For over a decade, FxScouts.co.ke has been reviewing forex brokers and provided in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Kenyan markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

- AvaTrade - Best FSCA Regulated Forex Broker

- FXTM - Best FSCA-Regulated Broker for Beginners

- HFM - Best FSCA-Regulated Broker with KES Accounts

- FBS - Best FSCA-regulated Cent Account For Beginner Traders

- Khwezi Trade - Best Local FSCA Regulated Broker

- markets.com - Best Trading Platform with FSCA Regulation

- FxPro - Best FSCA Regulated No Dealing Desk (NDD) Broker

- FXCM - Best Specialty Trading Platforms

- IG - Best FSCA Regulated MT4 Broker

- ThinkMarkets - Best Market Execution

- FxPrimus - Most Secure FSCA Regulated Broker

Best FSCA Regulated Forex brokers 2024

Last updated on April 9, 2024

Updated April 9, 2024

by Editorial Director Jeffrey Cammackby Jeffrey CammackAll Brokers Regulated

All Brokers Regulated

by Trusted Authoritiesby Trusted AuthoritiesAvaTrade – Best FSCA Regulated Forex Broker

Winner of the Award for Best Broker of 2020, AvaTrade offers the best overall trading environment of all FSCA regulated brokers with:

- Low spreads on a single account

- Award-winning customer service

- An excellent mobile trading platform, AvaTradeGo

- Great trading tools like AvaProtect

Tight Spreads, Seven Markets, One Simple Account

AvaTrade has low spreads across Forex, commodities, stocks, indices, crypto, bonds and ETFs. Leverage is set at 1:400 and spreads are some of the tightest we have seen for an account with only 100 USD minimum deposit and no commission – as low as 0.9 pips on the EUR/USD.

FXTM – Best FSCA-Regulated Broker for Beginners

FXTM is the best FSCA-regulated broker for beginner traders. Great value and a strong focus on assisting new traders is just the start here; highlights are:

- Great value Cent Account

- Tight Spreads and Low Minimum Deposits

- Weekend customer support

- Copytrading via FXTM Invest

- Huge education section

Tight Spreads and Low Minimum Deposits

While FXTM’s Standard Account is good with a minimum deposit of 100 USD and spreads starting at 1.3 pips, FXTM also offers a Cent Account with a minimum deposit of only 10 USD but only slightly wider spreads, starting at 1.5 pips.

HFM (HotForex) – Best FSCA-Regulated Broker with KES Accounts

HFM (previously known as HotForex) is a well-known international broker with a strong presence in Kenya. HFM has a local customer support team, and unlike many other international brokers, it offers KES trading accounts. It also offers fast and free deposits and withdrawals in Kenyan Schillings from a range of local banks. Regulated by the FSCA (FSP: 46632), the CMA (through which Kenyans are onboarded), CySEC, and the FSA, HFM has built a reputation for tight spreads with STP execution, low-cost Micro Accounts, detailed market analysis, and 24/5 customer support. With accounts that suit both beginners and professionals and detailed market analysis, HFM is a good choice for new and experienced traders.

HFM devotes an entire section of its website to market analysis and trading tools; these include daily market news, trade analysis, and outlooks. Trading calculators and economic calendars are also available for reference outside a trading platform.

FBS – Best FSCA-regulated Cent Account For Beginner Traders

A well-regulated broker with an FSCA licence, FBS offers two low-risk accounts for beginners, including its Cent Account, with a minimum deposit of only 1 USD. The Cent Account features low-risk trading and allows trading in USD cents, micro-lots, or smaller trading sizes. The Cent Account is also available as a demo account and will only expire after 90 days of inactivity.

FBS is also one of the better brokers in terms of education and market analysis. The education section is comprehensive and well-structured, and the market analysis is up-to-date and well-explained. Beginners will also appreciate that FBS’ customer service is available 24/7 – a welcome development, where the norm is 24/5. This is especially helpful for beginner traders who want to set up trading accounts on weekends.

