-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Sentiment analysis is key to understanding why price moves the way it does, as the market price is determined by how traders position themselves in the market. This market sentiment explains the irrational behaviour of the market, and how investor’s psychology impacts how currency exchange rates fluctuate.

What is Market Sentiment?

Whenever you open a trade, you are making a financial commitment. And in doing so, you are expressing a view on what you feel the market will do. Overall market sentiment is derived from the combined perspective of all opinions, trades, and ideas of every market participant. The combined market position is what we can define as market sentiment.

Traders can tap into this comprehensive view of the market as a way of doing an analysis. There are technical indicators that offer retail traders a picture of all the orders and positions currently open with the broker.

Tools for Sentiment Analysis

There are technical tools that can help you gauge the market sentiment. The typical sentiment indicator will show the percentage of traders for long versus short.

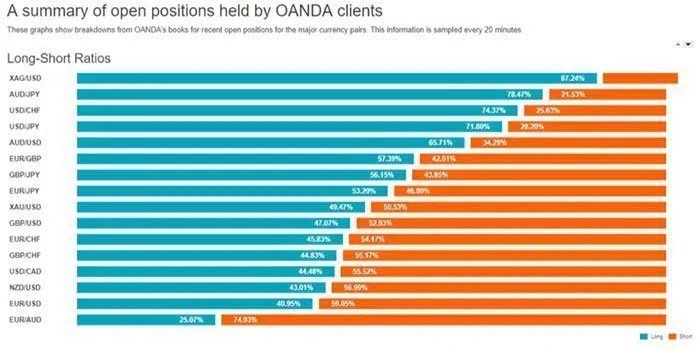

Below is a summary of all open positions by retail traders at Oanda. It shows that 87% of the client orders on XAG/USD (Silver to United States Dollar) are long. This means that 87% of the participants placing orders think that the price of Silver will rise against the Dollar.

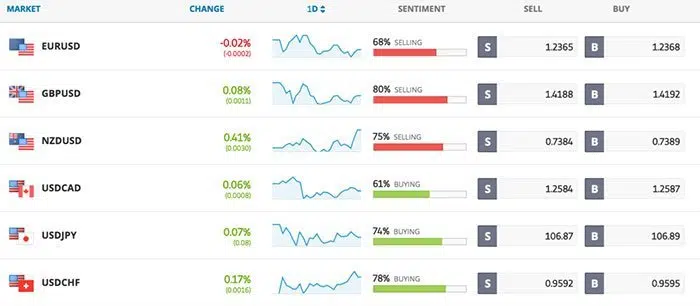

Below is a summary of the sentiment of major currencies at eToro. On the second row, it shows that 80% of the open orders on GBP/USD are selling because they believe the value of GBP will rise against the Dollar in the short term.

Contrarian Trading Using Sentiment Analysis

Sentiment analysis can help you spot contrarian trading opportunities. A contrarian trading strategy trades against the current market trend and centres around looking for points where a trend is likely to reverse.

Contrarian trading is far from risk-free. When you’re trading against a particularly strong trend, the market can sometimes continue to trade in the same direction longer than you can stay solvent. This is why it’s important only to trade those particular instances when you have excellent information to support your conclusion on future market movements.

It’s recommended to only trade those instances when the market sentiment reaches extreme levels of more than 70%. In this case, you may consider fading the market or trading against the trend.

Example

From the first OANDA sentiment analysis chart above, the EUR/AUD satisfies this condition of almost 75% of retail traders being short on this market. The next step is to look for significant support and resistance levels to time the market. The sentiment analysis tool only gives you the state of the current market, which is why you need to use this sentiment analysis in combination with other supportive technical analysis tools.

Successful contrarian traders try to minimise their losses and maximise their profits. Two key steps can help you achieve this:

- First, use a protective stop loss to ensure any losses are well contained

- Secondly, identify a strategy that allows your profits to run to benefit from the superior trading opportunities that the sentiment analysis method can provide you.

Incorporating sentiment analysis into your trading can add a competitive edge to your strategy. It can help you quickly identify new trading opportunities that few others are aware of.

Conclusion

Smart traders wait for sentiment to reach extremes, and wait for significant and reliable data before engaging the market. Once all the trade setup conditions are made, be patient and wait for the market to confirm your analysis before entering.

The main idea behind sentiment analysis is that you don’t have to know the exact probability of a trade. All you need to know is if sentiment will be better or worse in the future, and base your trades on that assumption.