-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | CySEC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Cryptocurrencies, Energies, Forex, Indices, Metals |

Last Updated On May 10, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on FXCC

Established in 2010, FXCC is a CySEC-regulated Forex/CFD broker. An STP/ECN broker, FXCC has three live account types. Minimum deposit on the most popular account (ECN XL Account) is 100 USD, leverage is up to 1:300 on FX pairs, and its variable spreads average around 0.6 pips. It offers commission-free trading, but unlike traditional STP/ECNs, it charges a significant spread mark-up on 2 of its accounts.

Trading platform choice is limited to MT4, but is available on multiple devices as well as major web browsers. FXCC provides minimal educational material, and lacks in market research and analysis compared to its peers. Customer service is available 24/5 via live chat, telephone and email.

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | CySEC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Cryptocurrencies, Energies, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

Cons

- MT4 only

- Limited education

- Limited market analysis

- Expensive withdrawals

- High minimum deposit

Is FXCC Safe?

FXCC is regulated by the Cyprus Securities and Exchange Commission (CySEC) and is a part of the European Markets in Financial Instruments Derivatives (MiFID), which gives it the freedom to operate in the entire European Union under the European Economic Area (EEA) agreement. Its authorization via the EEA also extends to the United Kingdom, allowing to provide services to British residents. FXCC is also registered in the Republic of Vanuatu, from where it provides services to clients outside of Europe and the UK. See the following list of FCXX Group registered companies:

- FXCC Cyprus Ltd is regulated by the Securities and Exchange Commission (CySEC) under company registration number 258741.

- FXCC Ltd is registered in the Republic of Vanuatu with registration number 14576.

- FXCC Ltd is registered with various regulatory bodies of EEA member states that allow the provision of our services in their jurisdictions.

FXCC deposits all client funds in segregated accounts, completely separate from any and all FXCC corporate accounts. FXCC also offers negative balance protection, and has the right to close all or part of the hedged positions in order to avoid the possible risk of negative balance due to wide spreads.

FXCC’s Trading Conditions

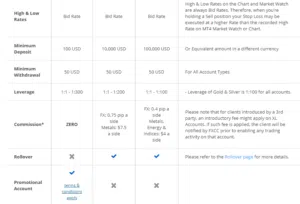

FXCC offers three live accounts and a demo account. All three live accounts have hedging capabilities, allow automated trading and scalping, and have a minimum transaction level of 0.1 lots. Once your account reaches a Margin Level that equals to the Stop Out Level or below, the system will automatically close all open positions.

FXCC does not charge a fixed commission, but charges spread mark-ups on all of its accounts, rendering its spreads much wider than other STP/ECNs. It is also not transparent for which account the spreads on the site refer to. Leverage is up to 1:30 on all accounts. Most reputable STP/ECNs have between 3 and 10 execution venues; FXCC has only one – routed to a single execution venue in Cyprus.

FXCC only allow currencies to be dominated in USD, GBP or EUR, and trading sessions run from Monday 00:05 – Friday 23:55 GMT. It also offers Islamic Swap Free accounts. See details of the various accounts:

Demo Account – The FXCC demo account expires after 30 days, which is not ideal for beginners. The demo account gives you a starting balance of 10,000 USD. It allows you to view charts, news and analysis, get access to the full-featured MT4 platform and experience real-time prices and real forex market volatility.

ECN XL Account – FXCC won Best Forex Trading Account of 2017 (UK Forex Awards) for its ECN XL Account. Minimum deposit is 100 USD, variable spreads start at 0,6 pips, and leverage is up to 1:300 on FX pairs. It also offers a swap-free option.

ECN Standard Account – Minimum deposit is 10,000 USD. It provides access to 30 instruments, and it allows a leverage of up to 1:200. With this account, clients are charged a spread mark-up of 1.5 pips for all FX pairs.

ECN Advanced Account – Minimum deposit is 100,000 USD, it provides access to over 200 instruments, and leverage is up to 1:100. Clients are charged a spread mark-up of 0,8 pips on FX pairs.

Spreads and commissions

All FXCC accounts have variable spreads starting at 0,6 pips, which is higher than its peers. Commissions are account-dependent: Commissions are not charged on the ECN XL Account, but clients are charged a spread mark-up of 1.5 pips on the ECN Standard Account, and 0.8 pips on the ECN Advanced Account. Most other STP/ECNs charge a flat commission fee per lot.