KhweziTrade – Best FSCA Regulated Broker

| 🏦 Min. Deposit | ZAR 500 |

| 🛡️ Regulated By | FSCA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT5 |

| 💱 Instruments | Commodities, Forex, Indices |

- FSCA Regulation and ZAR Accounts

- Tight Spreads and STP Execution

- Excellent Local Customer Support

- Free Deposits and Withdrawals

Why Should Traders Use KhweziTrade?

KhweziTrade is honest, transparent, and genuinely interested in the welfare of its clients. Trading conditions are competitive with some of the best international brokers and the personalised customer support is the best amongst local brokers. FSCA regulated and locally focused, KhweziTrade is one of the brightest stars in the local Forex industry.

Marketsx – Best Trading Platform with FSCA Regulation

Marketsx is a premium trading platform operated by Markets.com. Not only is Markets.com regulated by CySEC and ASIC, but it has also been regulated by the FSCA since 2012. The new Marketsx platform offers traders fast, low-cost trading on over 2,200 financial instruments. Launched in 2019, some of the highlights of the platform are:

- Over 2200 tradeable instruments

- Tight spreads with no commission

- 1:300 Leverage

- Lightning execution

- In-depth charting, asset comparison and sentiment tools

- Live-streamed, expert analysis

Trade Every Market with Tight Spreads

Traders have a choice of over 2,200 instruments on the Marketsx platform. These include

Over 50 global FX pairs including GBP/USD and EUR/USD, with spreads starting at 0.9 pips and leverage of 1:300. Other CFDs include leading stocks such as Apple, Amazon, Facebook, and Tesla, six of the world’s biggest cryptocurrencies, over 25 major market indices, commodities including precious metals and energies, dozens of regional and sectoral ETFs and US, UK and German government bonds.

FxPro – Best FSCA Regulated No Dealing Desk (NDD) Broker

FSCA-regulated since 2015, FxPro offers an NDD execution model on MT4, MT5, cTrader, and a browser-based platform. A reasonable 100 USD opening deposit and outstanding customer service are combined with competitive spreads – often as low as 0.6 pips. Features traders will like at FxPro are:

- Ultrafast NDD Execution

- Wide Platform Choice

- Tight Spreads

- Free Funding via the FxPro Wallet

Fast Execution and No Dealing Desk

FxPro’s NDD execution model has won awards over the years for its speed and reliability. Most trades are executed in less than 10 milliseconds and only 9% of orders receive negative slippage. These execution statistics are perfect for scalpers and traders who like to take advantage of volatile markets.

FXCM – Best Specialty Trading Platforms

| 🏦 Min. Deposit | USD 50 |

| 🛡️ Regulated By | FCA, ASIC, CySEC, FSA-St-Vincent |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, TradeStation |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

FXCM South Africa is an FSCA-regulated market-maker with tight spreads and low minimum deposits. While FXCM caters for new traders, is also offers innovative trading tools and platforms for experienced traders. Traders can expect:

- Wide Range of Specialty Platforms

- MT4 Support

- Innovative trading tools

- Excellent trader education

- No deposit or withdrawal fees

Platforms for Specialised Traders

FXCM supports a wide range of trading platforms including the industry-standard platform MetaTrader 4, its award-winning proprietary platform Trading Station, Ninja Trader, and other speciality platforms. Many of these platforms are suited to professional traders – highlights include:

- QuantConnect – An algorithmic trading platform with API integration.

- SeerTrading – An algorithmic trading platform with strong back-testing capabilities.

- NeuroShell Trader – A technical trading platform for building custom strategies for manual and automated trading.

- StrategyQuant – A machine learning automated trading platform.

IG Markets – Best FSCA Regulated MT4 Broker

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | ASIC, CFTC, BaFin, BMA |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

IG Markets, the world’s largest broker by revenue, has been regulated by the FSCA since 2010 and has 240,000 clients worldwide. As one of our highest-rated brokers, there is little that IG Markets does wrong. Traders frequently cite the following features:

- Tight Spreads and Full MT4 Support

- Excellent education and market analysis

- Responsive and knowledgeable customer support

IG Market’s MT4

MT4 is the world’s most popular trading platform. Automated trading, micro lots, customisable charts, and reliability have kept the platform in the lead for over 14 years. IG Market’s version of MT4 takes MT4 to another level with its free add-ons and indicators package. Highlights include a Trade Terminal, Stealth Orders, a Correlation Matrix, and a dozen indicators. In addition, all IG clients get access to Autochartist for free. This powerful automated technical analysis tool scans the markets for opportunities that you may have missed. All these features are available with tight spreads, with the EUR/USD averaging 0.86 pips but sometimes as low as 0.6 pips, and commission-free trading.

