.02 = 2%.

Example 2: A 100:1 leverage ratio means a margin requirement of 1/100= 0.01 = 1%.

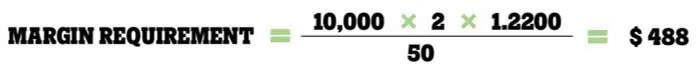

To calculate the margin requirements that your broker will ask you to put the deposit, use the following formula:

Let’s consider the following example:

- Buying EUR/USD at market price 1.2200

- Contract Size = 10,000

- Lot Size = 2

- Account Leverage = 1:50

As a result, you need to have at least $488 in your account as collateral so you can open that position. Otherwise, your order will be rejected because of insufficient margin available.

What is Equity?

Equity in Forex trading refers to the account balance plus the unrealised profit or loss from your open positions. The account equity refers to the total amount of money the account.

What is Free Margin?

The free margin is the amount of money in your trading account that is available for opening new positions. The free margin is calculated by using the following formula:

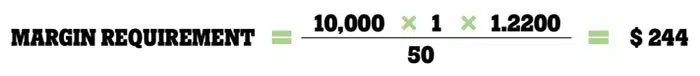

Let’s consider an example where you want to enter a trade with the following conditions:

- Balance =$10,000

- Leverage 1:50

- Margin = 2%

- Buy EUR/USD at 1.2200 with Lot size 0.1

The required margin for this trade is calculated as follows:

If, after entering this trade, the EUR/USD exchange rate falls to a rate of 1.2100, you have incurred a loss of 100 pips which is equivalent to $100 loss.

However, if after entering this trade the EUR/USD exchange rate rallied to an exchange rate of 1.2300 you have realised a profit of 100 pips which is equivalent to $100 gain.

On the Forex market, until you close the position, the floating PnL represents the unrealised loss or profit. The gains or the losses showed when the trade is still in progress represents the unrealised PnL. When the position is open, we can only discuss unrealised gains or losses. When you close your trades, only then will your profit or loss become realised.

What Is A Margin Call?

A margin call refers to the situation when the margin in an account is depleted and requires either to be funded further by the trader or the position to be closed.

Usually, when your account equity drops below the margin requirement, all open positions will be automatically closed by the broker. Other brokers will also send you margin alerts before so the trader can liquidate all positions.