-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

| 🏦 Min. Deposit | GBP 100 |

| 🛡️ Regulated By | FCA, FSCA, CySEC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 300:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, ETX |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices |

Last Updated On May 10, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on OvalX

As of January 26, 2023, OvalX is no longer accepting new clients. Choose one of our other recommended brokers for Kenyan traders.

OvalX (formerly ETX Capital) is a traditional FCA regulated market maker broker which provides traders with assets that include Forex, Indices, Shares, Commodities, and Cryptocurrencies.

With award-winning technology and an emphasis on high-quality education material for beginner traders, OvalX is a popular choice with traders looking for a traditional broker with professional client service.

| 🏦 Min. Deposit | GBP 100 |

| 🛡️ Regulated By | FCA, FSCA, CySEC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 300:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, ETX |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Great platform choice

Cons

- Poor customer service

Is OvalX Safe?

OvalX is a brand of Monecor London Limited, which is headquartered in London, founded in 1985, and listed on the London Stock Exchange. They have satellite offices in Denmark and the Czech Republic.

In recent years has won respected industry awards that express the industry’s response to the quality FCA regulated service they operate.

Regulated by the FCA (license number: 124721) since 01/12/2001 OvalX has won multiple awards for the quality of education and their proprietary platform in 2018 and 2019 from respected award shows in Europe.

OvalX is safe for traders.

Trading Conditions

The trading conditions are in line with what should be expected from market maker brokers. The live account offers 60+ FX currency pairs on instant market execution.

Account Types

Traders can enjoy a single live account type, in addition to the demo account option. Having a single account option is becoming more common as the broker rewards higher-deposit traders with tighter spreads.

Spreads and Commissions

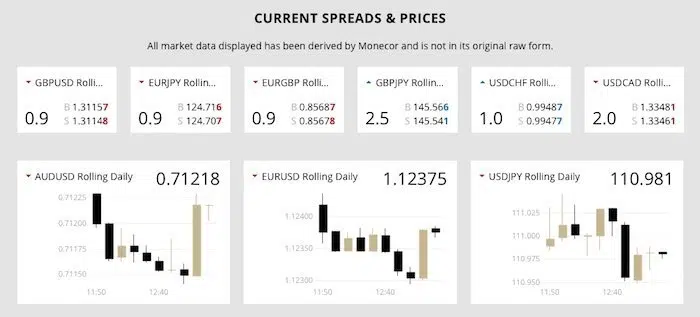

The spreads at OvalX tight considering they are the market. EUR/USD is as tight as 0.6 pips (average 1.01), while GBP/EUR has a minimum spread of 2 pips (average 2.69).

Trading at OvalX is commission-free on both platform choices.

Deposit and Withdrawal Fees

OvalX does not charge for deposits, but withdrawals under 100 GBP, or currency equivalent, a £10 administration fee will be charged.

Inactivity Fee

An inactivity fee of 300 ZAR (25 USD) will be charged every month for dormant accounts. A dormant account is one where no trading activity has taken place for 365 days. These charges are imposed to discourage money laundering.

OvalX for Beginners

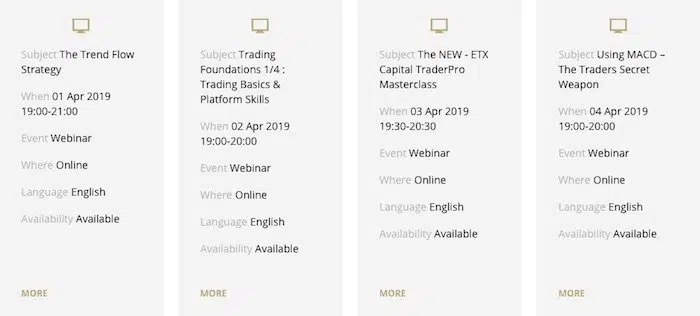

Education is one of two main focus areas for OvalX. With awards for Best Education (Online Personal Wealth Awards 2018), Best Forex Education (UK Forex Awards 2018) and Best Trading Education (Shares Awards 2018) newcomer traders will find high-quality training material in a multitude of formats.

Educational Material

OvalX has targeted courses for different asset classes, webinars, ebooks and platform guides. The Learn Forex course is a light 24-minute course designed to act as a quick starter guide to inspire confidence in the new trader. Other similar courses are available for learning indices, commodities, shares and cryptocurrencies.

While this course is unique in that it offers a different set of material for each of the asset classes, the content itself is limited and would leave a trader who was familiar with the basics of Forex trading lacking. Comparatively, the education section is thin compared to the education sections offered by other market maker brokers.

Analysis Material

All analysis material that OvalX has to offer is open to the public. The research team writes an analysis of future news events that are published a couple of times a month. While this would not directly translate to trading opportunities, they do show traders what to look for and help newcomers stay on top of the news.

Customer Support

Multi-lingual customer support is more traditional at OvalX with opening hours from Monday to Friday from 7:30 am – 9:00 pm (GMT) either by telephone or email.

Existing clients are provided with a separate phone number to shorten waiting times and personal account management.

Trading Platforms

Winners of numerous awards, the OvalX Trader Pro software is proprietary and for the expert trader. While MT4 is offered to less-experienced traders or those who want to use the industry standard, Trader Pro provides more markets, customisation and trading tools. Recently awards OvalX TraderPro has won are:

- Best Trading Platform – Online Personal Wealth Awards 2018

- Best Trading Platform for Professionals – Online Personal Wealth Awards 2019

- Best Forex Trading Platform – UK Forex Awards 2018

- Best Online Trading Platform, Shares Awards 2018

- Best Trading Tools – Online Personal Wealth Awards 2019

The MT4 platform is the commonly used trading software in the CFD trading industry. With the OvalX MT4 platform, traders can use Expert Advisors for automated trading, trade micro-lots, use MT4 hedging and one-click trading.

Free VPS is available for clients who deposit more than 2000 USD (or equivalent) and trade five lots per month. Should clients use a VPS and not reach the trading qualification a VPS subscription fee of 25 USD will be charged to the account balance.

Mobile Trading Apps

A mobile version of the OvalX Trader Pro software is available for Android and IOS devices, but recent comments from the community suggest that the application is buggy and some of the main features do not work.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the OvalX offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

OvalX Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. OvalX would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how OvalX stacks up against other brokers.