ThinkMarkets – Best Market Execution

Regulated by the FSCA since 2019, ThinkMarkets is an international broker with support for MT4, MT5 and its own ThinkTrader platform on two account types: One with a very low minimum deposit and the other a commission-based ECN account for more experienced traders. Traders can take advantage of:

- Split-second Execution and 99.99% uptime

- Wide choice of platform

- Low Minimum Deposits

- ThinkZero Account with Raw Spreads

UltraFast Execution and Full MT4/MT5 Support

ThinkMarkets operates twin Equinix trading servers located in Hong Kong and London, allowing for trade execution within milliseconds. This state-of-the-art technology allows ThinkMarkets to deliver an uptime of 99.99% and provides traders with the fastest execution speeds available. With supported MT4 and MT5 platforms, ThinkMarkets is the perfect venue for automated trading and scalping.

FXPRIMUS – Most Secure FSCA Regulated Broker

FXPRIMUS is an STP market maker founded in 2009 and fully regulated by the FSCA since 2018. Globally acclaimed for offering one of the fastest and most secure online trading environments, the company strongly focuses on customer satisfaction with free deposits and withdrawals and negative balance protection for all Kenyan clients.

Highlights are:

- Negative Balance Protection

- Third-party monitoring of client withdrawals

- Investor compensation

- Low minimum deposits

- Great customer support

Secure and Trusted

Security and trustworthiness is of the utmost importance at FXPRIMUS. FXPRIMUS is a regulated member of the Investor Compensation Fund (ICF), meaning that client funds are protected up to €20.000. As an added safety measure, FXPRIMUS has introduced professional indemnity insurance of €2.5million. In addition, FXPRIMUS has partnered with the Boudica Client Trust to introduce third-party monitoring of client withdrawals. This ensures that withdrawal requests are executed as quickly and efficiently as possible.

What is the FSCA?

The Financial Sector Conduct Authority or FSCA is the local regulator of all non-banking related activities and has oversight over all regulated brokers in South Africa.

The FSCA regulates all Forex brokers with an office in South Africa

Previously known as the Financial Services Board (FSB), the FSCA was founded in 1991 following the recommendations of Van der Horst committee. The committee recommended the creation of an independent body to supervise and regulate the non-banking financial services sector in South Africa.

In 2018, the FSB changed their name to the FSCA or the Financial Sector Conduct Authority. It is responsible for the market conduct regulation and supervision of financial service providers like Forex brokers, investment funds, and investment managers.

The Financial Sector Conduct Authority has the following four goals:

- Protect customers of financial services.

- Improve efficiency and integrity of financial markets.

- Promote financial stability.

- Increase financial inclusion.

To achieve these goals, it also creates regulations in the interest of the public and publishes warnings of illegal schemes.

Internationally, the Financial Sector Conduct Authority is a recognised member of the International Organization of Securities Commissions (IOSCO) and takes a leading role in regulation in the SADC block.

Why should I trade with an FSCA-regulated Forex broker?

All FSCA regulated brokers must keep client funds segregated from operational funds. This ensures that in the case of broker bankruptcy, all client funds can be returned.

FSCA-regulated brokers must also have a physical office in South Africa and submit regular audits to the FSCA. This ensures that any disputes are governed by South African laws and that client funds are not being misused.

FSCA regulated brokers must keep client funds in segregated accounts

Having a physical office in South Africa allows brokers to partner with local banks, which are governed by South African laws.

If your FSCA regulated broker does go bankrupt, you will also be able to walk into any branch of your broker’s local bank and remove all your funds from your segregated account. Gaining access to your funds will not be so easy in the event of a foreign broker’s bankruptcy.