Deposits and Withdrawals

In order to comply with the Anti-Money Laundering Directive, withdrawal requests will only be sent the same way the funds were received and up to the initial deposited amounts. FXCC offers many deposit and withdrawal methods. It does not charge a fee for deposits and offer a “zero deposit fee” promotion. This means that FXCC will pay the deposit fees charged by the payment processor when funds are deposited.

- Visa/Mastercard: Deposits are usually processed within one hour and FCXX does not charge a fee for withdrawals, and takes 5 – 10 working days to clear.

- Bank Wire Transfer: Estimated deposit transaction time is 5 – 7 business days. Withdrawals take 5 – 7 business days to reach your account, and fees are 30 USD – 45 USD per transaction.

- Union Pay: Deposits are processed in an hour. Withdrawals take 3 – 5 days to clear and cost 30 USD – 45 USD.

- Neteller: Deposits are processed in an hour, and withdrawals happen in real-time, but clients are charged 2.7% of the withdrawal amount.

- Skrill: Deposits are processed in an hour, and withdrawals happen in real-time, but clients are charged 2.7% of the withdrawal amount.

FXCC charges a fee of 5 USD a month after 120 days of inactivity on accounts.

Bonus Structure

FXCC offers discretionary bonuses and promotions that may be applied to your account, but see its website for current offerings.

FXCC for Beginners

FXCC does not offer many educational materials for beginner traders compared to its peers. It has a number of articles describing the benefits of an ECN and a glossary of terms, but does not offer training videos, trading seminars or courses. It also lacks in up-to-date market analysis content, providing a basic daily technical analysis, economic calendar and ‘Traders Corner Blog’. Its demo accounts also expire in 30 days. The international customer service team is available 24-hours a day, 5 days a week for all client account and technical questions, but its website is often not responsive, and it is difficult to navigate the FAQs.

Educational Material

As mentioned, FXCC has minimal educational content. It does offer a number of downloadable PDF booklets that address Forex trading, but you have to register an account to access these materials. All educational content is translated into over 80 languages.

Analysis Material

FXCC’s limited research and analysis section provides an up-to-date basic daily technical analysis, a morning roll call analysis, and a forex news section. It also offers a ‘Traders Corner Blog’ with up-to-date trading news and an economic calendar for planning. All market analysis material is fully translated into over 80 languages.

Customer Support

The multi-lingual customer support team at FXCC is available 24/5 via telephone, live chat and email, but, as with all regulated brokers, cannot offer investment advice.

Trading Platforms

FXCC offers traders the industry-standard MT4 platform. All the necessary trading tools and resources are on hand to allow traders to conduct research and analysis, enter and exit trades and even use third-party automated trading software. A built-in library of more than 50 indicators and tools streamline the analysis process, enabling traders to identify trends, and define various market shapes. MT4 software also offers an impressive array of analytical tools, and nine timeframes are available for each financial instrument. MT4 is available for PC, smartphones and tablets.

FXCC’s Trading Apps

FXCC supports mobile versions of all MT4 platforms, and customer service is available 24/5 to answer questions about the software and help with set-up.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of how we review FXCC’s product offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Warning

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. FXCC would like you to know that: Trading in Forex and Contracts for Difference (CFDs), which are leveraged products, is highly speculative and involves substantial risk of loss. It is possible to lose all the initial capital invested. Therefore, Forex and CFDs may not be suitable for all investors. Only invest with money you can afford to lose. So please ensure that you fully understand the risks involved. Seek independent advice if necessary. FXCC does not provide services for United States residents and/or its citizens.

Overview

FXCC is a non-traditional, CySEC regulated STP/ECN broker. It offers the industry-standard MT4 platform, available for PC, mobile devices and tablets. FXCC does not charge commission, but charges a spread mark-up on 2 of its accounts. Minimum deposit for the ECN XL account is 100 USD. Its variable spreads average at around 0.6 pips.

FXCC does not offer many educational materials compared to its peers and it has a limited market analysis section. The demo account expires after 30 days, rendering it difficult for beginners to get a grip on trading, but customer support is available 24/5.

Overall, FXCC is a non-traditional STP/ECN which lacks in educational and market analysis material. Be aware of its trading conditions: unlike other STP/ECNs, it charges a spread mark-up on 2 of its live accounts.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how FXCC stacks up against other brokers.