-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Forex Demo Accounts

Learn to trade with no risk

-

No-deposit Bonuses

Live trading with no deposit

-

KES Trading Accounts

Save on conversion fees

-

ECN Brokers

Trade with Direct Market Access

-

Lowest Spread Brokers

Raw spreads & low commissions

-

Market Maker Brokers

Fixed spreads & instant execution

-

MetaTrader 4 Brokers

The top MT4 brokers in Kenya

-

MetaTrader 5 Brokers

The top MT5 brokers in Kenya

-

TradingView Brokers

The top TradingView brokers

-

cTrader Brokers

The top cTrader brokers in Kenya

-

All Trading Platforms

Find a platform that works for you

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

With Forex trading, risk management is really important! The Forex market can often be unpredictable and even successful traders have to endure losing trades. One of the most important ways to protect your Forex trading account, is by using stop loss orders. Of course, the ability to automatically close a winning trade at a specific price is also really important. A take profit order is used to perform this task effortlessly. Let’s learn more about using stop loss and take profit orders…

What is a Stop-Loss Order?

With a buy (long) trade, a stop loss can be placed below the entry price at which the currency pair or other asset is bought. In this case, the stop loss order will automatically close (liquidate) the trade by selling it if the market price reaches the level at which the stop loss is placed.  With a buy (long) trade, your stop loss is placed below the entry price, with a take profit above the entry price. If the price declines and hits your stop loss, you will make a loss; if the price ascends to hit your take profit, you will make a profit. Conversely, a stop loss can be attached to a sell (short) trade, in which case it is placed above the entry price and automatically closes (liquidates) the trade with a buy action if the price level of the stop loss is reached.

With a buy (long) trade, your stop loss is placed below the entry price, with a take profit above the entry price. If the price declines and hits your stop loss, you will make a loss; if the price ascends to hit your take profit, you will make a profit. Conversely, a stop loss can be attached to a sell (short) trade, in which case it is placed above the entry price and automatically closes (liquidates) the trade with a buy action if the price level of the stop loss is reached.  With a sell (short) trade, your stop loss is placed above the entry price, with a take profit below the entry price. If the price ascends and hits your stop loss, you will make a loss; if the price declines and hits your take profit, you will make a profit. Although a stop loss order is generally an effective way to set a limit on how much you can lose on a trade, there is no guarantee that your trade will close at the specific price at which your stop loss is placed. If market liquidity is thin or if there is a price gap, you could easily get a worse price than which you bargained for. Of course, your stop loss order could also be filled at a better price than you anticipated if positive slippage occurred. Forex traders who carefully manage their risk and use acceptable amounts of leverage are unlikely to suffer notable losses due to price gaps that breach their stop loss orders. Before placing a trade, a trader needs to know how much money he is willing to lose on that particular trade. This amount will influence the lot size of the trade and, in certain cases, the distance of the stop loss in pips.

With a sell (short) trade, your stop loss is placed above the entry price, with a take profit below the entry price. If the price ascends and hits your stop loss, you will make a loss; if the price declines and hits your take profit, you will make a profit. Although a stop loss order is generally an effective way to set a limit on how much you can lose on a trade, there is no guarantee that your trade will close at the specific price at which your stop loss is placed. If market liquidity is thin or if there is a price gap, you could easily get a worse price than which you bargained for. Of course, your stop loss order could also be filled at a better price than you anticipated if positive slippage occurred. Forex traders who carefully manage their risk and use acceptable amounts of leverage are unlikely to suffer notable losses due to price gaps that breach their stop loss orders. Before placing a trade, a trader needs to know how much money he is willing to lose on that particular trade. This amount will influence the lot size of the trade and, in certain cases, the distance of the stop loss in pips.

How to Calculate your Stop-Loss distance in pips?