Over-the-counter Derivative Provider (ODP) licence

Since 2019, the FSCA has required all Forex brokers in South Africa to apply for an Over-the-counter Derivative Provider (ODP) licence. This has created a new set of requirements for South African Forex brokers to follow:

Due Diligence: Brokers now need to conduct due diligence on new traders before they can be allowed to trade. Clients will need to prove their capital adequacy before starting to trade. New traders must also show that they understand the risks involved.

Reporting: Every broker that has been authorised must also report the details of every transaction to an authorised trade repository. These transaction details include the names of the parties, the valuation of the transaction, the underlying asset of the trade, details of the instrument traded, and the margin that has been maintained.

Forex brokers who do not hold an ODP licence are in contravention of the regulations and can be liquidated at the request of the FSCA, as happened to JP Markets in September 2020 (see image above).

All FSCA regulated brokers must apply for an ODP licence

These new requirements have put the FSCA firmly in charge of the Forex industry in South Africa and will provide a much safer and more secure environment for traders.

How to check if your Forex broker is regulated by the FSCA

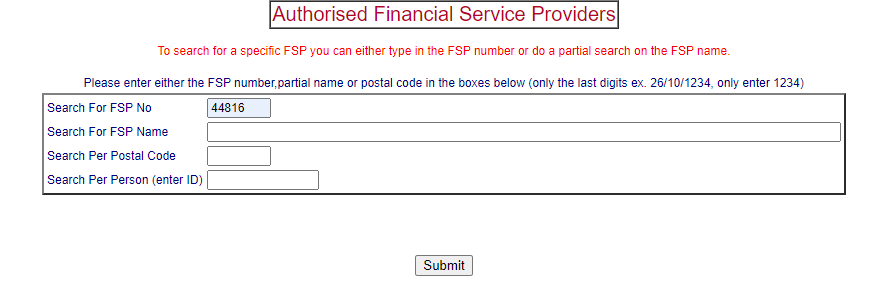

All Forex brokers that are regulated by the FSCA are required to publish their Financial Service Provider (FSP) number on their website. KhweziTrade is a popular South African Forex broker, and we can see from the bottom of their website that their FSP number is 44816:

Once you have the FSP number of a broker you can go use the FSCA’s search page to enter the FSP and verify that the broker is indeed licenced. You can see below that we have entered KhweziTrade’s FSP as listed on their website.

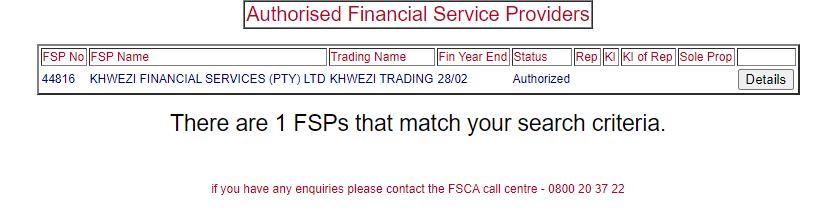

Once we submit the FSP number via the FSCA’s search page, we can see that there is a company called Khwezi Financial Services (Pty) Ltd with that FSP number.

A broker having a legal name different to their trading name is quite common, so it is sometimes difficult to search for a broker by trading name alone using this service. When you can, use the FSP number, or legal name if you know it.

