-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, FMA |

| 💵 Trading Cost | USD 8 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | Plus500 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Last Updated On May 10, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Plus500

Plus500 is a leading CFD provider with CFDs on Forex, equities, indices, cryptocurrencies, commodities and options. Clients of Plus500 have access to an easy to use trading platform, but membership lacks trading courses for beginners and market analysis. Plus500 is supervised by some of the best global regulators but is not currently licenced by the FSCA.

The Plus500 trading platform offers Kenyan traders a single account option, however, a lack of platform support for copy trading, hedging and scalping, could limit traders looking for new ways to trade. Plus500 falls behind in market analysis, advanced trading tools, and an absence of trading courses, making it less suitable for beginners or inexperienced traders.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, FMA |

| 💵 Trading Cost | USD 8 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | Plus500 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Wide range of assets

Cons

- Limited education

- Limited account options

Is Plus500 Safe?

Plus500 was founded in 2008 in Israel and has grown into one of the largest online brokers in the world – not only is the company publicly traded on the London Stock Exchange, meaning an additional level of scrutiny, it’s subsidiaries are regulated by seven national authorities:

- Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority (FRN 509909).

- Plus500CY Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC Licence No. 250/14).

- Plus500AU Pty Ltd holds AFSL #417727 issued by ASIC, FSP No. 486026 issued by the FMA in New Zealand and Authorised Financial Services Provider #47546 issued by the FSCA in South Africa.

- Plus500SG Pte Ltd (UEN 201422211Z) holds a capital markets services license from the Monetary Authority of Singapore for dealing in capital markets products (License No. CMS100648-1).

- Plus500IL Ltd is registered in Israel and licenced to operate a trading platform

As per regulations, all client funds are kept segregated from the brokers own and Plus500 also offers negative balance protection, ensuring that clients cannot lose more than they have in their account.

Plus500 does not highlight any industry recognition it has received, but the company did win the Best Trading App Award from Daytrader.com in 2019.

Trading Conditions

Plus500 is a market maker which mean that Plus500 makes the market and trades are not passed on to the international currency markets. Because the market is a closed system, Plus500 is the counterparty to every trade – there are few requotes and fast trade execution.

Plus500 makes a profit from the difference in the buy and sell spreads, and additional commission is not charged on trades.

Spreads at Plus500 are variable and always changing. The Plus500 prices used in this review are are taken on 29.09.2020 12:00h. For more accurate information, check their website.

Account Types

There are two account types – a demo account with play money, and a live account where clients can deposit real funds once the account is verified but Plus500 staff. There are no functionality limitations on the demo account.

Plus500 is a CFD Service. Your capital is at risk

Demo Account

The demo account gives the trader a practice area before you put up any money. The Plus500 platform is different from other brokers, so I would strongly advise you to have a good look around before you commit with a deposit. Some traders will enjoy the Plus500 platform, but others will prefer a more traditional layout.

Live Account

Besides the demo account, Plus500 only offers one other type of account with a minimum 10.000 Shilling deposit amount. Nothing really with this account – very cut and dry with standard technical charts and fundamentals available.

Spreads and Commissions

Trades at Plus500 are commission-free. Plus500 generates all revenue on the bid/ask variable spreads. The currency pricing used at Plus500 is taken from a 3rd party and reflects actual market value, and then a spread is added on top of the price to create a Plus500 price that the clients can trade. Spreads are published alongside the instrument on the platform.

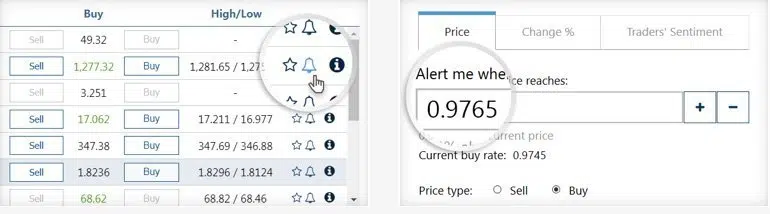

**This is only illustrative of what you can expect of the Plus500 platform. No actual.**

Deposit & Withdrawal Fees

Plus500 charges no fees for deposits or withdrawals unless the maximum number of five withdrawals per month has been exceeded. In this extreme case, the client will be charged USD 10 or equivalent per withdrawal.

Note that your bank or credit card company may charge your fees for moving money between Plus500 and your bank, but no fees are charged for this service by Plus500.

Inactivity Fee

Should a client not log into the trading account for three months, a fee of USD 10 will be charged. Should you not log into your account for six months, a total charge for those six months will be USD 20.

**This is only illustrative of what you can expect of the Plus500 platform. No actual.**

Customer Support

Plus500 offers 24/7 customer support via email, online chat and WhatsApp message in 31 different languages. This is a much higher level of service than is commonly available.

The only way the customer support could be improved is by offering phone support for more complex queries and troubleshooting.

Trading Platform

The Plus500 platform can be downloaded an installed on a computer, or a trader can use the Webtrader interface on a browser. Both retail and professional traders use the same desktop and mobile applications.

Mobile Apps

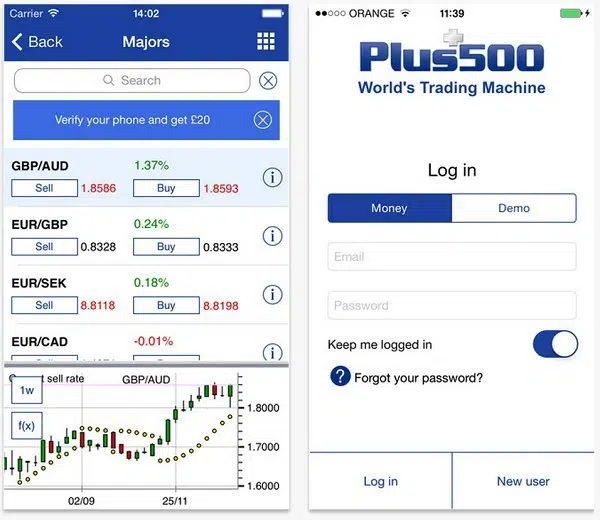

Plus500 mobile apps are free for Windows, Android and IOS. They offer all of the features of the web and downloaded version of the trading suite, and make a convenient on-the-go trading solution.

**This is only illustrative of what you can expect of the Plus500 platform. No actual.**

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Plus500 offer. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Plus500 Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Plus500 would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

Plus500 is a leading brand in the CFD trading industry and has a loyal following of traders, with a lot of focus on making the trading platform easy to understand and a focus on trying to get the best trading conditions possible. While the education and research area could be developed further, note that the platform is not suitable for beginners/inexperienced traders.