Let’s say you’ve noticed a decent support or resistance area and you want to place your stop loss just below or above it at a certain price level. So, you have chosen the price level for your stop loss but you need to know how many pips it is away from your potential entry price. To do this, you have two options:

- For a long trade, subtract the stop loss value from the entry price. Then divide this value by the pip value (denominated in the quote currency of that pair) to get the distance of your stop loss in pips. Here is an example on the EUR/USD:

Entry price: $1.00500

Stop loss: $1.00000

Entry price minus stop loss price = $0.005. The pip value in U.S. dollar (the quote currency) is 0.0001. Divide 0.005 by 0.0001 and you get 50. This is the distance of your stop loss in pips. For a short trade, simply subtract the entry price from the stop loss price and do the same calculation. If you’re not sure how to calculate the pip value (denominated in the quote currency) of a pair, you definitely need to read What is a Pip?. Here you will also learn how to calculate the pip value of any currency pair in the specific currency in which your trading account is denominated, for example, the U.S. dollar.

- A faster way to calculate the distance of your stop loss in pips, is to use your trading platform’s ruler/crosshair tool to measure the distance. Depending on which trading platform you use, you might have to do a simple conversion from points to pips, though. An example of where this is necessary, is with the MT4 trading platform. For example, if you open a USD/JPY chart and measure a distance of 580 points with the ruler, you need to divide this number by 10 to get 58, which is the correct distance in pips. If you use a broker that supports the cTrader trading platform, the ruler will give you the correct distance in pips.

If you don’t know where the ruler/crosshair tool is situated on your trading platform, please read Learn to Trade Forex Successfully – The Essential Guide

What is a Take Profit Order?

A take profit order closes a trade automatically when the price of the traded asset reaches the price level at which the take profit order is placed. Just like a stop loss order, a take profit order is subject to potential positive or negative slippage. In certain instances, it may be preferred not to use a take profit order. In this case, a trader would most likely use a trailing stop loss to lock in his profit. Alternatively, the trader can close the trade manually at an optimal price and time. For more information regarding trailing stop losses, read How to Place My First Forex Trade. As displayed earlier in this guide, with a buy (long) trade, a take profit order is placed above the entry price. With a sell (short) trade, it is placed below the entry price.

How to place Stop Loss and Take Profit Orders?

With any Forex trading platform, you can attach stop loss and take profit orders to your trades and orders. You can attach it to any of the following:

- Market orders that are ready to be placed. When a market order (with a preset stop loss and take profit order) gets executed, the stop loss and take profit are instantly attached to the trade.

- Open trades that were initially placed without a stop loss and/or a take profit.

- Pending orders (including buy stop, sell stop, buy limit, and sell limit orders). When pending orders are set up, stop loss and take profit orders can be attached to it. Then, when the price reaches the pending order and activates it, the stop loss and take profit orders are instantly attached to the trade.

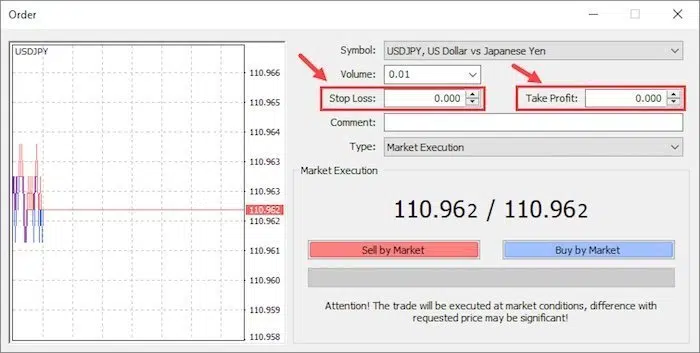

With the MT4 trading platform, you can open the order entry box by pressing F9 on your keyboard. Alternatively, you can right-click on the chart of your choice. Then select ‘Trading’, and then ‘New Order’. You will then see the following box on your screen:  Here you can enter all the parameters of your market or pending orders, including stop loss and take profit price levels (see the red boxes). To find some of the best MT4 brokers, take a look at MT4 Forex Brokers. We also have a comprehensive MT4 guide to get you started with MetaTrader 4 in no time.

Here you can enter all the parameters of your market or pending orders, including stop loss and take profit price levels (see the red boxes). To find some of the best MT4 brokers, take a look at MT4 Forex Brokers. We also have a comprehensive MT4 guide to get you started with MetaTrader 4 in no time.