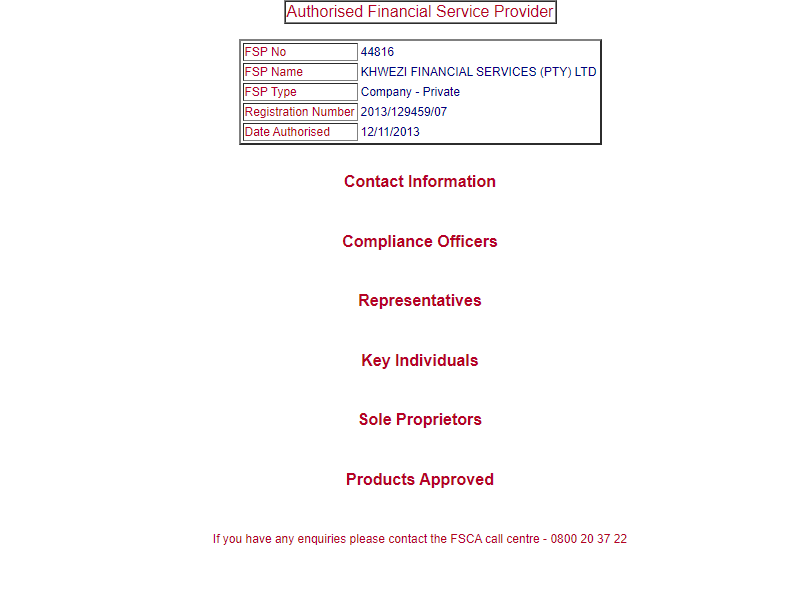

If we click on the Details button, we then have a full overview of Khwezi Financial Services regulatory status:

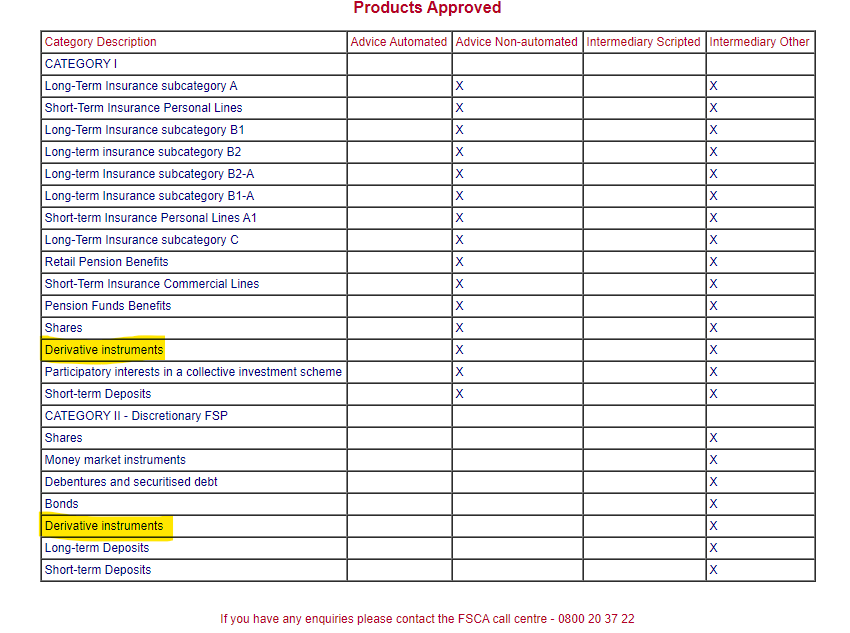

The important part of this section for our purposes is the Products Approved section. Let us have a look at it in closer detail:

Here we can see that Khwezi Financial Services, as a large financial services company, holds a wide range of licences. We have highlighted the two product licences that matter for our purposes. We can see that they hold a Category I and a Category II licence for Derivative instruments.

All Forex trading is over-the-counter derivative trading

All Forex trading is derivative trading, as traders never actually hold any currency – they are just speculating on a price derived from a real-world asset (such as the USD). So Khwezi Financial Services’ two Derivative instruments licences allow them to provide derivatives (such as Forex derivatives) to traders.

If you are ever unsure whether a broker is FSCA regulated, the FSCA search page is the best place to find out. Be aware that some bad brokers will use names similar to licenced financial services companies so as to confuse people.

Other FSCA Protections for Forex Traders

The FSCA’s supervises activity in the Forex currency market to protect Forex traders from irregularities and rogue brokers. If you want local protection when trading Forex, you want your broker to be regulated locally.

The FSCA issues public warnings about fraudulent brokers in the regularly-updated Media Releases section of their website. These warnings include guidance on individuals or companies misrepresenting themselves, or organisations falsely representing their services.

This register of FSPs will also show if an entity has submitted an application to the FSCA, or if it has been stripped of regulation in the past.

Financial regulation is a crucial metric in our review process, as regulation is the primary way we establish the trust of the brokerage. We believe that there is value in being locally regulated as it gives clients more straightforward access to solve any disputes that could arise.

Regulation is the primary way to establish trust in a Forex broker

FSCA Strategy 2018-2022

Central to the mission of the FSCA are four core statements, which together, form the reason why residents want to trade with an FSCA regulated Forex broker.

The FSCA improves the efficiency and integrity of the South African financial markets. By monitoring the whole financial market and not just any particular entity, it ensures the safety of the entire market, and in doing so, can protect all market participants including retail Forex traders.

In addition, the FSCA ensures that regulated brokers treat all clients fairly. A client of a regulated brokerage who feels they have been cheated has a legally defined process to resolve their issue. All regulated brokers must have this process available to potential clients.

FSCA-regulated brokers must present written material in a way that does not confuse or mislead the reader. They are required to provide financial education and promote the financial literacy of potential clients. As financial products can be complicated, it is the obligation of all regulated members to explain all products and their associated risks.

Finally, the FSCA assist in maintaining financial stability in South Africa by supervising the registered entities.

A client trading with an FSCA regulated broker should expect to be treated fairly, expect to be educated on financial products whenever needed, and can rest assured that the government is monitoring their broker’s activities to ensure they are safe and secure.

History of the FSCA

Previously known as the Financial Services Board (FSB), the FSCA opened in 1991 following the recommendations of Van der Horst led committee. The committee had recommended the creation of an independent body to oversee or supervise and regulate the non-banking financial services sector in South Africa.

After the Van der Horst committee, various acts have increased and expanded the mandate of the Financial Services Board. In 2001, the Financial Intelligence Centre Act and the subsequent amendments that followed later increased the FSB mandate to include issues of combating money laundering.

Later in 2004, the Financial Advisory and Intermediary Services, also known as FAIS, expanded the role of FSB to include, among other things, the conduct of market in the banking sector.

As of April 1st, 2018, the FSB changed their name to the FSCA or the Financial Sector Conduct Authority which is responsible for market conduct regulation and supervision.

The FSCA Structure

A board oversees the Financial Sector Conduct Authority which executes its mandate through divisions. The FSCA has the sole mandate to select its own Commissioner, making the organisation less of a target of the financial politics and pressures. Apart from overseeing the day-to-day running of the institution, the Commissioner acts as the Registrar of the Non-banking Financial Institutions in South Africa.

The authority of the Commission is distributed to Deputy Commissioners appointed by the Minister of Finance, and are supported by the Chief Risk Officer, General Counsel, Media Liaison Officer.

Key Financial Sector Conduct Authority Responsibilities

As part of its mission of ensuring that the investment environment in South Africa is sound and conducive, the Financial Sector Conduct Authority has built a strong reputation for its regulatory framework in the following sectors:

- Capital Markets

- Insurers

- Financial Services Providers

- Collective Financial Schemes

- Nominee Companies

- Friendly Societies

- Retirement Funds

The FSCA ensures the cooperation of regulated entities and has the power to impose compensation orders, unlimited penalties and cost orders for those who do not comply. These orders are adhered to as though they are a judgment from South Africa’s Supreme Court, and are a matter of public record.

A customer complaints service is effective in fielding complaints, plus a separate self-policing appeals board which any aggrieved entity can approach should they feel like they might have been aggrieved by either the regulator or any of its executive officers.

Summary

The FSCA is credited for bringing stability and transparency to South Africa’s investment industries. Forex traders who want to have protection can find brokers that are locally regulated, and who comply with South African law. In some cases, South African clients can keep their funds locally, further increasing trust with the brokerages.

FAQs

How do I know if a Forex broker is regulated by the FSCA?

Every broker regulated by the FSCA is required to post their FSP licence number on their website. If you know the broker’s FSP number or legal name, you can also use the FSCA’s search facility to check on their regulatory status.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the UK’s regulator, the FCA, or the Australian regulator, ASIC).

Our Rating & Review Methodology

Our State of the Market Report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.